Personal

Blog: Cooperation will stymie claims touts and dodgy claimant firms

Claimant lawyers need to report dodgy peers to the Solicitors Regulation Authority, urges Andrew Twambley, spokesperson for Access to Justice, arguing current legislation is enough to tackle fraud.

Interview: Robin Smith, We Go Look

Jonathan Swift speaks to We Go Look CEO and co-founder Robin Smith about building an on-demand business that handles insurance claims and why the Crawford & Co acquisition means she has more time now for the "fun stuff"

We need to talk about fire claims

With concerns growing about the coordination of the many parties involved in investigating major fire claims, a roundtable recently brought together insurers, adjusters, forensic investigators and fire service chiefs. As they discussed the many…

Roundtable: Digital is an attitude

Being a digital insurer isn’t about the aptitude but the attitude. This was the conclusion of a roundtable I chaired recently for Post, in conjunction with SSP.

AIG's Anthony Baldwin on claims, actually

Technology and innovation are important to the insurance sector but Anthony Baldwin, CEO of AIG, says while concentrating on these insurers must not lose sight of what is important to the customer: the claim.

2017 Post Claims Awards: Full list of winners

Covea notched up two team wins and NFU Mutual chief claims manager Matthew Scott (above) took home the Achievement Award at the Post Claims Awards last night at the Sheraton Park Lane, London.

Roundtable: Digital: Brokers - Surviving the digital age

At a time when regulation and taxes are weighing heavily on their operations, brokers find they have to adapt to the digital age. At a Post roundtable, in association with SSP, they discussed how they can leverage new technologies to better serve their…

Editor's comment: Time to play nicely

We have a sign in our kitchen with the rules of the house. As well as being told not to run (and throw balls in the house), my son knows it’s important to play nicely.

In Depth: Claimant lawyers move from whiplash to holiday illness claims

Proposed whiplash reforms are likely to be tough on claimant law firms. Many are carving out a niche in holiday destinations for gastric illness claims.

Motor Report: What's driving motor?

With trials of driverless car fleets now occupying our national roads, the motor sector is getting an upgrade like never before. As fraudulent claims continue to accelerate and while premiums pay the price, new entrants are causing insurers to tighten…

Why and how cross-selling works for microinsurance

Cross-selling is a great way to distribute microinsurance, as illustrated in Africa, where some farming insurance programmes are also experimenting with new ways to pay out claims, write Tom Johansmeyer, assistant vice-president at Verisk Insurance…

Aviva plans to tackle dual pricing with Ask It Never service

Aviva is planning to tackle the issue of dual pricing with its Big Data-driven Ask It Never service and offer customers a fixed level pricing when they renew their policy.

Mass's Simon Stanfield on the whiplash opportunity

The delay in whiplash reform should not be wasted, says Simon Stanfield, chair of the Motor Accident Solicitors Society, urging all parties to grasp the opportunity.

Blog: Connected homes should get cheaper premiums

Connected devices could help household insurers offer cheaper premiums to responsible homeowners, says Craig Foster, managing director of Homeserve Labs.

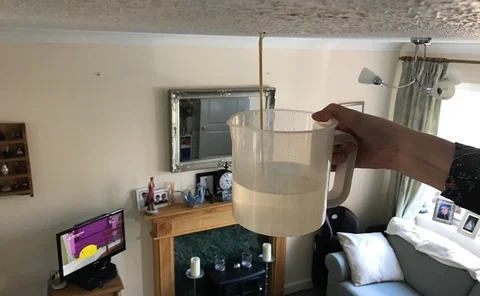

This Week: Menace, manifestos and managing general agents

There is a menace in my house in the form of water. First it caused problems in my kitchen (as many of you will remember) and now it's found its way out of the bathroom.

Blog: Driverless cars are just three chicanes away

Before driverless cars take to the road, the public needs to be reassured about their safety and cyber risks need to be mitigated, write Deloitte partners Gurpreet Johal and Nigel Walsh. But once liability is clarified, insurers stand to benefit.

Dacre Bleu: will the industry act after Daily Mail attack on insurer 'sharks' and 'pirates'?

Post content director Jonathan Swift reflects on the Daily Mail coverage of insurers reportedly ripping off loyal customers, and asks if beneath the tabloid headlines there lies a home truth the industry needs to act on?

Interview: Conor Brennan, Zurich UK

Zurich has seen a seismic shift in the last year. A group-wide restructure also saw a reworked operating model in the UK, with commercial, general insurance and life businesses under a single leadership.

Blog: Insurers need to invest in handling subsidence claims

Insurers may not be saving that much money by cutting back on subsidence claims handling, notes Nick Turner, professional services director at Claims Consortium Group, arguing that triage and on-site inspections can help provide a smooth service and…

Blog: Underwriters need to know their knowns and unknowns

Underwriting behaviours can be embodied by three famous Donalds: Duck, Trump and Rumsfeld, observes Nick Dinsdale, portfolio manager at Covéa, adding that quantifying the known and unknown facts will help make informed decisions.

Blog: Automated claims aren't outlandish

Digital advances will allow insurers to automate smaller claims, predicts Graham Gibson, chief claims officer at Allianz, warning that technological agility and customer focus will be key to survival.

Swinton invests £45m in IT and digital distribution channel

Swinton has said it is hoping to transform its distribution model with a £45m investment in IT. This follows a restructure that will shut 84 branches and leave 900 people out of work.

Q&A: Rob Flynn, More Than

More Than relaunched last week with a new advertising campaign featuring fictional Scandinavian founder Mordenn Surenns. Real-life boss of More Than Rob Flynn talks about the developments behind the scenes at the direct insurer.

BIBA 2017: The conference, as it happened

The British Insurance Brokers' Association held its 2017 conference in Manchester.