Opinion

Leveraging AI to accelerate decarbonisation in insurance

Andy Waring, head of intermediary at Stubben Edge, examines how artificial intelligence could help insurers achieve their Net Zero goals.

Why Markel’s media team are cautious about AI-exposed risks

Sam Clarke, media and entertainment underwriter at Markel, questions how underwriters can be comfortable with the intellectual property exposures of generative artificial intelligence when each jurisdiction would effectively view and handle claims…

Rise of the AI-broker

Artificial Intelligence has many real-world applications and is already helping the insurance broking community in the US spend more time connecting with, listening to, and advising customers, says Chris Kitchener, vice president of product management…

Why insurers shouldn’t wait for regulatory clarity on AI

Philip White, a lawyer at The Legal Director, explains why insurers should put in place good governance to harness the growing capabilities of artificial intelligence now rather than wait for the watchdog to set rules for the use of this technology.

Unlocking AI’s potential demands a fresh approach

To unlocking artificial intelligence’s potential, Oliver Wyman partner Fady Khayatt argues that, rather than think about how the industry has always worked, insurers should envision what a role and process could become.

Why AI won’t fully replace the human touch in insurance

By anticipating customer needs, investing in personalised experiences, and only then utilising the latest in AI technology, Jonathan Roomer, co-founder and head of customer success at YuLife, argues insurers can redefine customer success and generate…

QBE’s Gudhka shares seven steps to manage GenAI risks

Jaini Gudhka, senior risk manager at QBE, shares the seven steps businesses can take to manage generative artificial intelligence risks.

Why cyber insurers need to take a Quantum leap

The rise of quantum computers presents a challenge unlike any the cyber insurance industry has faced before, according to Tim Callan, chief experience officer at Sectigo, who argues proactively adapting policies and services is vital in the face of this…

Hiscox’s Tipper on why creative AI demands respect

Max Tipper, head of media at Hiscox UK, considers whether the media and creative businesses are ready to safely use generative artificial intelligence, and whether insurers are ready to provide the protection these companies need.

Unforeseen impact of generative AI on insurance

Rory Yates, chief strategy officer of EIS, explains why labelling everything as generative artificial intelligence is confusing at best, and at worst could be a very dangerous mistake.

Who is liable if AI in healthcare fails and causes harm?

Law firm DAC Beachcroft’s Simon Perkins and Stuart Wallace reveal what could happen if a claim is made against a healthcare provider that relies on artificial intelligence to spot diseases.

Is insurer service really that bad?

News Editor View: After comments from Jensten’s Alistair Hardie earlier this week saying no insurer gets service right and that we should “rip up the service rule book and start again”, Scott McGee asks: Is it really that bad?

Zurich’s Bush on why it’s never been more important to build resilience

View from the Top: Charles Bush, head of large and complex and commercial claims at Zurich, argues its incumbent on insurers to work with policyholders on innovating new resilience solutions.

Aon’s Biddle on inspirational women improving social mobility in insurance

Charlotte Biddle, senior global benefits consultant at Aon, on making general insurance a more inclusive industry for individuals who feel “more Primark than Prada”.

What does Winslow’s hiring splurge say about DLG’s future?

Content Director’s View: Jonathan Swift takes stock of Direct Line Group CEO Adam Winslow’s new look executive team and asks whether it has the attributes to succeed.

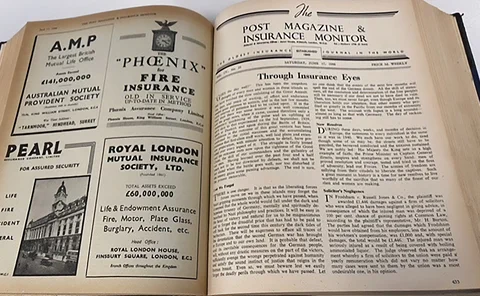

How D-Day was reported by Post

To mark the 80th anniversary of the Normandy landings and D-Day, we dip into our 184-year archive to see what Insurance Post said at the time.

What a Labour victory means for insurance

James Daley, managing director of the research and consultancy group Fairer Finance, reveals who should fear the approach of a new Labour administration and what companies could thrive if the Conservative Party are ousted at the general election on 4…

Known unknowns and the certainty of net zero

On World Environment Day (5 June), Ofir Eyal, director at consultancy Marakon, examines how the insurance industry is balancing the trade-off between revenue and reputation when it comes to climate planning.

Insurance’s problem with a shrinking pool of arbitrators

Mark Everiss, partner in insurance and reinsurance at Eversheds Sutherland, explores the practicalities of, and difficulties in, finding a competent impartial tribunal of arbitrators to determine insurance and reinsurance disputes.

Understanding flood resilience – one garden and brick at a time

Editor’s View: Emma Ann Hughes considers ways the insurance industry can help make the world more resilient to climate change by being more innovative in how it inspires adapting homes and gardens.

Redefining risk with Martyn’s Law

Paul Tarne, partner at law firm Weightmans, explains how landmark counterterrorism legislation Martyn’s Law will affect insurers.

How AI can place insurers in the green lane

Bill Brower, senior vice-president of global industry relations and claims sales at Solera, explains how artificial intelligence will be pivotal in moving the needle on insurer's environmental, social and governance goals.

Groundhog day after 39 years at the ABI

After retiring from the trade body, Malcolm Tarling, former chief media relations officer at the Association of British Insurers, urges providers to avoid trying to make their products sexy and says clear communications are essential in the fight to…

Is premium finance still a tax on the poor?

News Editor’s View: Scott McGee considers whether recent steps taken by trade bodies to address premium finance will reassure the Financial Conduct Authority that this payment method is no longer a ‘tax on being poor’ that needs to be tackled.