Personal

Trade Voice: ABI's Jonathan Fong on the risks that e-scooters pose to road safety

With the number of privately owned e-scooters in the UK already in excess of half a million, Jonathan Fong, policy advisor at the Association of British Insurers, argues that any wider expansion of their use must not happen without robust regulations…

Vnuk cut gets Lords committee green light

The Motor Vehicles (compulsory insurance) Bill, which looks to amend the controversial Vnuk Law, has passed through the Lords committee.

Price walking ban pushes motor premiums up; Zurich opens branch; Handl acquires IPRS; Mason Owen MBO; and under 30s telematics sales rise

For the record: Post wraps up the major insurance deals, launches, investments and strategic moves of the week.

Data Analysis: Cost-of-living increase drives one-in-10 to cancel insurance products

Exclusive: One in 10 people surveyed by Post and Consumer Intelligence said they had cancelled an insurance product in the last six months due to the cost-of-living squeeze.

Bupa's Iain McMillan looks at how to attract and retain a happy workforce

In a white-hot labour market, Iain McMillan, director of distribution at Bupa UK Insurance, asks what is the key to maintaining talent retention and attraction, and managing an employee health and wellbeing strategy during a period of post-pandemic…

Digital Bar Quarterly: What does it take to be ‘The Insurer of the Future?’

Having attended Insurtech Insights Europe 2022 last month, Altus Consulting business executive Mike Daly shares some thoughts including the possibility we are at a ‘tipping point’ in terms of someone creating ‘the Netflix of Insurance’.

LV, Axa and Keoghs smash fraud ring; Flood Re launches Build Back Better; Howden buys SPF; Go Insur backs start-up Insuristic

For the record: Post wraps up the major insurance deals, launches, investments and strategic moves of the week.

Mulsanne ordered to pay 60% of Marshmallow's costs following legal battle

Mulsanne has been ordered to pay 60% of the costs incurred by Marshmallow during a recent legal battle between the insurer and its former broker.

Fears OIC portal is not meeting objectives as unrepresented claimants make up less than 10% of users

Latest figures from the Ministry of Justice show that unrepresented claimants still make up less than 10% of those using the Official Injury Claim portal, as concerns grow that portal is not meeting objectives of being “consumer friendly”.

Insurers to save £2bn as Vnuk law set to be axed by the end of June

The controversial Vnuk law, which could have created an extra £2bn a year of costs for the insurance sector, is expected to be axed by the end of June as Motor Vehicles Bill passes through House of Lords’ committee stage with no amendments.

Charlotte Halkett appointed as Many Pets CUO

Many Pets, formerly known as Bought By Many, has appointed Charlotte Halkett to its newly-created chief underwriting officer.

Revolut in Allianz tie-up; AUB confirms Tysers talks; QBE poses resilience challenge; and Rear’s SPAC Financials Acquisition Corp to raise £150m via listing

For the record: Post wraps up the major insurance deals, launches, investments and strategic moves of the week.

British Insurance Awards: 2022 shortlist revealed

This year the British Insurance Awards return back to their spiritual home at the Royal Albert Hall after a two year absence.

Interview: Kelly Ogley, A-Plan

Four months after stepping up to the role of CEO at A-Plan, Kelly Ogley tells Pamela Kokoszka about her three passions, discusses the growth plans for the broker, and reveals how it has managed to remain relevant for the past 58 years

Citizens Advice ethnicity penalty campaign a ‘wake up call to FCA’

Citizens Advice ethnicity penalty report must be "a wake up call to the Financial Conduct Authority” to act on its promise to HM Treasury as insurers face warnings the fallout from this could be as far reaching as the Test Achats gender ruling.

RSA's Norgrove promises broker service improvements

RSA UK and international CEO Ken Norgrove has promised to materially improve the insurer’s level of service to brokers by the end of the year, admitting that it had fallen short in recent years.

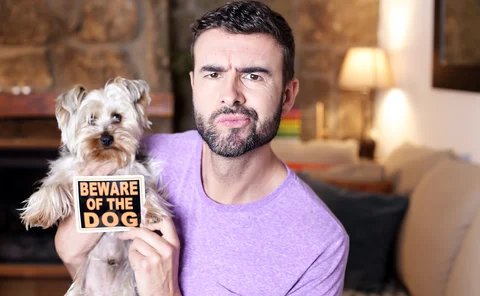

Blog: The curious incident of the dog and the bite crime

Rebecca Conway, chief legal officer at Arc Legal Assistance, reflects on the increase of pets in households in the UK during lockdown, and what route policyholders can pursue if they are bitten by a dog that has not been trained or socialised enough.

Analysis: How dual pricing reforms are shaking up insurance

Post investigates what changes the industry has seen following January’s dual pricing reforms, and if insurers are following the right path on price walking.

Clyde & Co merges with BLM; Beazley unveils underwriting structure; KGM buys Eridge Underwriting Agency; Blanc becomes WWF ambassador; and Swiss Re warns of global protection gap

For the record: Post wraps up the major insurance deals, launches, investments and strategic moves of the week.

APRIL FOOLS' DAY: Qumble in 'unbrielievable' industry first with parametric dairy product

Exclusive: Insurtech Qumble is set to bring its innovative parametric cheese cover to the mass market – both on earth and the moon – over the next quarter.

Robust e-scooter regulation needed at 'earliest opportunity', sector urges Shapps

Four insurance industry trade associations have called on the government to bring in 'robust' legislation around the use of e-scooters as soon as possible if they are to be permitted beyond current trials.

Data analysis: FOS insurance backlog tops 9000 cases

Freedom of information requests by Post and sister title Insurance Age have laid bare the scale of insurance case delays at the Financial Ombudsman Service.

UK's first public insurtech Ondo expects to break even within two years

Ondo, which became the first UK insurtech to go public last week, expects to break even within the next two years, its CEO Craig Foster has told Post.

Motion for mandatory leasehold buildings insurance commissions disclosure tabled in parliament

An early day motion naming Reich and calling for regulated firms to be required to disclose leasehold buildings insurance commissions has been tabled in the House of Commons.