Post blog

Blog: Eight steps to keeping climate change insurable

The effects of climate change, such as rising sea levels and above-average temperatures, have long been apparent, however Swiss Re’s CEO, Tava Madzinga argues the resulting risk landscape is now more dynamic than ever.

Blog: The measure of indemnity in property damage loss?

Mike Ledgerton, head of major loss at Questgates, reflects on the Court of Appeal decision in Endurance Corporate Capital Ltd v Sartex Quilts & Textiles Ltd., which has potentially far reaching consequences to the measure of indemnity.

Blog: Covid-19 - safeguarding home workers’ health and safety

The risk posed by Covid-19 has led many employers to set up home working for all or some of their employees as a way of reducing the risk to employees of exposure to Covid-19. Clare Bone, partner and solicitor advocate at BTO, argues the fact that an…

Blog: Frictionless payments - driving customer loyalty

Frictionless payment options have taken on new significance following the outbreak of Covid-19, but their significance runs much deeper. Nigel Phillips, commercial director of insurtech CDL, looks at the technology’s potential to redefine the…

Blog: Navigating risk in a changing operating environment

Diversification can be key to business stability and growth as companies across the country are finding themselves navigating changing operating environments within their industries and professions, offering potentially rich rewards. But Paul Coleman,…

Blog: Covid-19: ‘boiler plate’ clauses and statutory obligations will come into sharp focus in the coming months

Business interruption policies have come under the spotlight with the coronovirus pandemic but Tamsin Hyland, an associate solicitor at Plexus Law, explains that as real life business continuity begins to be enacted, changing risk management could put…

Blog: Total loss vehicle claims - why are claims directors taking more interest?

In the past, it might be fair to suggest that many claims directors have typically not taken a great deal of interest in the sub-set of motor claims that is ‘total loss’ writes Rob Smale, non-executive director at E2E Total Loss Vehicle Management.

Blog: What the future holds for insurance and healthcare

The insurance industry is at something of a crossroads, with regulatory requirements insisting on total transparency in terms of advice and access, and a number of other challenges around capital and distribution. Paul Goodhind, partner and chief…

Blog: How insurers and brokers should engage with insurtechs

Insurers and brokers ask the most ridiculous, irrelevant questions, which starkly highlights how out of touch they are when it comes to IT procurement today, Inzura CEO Richard Jelbert argues as he looks at the current process and some of the questions…

Blog: Is Allianz hypocritical in dumping Saracens while extending Juventus tie-up?

As Allianz looks set to end its relationship with Saracens, after extending its Juventus deal, content director Jonathan Swift asks what is worse: salary cap breach or match fixing?

Blog: High-end watch claims - can you replace a Rolex?

In a world dominated by smart technology, old-fashioned timepieces are bucking the trend with high demand. Alex Wakefield, executive adjuster at McLarens Private Clients, explains that brokers and loss adjusters need to keep aware of market appreciation…

Blog: Insurtechs won’t eat your lunch, but they will pull up a seat at the table

Increased collaboration means insurers no longer need to worry about insurtechs taking their market share but Laura Drabik, chief evangelist at Guidewire Software, explains this integration must be done correctly or the market will face unhappy customers…

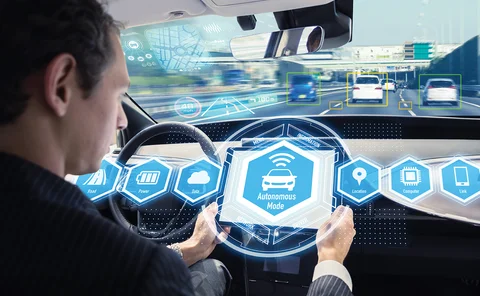

Blog: Adas data shortage for insurance is about to get sorted

Advanced safety features not only differ in performance and description among different manufacturers, but even among models by the same car manufacturer. Andrew Ballard, senior global product manager at Lexis Nexis Risk Solutions, believes deep data…

Blog: Future-proofing the broker model

The insurance market seems stuck on the idea that digitisation and a move to app-based insurance products, will negatively impact brokers. Inzura CEO Richard Jelbert explains why they should be seen as an opportunity instead.

The NED Blog: Regulation and the regulators

The regulatory agenda is always something of a concern to the independent non-executive director in the insurance market and keeping a close eye on the 2019 and 2020 plans from both the Financial Conduct Authority and Prudential Regulatory Authority is…

Blog: Your dick is not in my job description – on reflection

A year ago today Post published a blog I wrote called ‘Your dick is not in my job description’, which was about sexism and sexual harassment in the industry based on my own experiences.

Blog: Cyber attacks - how can businesses combat human error?

Approximately three-quarters of cyber claims notified to CFC in the last year involved some kind of human error or oversight. This is in part due to the truth that theft of funds, ransomware, extortion and non-malicious data breaches usually involve the…

Startupbootcamp's Sabine VanderLinden on inclusion in insurance

In June, I discussed the topic of ‘inclusion in insurance’ at The Women in Insurance Global Conference in New York, writes Startupbootcamp CEO Sabine VanderLinden. The topic is now taking centre stage in our industry as alongside their credit score,…

Blog: Lloyd's Delegated Authority Management Survey – how is the sector performing?

Mazars recently published its sixth Lloyd's Delegated Authority Management Survey designed to monitor development and changes in the specialised area of the Lloyd’s insurance market. Michael Campbell, director of delegated authority reviews at Mazars,…

Blog: Cyber crime - keeping ahead of evolving threats

With the imminent explosion of Internet of Things devices via the 5G rollout and the systemic rise in the use of artificial intelligence, technology is increasing both in complexity and connectivity writes James Maass, cyber incident specialist at CFC…

Blog: Contents insurance - meeting the needs of generation rent

The rental market in the UK is changing and it's changing fast. As house prices go through the roof, owning a place has become a pipedream for the younger generation, writes Stephen Cowap, head of insurance at Urban Jungle.

Blog: Silent cyber - the challenges facing the insurance industry

Following a line of cyber-related regulatory developments, Lloyd's has announced it is mandating that “all non-affirmative policies provide clarity regarding cyber coverage by either excluding or providing affirmative coverage". But according to Barnaby…

Blog: Whaley Bridge throws spotlight on non-damage business interruption cover

This month’s dam breach at Whaley Bridge brought a small community to a standstill, with many businesses unable to trade for a full week due to the enforced evacuation of the town and its surroundings writes Sarah Baker, head of business interruption, UK…

The NED Blog: The importance of the audit committee

Challenging the executive management team in terms of the decisions they make is a key responsibility of being a non-executive director. Michael Gaughan explains that one of the aspects of the role is to sit on various Board Committees to look at…