Big data

Blog: The financial crime insider threat

The insurance industry has woken up to the growing criminal threat. However, Dennis Toomey, global director of counter fraud analytics and operations at BAE Systems, highlights that much investment in this area has focused on the external threat.

Blog: Home history data may build a better picture for pricing

Pricing practices in the home insurance market are under scrutiny and according to Jay Borkakoti, director, home insurance, UK and Ireland, LexisNexis Risk Solutions insurers need to use claims history data to better their understanding of property risk.

The MGAA's Peter Staddon on evolving MGAs

Many managing general agents are turning to digitalisation to enable them to look deeper into their books of business, Peter Staddon, managing director of the Managing General Agents' Association, explains this will allow the MGAs to see potential…

Analysis: The future of pricing – Data and technology

Insurers are coming under increasing pressure to develop new ways of pricing. But, while data and technology hold the key, insurers face some significant challenges as they move to this brave new world.

Hiscox's Ben Walter on why insurance needs a digital turbo charge

Digital transformation is urgently needed to make our industry faster and more efficient, says Ben Walter of Hiscox Global Retail

Interview: Airmic board members

In March, Airmic appointed four new board members. Post spoke to them about how risk management has changed during their time in the profession, what they need insurers to deliver and emerging risks

This week in Post: Big fish, little fish, cardboard box?

It might be the name, but this week I’ve spotted some similarities between Gibraltarian unrated insurer-facing-liquidation Lamp Insurance and an angler fish, sparking some strange and slippery debate in the office.

Roundtable: Making data fit for compliance and regulatory purpose

The use of data is widespread but where insurers are on their integration journeys can be very different. Post, in association with Marklogic, brought a panel of experts together to discuss best practice in this area including effective compliance and…

Spotlight: Data - Ordering data in

Insurers continue to hang their success on the quality and use of data, with businesses continually reviewing how to gain a commercial advantage. Edward Murray looks at the benefits of using external data providers and why some peril risks have proven…

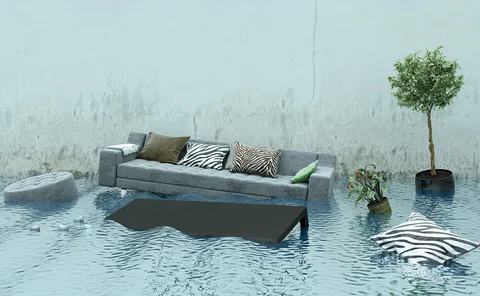

Spotlight: Data - Why are insurers ignoring data for escape of water claims?

Don’t blame the rain for the growing number of water-related claims in the UK, blame the plumbing

Brexit and fair pricing lead FCA general insurance agenda for 2019/20

The Financial Conduct Authority has set out its priorities for the year ahead in its 2019/20 business plan, identifying Brexit as its “immediate priority”.

Blog: The changing landscape of identity theft

Valid motor insurance is proving to be as valuable a disguise for today’s criminals as stockings over the head or a mask, according to James Burge, fraud manager at Allianz

Insurance Hound: Most downloaded content by insurers in March

Four of the five articles downloaded most by Post’s sister title Insurance Hound’s insurer audience during March explicitly addressed ways in which technology has changed the insurance landscape.

Blog: How insurers can maximise the value of data

Data is now in vogue for the insurance industry and Mike Smart, business development director at BAE Systems Applied Intelligence, explains why data scientists are going to be much sought out in the future.

Trade voice: Airmic's John Ludlow on becoming risk partners

Insurers are expanding their services beyond products, but there is much more to do. Underwriters and risk managers should view each other as risk partners, says Airmic CEO John Ludlow.

Special Report: Motor Insurance Research 2019

What’s fueling motor insurance today? Michele Bacchus talks to the industry and gives the low-down on what’s heading down the highway towards insurers in both the fast and slow lanes

Blog: Turning the tide on account takeover fraud

Many of us have either experienced fraud, seen friends who have fallen victim to it or witnessed the direct results in our workplaces. Shaun Smith, Iovation sales executive, explains why it's no surprise that one of the fastest growing fraud types in the…

Interview: Clive Nathan, Global Risk Partners

Clive Nathan joined Global Risk Partners as its underwriting CEO, overseeing the consolidator’s managing general agent division, in April last year.

Analysis: Bad data - A risky business for insurers?

Data is everywhere: good data, partial data, valuable data, bad data. Insurers need data to measure and price risks but do they take enough care in assessing the quality and provenance of the data they are using and are their processes sufficiently…

This week in Post: Storm, Brexit and diversity

This week, the sunshine we were blessed with last week was replaced by a more winter-appropriate grey sky and rain.

Amanda Blanc issues caution on insurer big data use

Zurich EMEA CEO, Amanda Blanc cautioned insurers on how they use big data in her keynote speech at the Association of British Insurers annual conference.

Q&A: Paul Mang, Guidewire

Aon's former CEO of analytics, Paul Mang has been tasked with bringing together Guidewire's Analytics and Data Services division. Mang spoke to Post about cyber risk, data, and lifted the lid on Guidewire's $275m purchase, data tool Cyence.

RSA partners with insurtech on government-backed machine learning project

RSA is among the partner organisations working on a new government-funded two-year research programme into the application of machine learning and data analytics for risk modelling.