Post blog

Insurtech diary: Trekking the glacier

In the last instalment in our insurtech series, Buzzgroup founder and CEO Becky Downing, reflects on the past 12 months and the story of Buzzvault’s launch.

Insurtech diary: Confessions of an insurtech pricing guy

As head of pricing for Buzzvault, Paul Vinten is keen to unleash his inner data scientist on the firm's new product and see which rabbit hole the figures might take him down.

Blog: How can the wider insurance industry cope in times of surge?

Unpredictable climates mean the industry is facing an increase of surge events and pressure to handling them effectively and efficiently. Jonathan Davison, strategic development director of the British Damage Management Association, shares his view on…

Blog: Tackling theft

High-tech and more traditional theft is on the up, so understanding the latest trends is an important step in tackling it, according to Neil Clutterbuck, chief underwriting officer at Allianz Insurance.

Blog: Getting to grips with the quote manipulation data to combat fraud

Quote manipulation has become a growing challenge for insurers. In a two-part series, CDL partnerships director Nick Jackson takes a look at insights drawn from its data to examine how this information is being used to identify and combat fraud.

Blog: The future landscape for AI claims around the world

Governments around the world are looking to regulate artificial intelligence and as Lee Gluyas, partner, and Stefanie Day, associate with law firm CMS, explain those that get there first will be the ones to benefit.

Insurtech diary: Getting stuck into insurance

The second of a fortnightly series of diary posts providing an insight into the launch of a new insurtech, from Charlie Vinall, business operations manager at Buzz.

Top 100 Insurtech: Quarter four update

It’s time for the final 2018 update on the Insurtech 100, the global index compiled for Post by Tällt Ventures. Here founder and CEO Matt Connolly rounds up the latest investment and partnership news.

Blog: What workplace inequality means for insurers

Helen Bancroft, liability manager, and Stuart Toal, casualty account manager, explain why insurance professionals need to work closely with employers to ensure they are prepared for more workplace inequality claims

Blog: Why you should get involved with The Claims Apprentice in 2019

From automation to digitalization; from controlling claims inflation to the legal framework for driverless cars, it could be argued that working in claims has never been scarier – but more exciting.

Telematics Watch: The state of play for 2019

Post has teamed up with telematics broking specialist Igo4 for a new quarterly series looking at the growth and trends in this the sector. To kick things off its CEO Matt Munro looks at who is buying these policies and where they live.

Blog: How insurance risks exclude victims of domestic abuse

Victims of economic abuse often struggle to access insurance, writes Alice Merry, financial inclusion consultant for Surviving Economic Abuse, explaining what the industry can do about it.

Blog: Database overload

The insurance industry has achieved many successes in its fight against fraud but it now needs to address database overload, urges Steve Crystal, head of financial crime at Sedgwick.

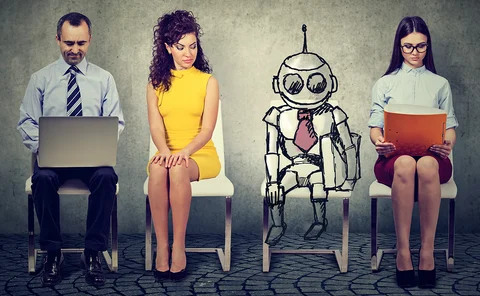

Blog: Insurance needs to re-skill its workforce

In a world where insurance processes are being automated, the industry needs to re-skill the next generation of workers, writes Brett Moffatt, managing director, Europe, Middle East and Africa, of Talent Intelligence.

Blog: How to defend cavity wall insulation claims

Liability insurers are seeing a dramatic increase in claims arising from allegedly defectively installed cavity wall insulation. Tom Corrigan, partner at DAC Beachcroft, asks whether there is cause for concern.

Blog: Flood claims involving children

A flooded home can be traumatic, especially for children. Jonathan Davison, strategic development director at the British Damage Management Association, explains how the claims process can be designed to protect the mental wellbeing of younger family…

Supply chain focus: How ADAS is shifting the goalposts in motor repair

With positive claims experience being one of the most important aspects of policyholder retention, the impact of the supplier on their journey will come under increased scrutiny. And motor claims is no different writes Pete Marsden of National…

Blog: Loss adjusters are developing new skills to tackle escape of water claims

As insurers are trying to tackle rising escape of water claims costs, loss adjusters are developing increasingly specialised skills, explains Darren Francis, escape of water project manager at Crawford & Company.

Blog: Technology - right or wrong for claims (or both)?

Insurers building the new claims portal must be careful not to force clients down a path they don’t wish to go argues Minster Law director of claims Marcus Taylor, who points to public concerns over technology as a major obstacle to overcome

Blog: The gaping hole in the FCA regulation of CMCs

The Financial Conduct Authority’s consultation into claims management companies has a gaping hole, warns Kurt Rowe, associate at Weightmans, explaining why it matters for insurers.

Blog: How to treat brain and spinal cord injury claims

Insurers face a variety of challenges when dealing with brain and spinal injury claims. Raouf Achour, associate at Horwich Farrelly, lists the latest treatments - and the medico-legal issues attached.

Blog: Got your A-level results? Check out insurance apprenticeships

On A-level results day, Carmen McDonagh, operations director at Complete Cover Group, urges school leavers to consider an insurance apprenticeship.

Blog: Open banking offers a new insurance distribution channel

Some might have already labelled it a failure but open banking will continue to evolve and insurers should sit up and take notice. That is the view of The Marketing Eye's Neil Edwards, who believes these platforms could eliminate form filling and make…

Blog: Supporting neurodiversity within the workplace

Debbie Mawer, director of people and culture at Claims Consortium Group, explains how to attract and nurture a neurodiverse workforce.