Big data

Blog: Are MGAs best placed to build the future of underwriting?

Unencumbered by legacy technology, managing general agents are well placed to invent a better future for insurance. Cytora CEO Richard Hartley on why the likes of C-Quence and Convex are creating a radically different type of insurance company.

Q&A: Jeffrey Skelton, Lexis Nexis Risk Solutions

Jeffrey Skelton has worked for Lexis Nexis Risk Solutions for more than 17 years and in July was appointed as managing director for insurance for UK and Ireland. Harry Curtis spoke to him about his career to date and future plans.

Axa's Jon Walker on why it takes three to make the market work

In a hardening market, competition is tough to place property and casualty risks. Now more than ever, brokers need to work closely with insurers and customers on claims prevention and risk management, writes Jon Walker, executive MD of Commercial…

Munich Re, Allianz and Zurich discussed the management of unstructured data in claims during Post webinar

Insurance companies are dealing with increasing volumes of digital media associated with claims initiation and claims investigation processes.

Telematics Watch: Addressing misconceptions

From scepticism about data to dissatisfaction about driver behaviour scores, Igo4 CEO Matt Munro addresses some of the common misconceptions about telematics, and suggests marketing and communications are key to avoiding complaints.

Google’s investment in us, is an investment in brokers too: Applied product boss

Google’s 2018 investment in Applied Systems also represents an investment in the future of the intermediary sector, according to the software house.

LV and Zurich discussed improving customer loyalty during Post webinar

Personal lines customers are a promiscuous bunch, known for changing insurers for a few pounds.

Insurance Technology Summit Q&A: Duck Creek Technologies Europe managing director Bart Patrick

Ahead of the Post Insurance Technology Summit, Post editor Stephanie Denton sat down with Duck Creek Technologies Europe managing director Bart Patrick to discuss the cultural step change need in insurance to remove the upgrade nightmares.

Allianz UK CUO in bid to double data specialist roles over two years

Allianz is “investing heavily” in the data space and will seek to double the number of data specialist staff it employs over two years.

Arch-backed MGA Archipelago aims to address PL underinsurance with data driven fair pricing

Arch Insurance-backed managing general agent start-up Archipelago Risk Insurance has announced that after a six month “pilot” it is ready to open the doors in a “controlled way”.

LV opens University of Bristol campus data ethics office

LV general insurance CEO, Steve Treloar said it is “ever more important” to understand data ethics, as the insurer launches its university office in Bristol.

Blog: Advancements in vehicle technology - are insurers keeping up?

Fifty years ago, as the first Ford Capris, Austin Maxis and Aston Martin DBS V8s arrived on the UK’s forecourts, Thatcham Research was established to improve vehicle safety standards and contain claims cost. However Graham Gibson, chief claims officer at…

Government issues warning over use of AI in insurance pricing

The rise of artificial intelligence and big data could create a new class of ‘uninsurables’ in society, a government task force has warned.

This week in Post: Culture vultures

At the Monte Carlo annual rendezvous this week, Lloyd’s chairman Bruce Carnegie-Brown said the corporation was ready to “hang” perpetrators of bad behaviour after its culture survey revealed some “sobering” results.

Special Report: The future of personal lines insurance: Expert view

The insurance industry needs to understand the demands of its future customers if it is to satisfy their expectations. EXL’s head of UK and Europe and SVP Insurance, Nigel Edwards explains how smarter insurers will adopt personalisation and a…

Special Report: The future of personal lines insurance

Retail insurance customers are changing, with a growing opinion that those born after 2000 will have very different expectations than those over twice their age because they are digital natives. Sam Barrett explores what the industry needs to do to…

This week: Go Compare's car crash advert

Go Compare was criticised this week for an arguably tone-deaf advert in which its singing mascot was involved in a serious car accident.

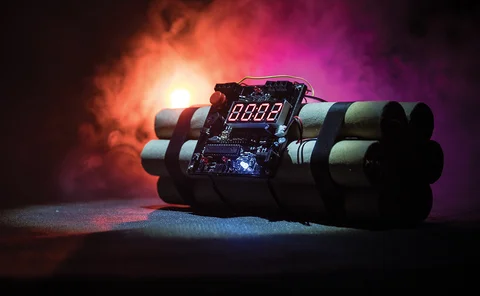

Spotlight: SME market: SMEs and cyber risk - a ticking time bomb

SMEs are a prime target for cyber criminals because they are believed to have limited resources and employ less technically aware employees than larger enterprises. Despite this, these businesses, their insurance providers and brokers are not assessing…

Spotlight: SME market: Where do the biggest opportunities lie for brokers in the SME market?

There seems to be a significant number of drivers for change in the SME market, which begs the question how the relationship between brokers and these clients will change. Edward Murray looks at the opportunities available for intermediaries to remain as…

Six more insurtech start-ups to watch in 2019 and into 2020

In the latest in his series of Insurtechs to Watch, Post content director Jonathan Swift casts an eye over six more start-ups looking to make a splash in the UK insurance sector.

Blog: What lies ahead for the future of skills in the insurance industry?

The London insurance market is facing a huge skills shortage as insurance firms struggle to compete for talent. While a huge number of baby boomers are retiring from the sector and taking those long-held skills with them, there is also a distinct lack of…

Blog: The financial crime insider threat

The insurance industry has woken up to the growing criminal threat. However, Dennis Toomey, global director of counter fraud analytics and operations at BAE Systems, highlights that much investment in this area has focused on the external threat.

Blog: Home history data may build a better picture for pricing

Pricing practices in the home insurance market are under scrutiny and according to Jay Borkakoti, director, home insurance, UK and Ireland, LexisNexis Risk Solutions insurers need to use claims history data to better their understanding of property risk.

The MGAA's Peter Staddon on evolving MGAs

Many managing general agents are turning to digitalisation to enable them to look deeper into their books of business, Peter Staddon, managing director of the Managing General Agents' Association, explains this will allow the MGAs to see potential…