Big data

View from the Top video: Climate, catastrophe and insurance – understanding and preparing for the next major systemic risk

In this exclusive interview recorded as part of the Insurance Post Live Annual Conference 2021 and sponsored by Verisk, Emma Karhan discussed what steps insurers can take to protect the economy and society from the next big systemic risk.

Boardroom video: Is the customer always right? – strengthening bonds and responding to policyholder needs post-lockdown

In this video sponsored by Salesforce and recorded as part of the Insurance Post Live Annual Conference 2021 an expert panel discuss:

Modernizing data platforms - are insurers ready?

Insurance companies hold large volumes of customer data across the value chain, however the systems that contain it are usually slow and outdated. Which can be a major drawback as time when insurers need to expand their offerings with agile data…

Digital disruption in insurance – managing indemnity spend on escape of water claims

Insurers are grappling with rising escape of water claims costs. One of the most common types of domestic property damage claims, insurers are paying out an estimated 2.5 million every day, according to the Association of British Insurers.

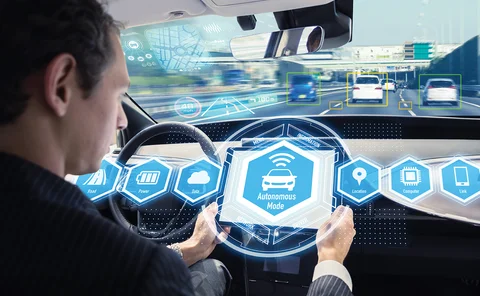

The ADAS tipping point – are motor insurers ready as the technology finally goes mainstream?

Advanced driver assistance systems have been part of new vehicles for over a decade now, with these features becoming increasingly common as manufacturers look to gain competitive advantages over rivals.

The death of insurasaurus? Why complacent and out of touch insurers must overhaul their business, and their image, to survive

Like other corporate dinosaurs, many insurers face extinction if they don’t become less reliant on old ways of doing things and robust barriers to entry.

Blog: Digital claims - The final frontier

The front end of personal lines is like a gold rush town where the gold has already gone. But Paul Stanley, the CEO of 360 Global Net, argues the next frontier for pioneers is claims - and it may be the last.

Ardonagh acquires adjuster; ERS enters new lines; Geico partners with UK insurtech; and Partners& buys in Devon

Post wraps up the major insurance deals, launches, investments and strategic moves of the week not covered elsewhere on www.postonline.co.uk

Spotlight: Technology – Embracing evergreen technology

Outdated legacy systems have haunted the insurance space for years, stifling innovation and pushing up development costs. Now, with pressures coming from new entrants and customer expectations increasing, Post looks at why insurers are looking to…

Blog: Dealing with non-disclosure of delivery driving

Uptake in the gig economy has been significant due to the pandemic and helped keep many families solvent. Martin Williams, chief operating officer at Thing Co, investigates the hidden danger of people relying on their private motor insurance when using…

Watch Insurance Post's LIVE Technology conference today

The Insurance Post LIVE Technology Conference brings you the latest innovation occurring in the UK insurance sector. Our unmissable two-day agenda features technology and digital experts from across the sector to offer their guidance and knowledge to…

Axa teams up with Microsoft; Ardonagh unveils Beazley capacity deal; Lloyd's to open Manchester hub; LV rolls out ethical standard

Post wraps up the major insurance deals, launches, investments and strategic moves of the week not covered elsewhere on www.postonline.co.uk

Q&A: Ant Middle and Adam Beckett, Ageas

Ageas CEO Ant Middle and chief distribution officer Adam Beckett spoke to Post about the insurer’s intention to grow its intermediated personal lines business and plans to invest in what it calls its ‘technical engine room’.

Interview: Mark Allan, Ki

Lloyd’s first algorithmically driven syndicate Ki began trading on 1/1 this year. Jonathan Swift caught up with its CEO Mark Allan to discuss early progress, its plans to integrate brokers on its platform with APIs and why it should not be simply…

FCA adds four to exec team

The Financial Conduct Authority has recruited four people to its executive leadership team including its first chief data, information and intelligence officer.

Advertising feature: Transforming the way customers buy insurance over the phone

Leveraging value from InsureTech to drive innovation into transformation and ultimately competitive advantage in the current climate is a theme across the insurance industry akin to the Oklahoma Land Rush of 1889, writes Rob Saunders CEO of ActiveQuote.

Eldon and Leave EU appeals in ICO case dismissed by Upper Tribunal

Three judges in the Upper Tribunal Administrative Appeals Chamber have dismissed all five appeals made by Leave EU and Arron Banks’ Eldon Insurance Services (now known as Somerset Bridge) in a case with the Information Commissioner’s Office.

Briefing: Seven insurtechs to watch in 2021

For a sixth year running, Post content director Jonathan Swift scans the insurtech space and identifies up-and-coming businesses potentially worth watching over the next 12 months.

Blog: Analytics has a critical role to play in major and complex loss

It is not just low-value claims that can benefit from technology – data analytics has an important role to play in major and complex loss, argues Neil Baldwin, McLarens executive director.

Future Focus 2030: The insurance eco-systems podcast - the evolution of collaboration

It is the year 2030 and the last decade has seen the insurance eco-system evolve as quickly in 10 years as it had previously done in the last century.

Future Focus 2030: The eco-system revolution

As part of a monthly series, Post looks into the future at how the insurance industry might change, focusing on a specific issue. For this instalment David Worsfold looks into the evolution of insurance eco-systems

Pen Underwriting’s Tom Downey on data quality and the need for collective responsibility

Tom Downey, CEO of Pen Underwriting, sets out why data quality is the key battleground of today that no-one in the insurance industry can afford to lose.

Blog: Don’t lose your data in Excel hell

After an Excel error was blamed for 16,000 coronavirus cases being missed by the Track and Trace scheme, Covernet business development director Jim Campbell considers how insurers, brokers and managing general agents can avoid their own ‘Excel hell’.

Fully Comp episode 3: Will parametrics live up to the hype - and could it ever enter the insurance mainstream?

Welcome to the third episode of Fully Comp, Insurance Post’s new regular video series tackling some of the biggest issues in insurance.