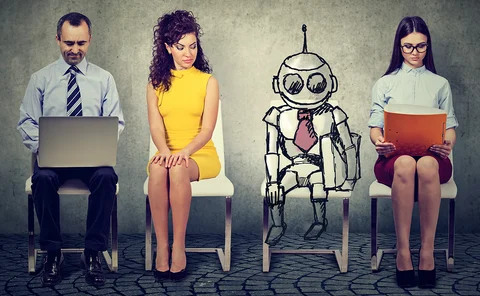

Artificial intelligence (AI)

What it takes to be a Power List player in 2024

Insurance Post’s Power List reveals today’s leading lights in the industry, the demise of big name digital disruptors plus who has shaken up the market in the last 12 months.

Insurance influencer argues AI scares the ‘antiquated’ industry

The insurance industry is terrified of AI, which could delay its adoption in the insurance industry, according to Instagram insurance influencer TheHardMarket.

Big Interview: Tara Foley, Axa

Tara Foley, CEO of Axa UK & Ireland, outlines how the business can now do intraday pricing, shares the provider’s growth plans, and reveals how artificial intelligence is changing ways of working at the insurer.

Axa reveals how AI is transforming the business

Axa UK & Ireland has 12 “between proof of concept and proof of value” artificial intelligence initiatives currently ongoing across the business, according to CEO Tara Foley.

Peppercorn accelerates B2B deal after funding round

Peppercorn AI raised £1.25m more than anticipated in its latest funding round, allowing the firm to bring plans for its first B2B deal six to nine months forward.

How generative AI can catapult insurance into the future

Graeme Howard, non-executive director at esynergy, explains how insurance companies that have traditionally been on the back foot can now surge ahead of technology-embracing banks by embracing generative artificial intelligence.

FCA to work with Big Tech on sharing data with insurers

The Financial Conduct Authority intends to examine how Big Tech firms’ datasets could unlock better insurance products, more competitive prices, and wider choice for customers.

How an AI-assisted motor claims handler cared for me

Editor’s View: Emma Ann Hughes shares how a recent call to her motor insurer highlighted why humans will always be needed to care for policyholders in their hour of need.

Q&A: Roi Amir, Sprout AI

Frances Stebbing speaks to Roi Amir, CEO of Sprout AI about how insurers can rebuild policy holders trust in artificial intelligence and why insurers need to bring customers along for the digital transformation journey.

Using AI to monitor claim health

Wayne Calderbank, group data and performance director at Claims Consortium Group, says artificial intelligence is enabling the monitoring of sentiment within the claims journey and ensuring potential problems can be identified and addressed.

Roundtable: Scaling up new technology while avoiding the pitfalls

Many commercial insurers and brokers are keen to adopt more automation and AI to drive efficiency and improve customer outcomes. However, the complex and bespoke world of corporate insurance means they face greater challenges than in the personal lines…

What the future holds for AI regulation

Striking the right balance between regulatory intervention and industry autonomy is crucial to realising the full benefits of artificial intelligence while ensuring ethical, accountable, and inclusive practices within the insurance sector, argues Nutan…

Q&A: Waseem Malik, Aviva

Aviva’s chief claims officer Waseem Malik spoke to Insurance Post about the evolution of claims roles, the progress of Aviva's digital transformation, and emerging trends in fraud.

British Insurance Technology Awards shortlist 2024 announced

Today Insurance Post can reveal the shortlist for the 2024 British Insurance Technology Awards.

Zurich reveals it has found more than 160 use cases for AI

Zurich has deployed more than 160 artificial intelligence-powered solutions across its business around the world, the insurer’s group chief information and digital office Ericson Chan has said.

And the insurance Oscar goes to...

Ahead of the 96th Academy Awards, better known as the Oscars, Alex Nicoll, UK head of media and entertainment at Sedgwick, considers how the ceremony will shine a spotlight on the incredible potential of virtual production and serve as a reminder of the…

Zurich’s Jonathan Davis on debunking AI myths

View from the Top: Jonathan Davis, data science lead at Zurich UK, offers his take on the big questions on artificial intelligence.

Is technology the solution to underinsurance?

Rebecca Fuller, managing director and global fixed asset advisory services leader at risk advisory firm Kroll, explains why without technology insurers and brokers haven't got a hope in hell of knowing whether a property is underinsured.

Tysers on the necessity for ‘data-driven’ transformations

Steve Jolley, chief information officer at Tysers, shares how the company transitioned from a traditional to a “truly data-driven” digital insurance platform with low-code.

Admiral partners with Google Cloud for new products

Admiral has struck a deal with Google Cloud, which will see the technology giant host the provider’s policy management and billing platforms plus use generative artificial intelligence to produce new products and services.

Why AI isn’t the silver bullet for the insurance industry’s problems

Artificial intelligence cannot remove all the manual work for insurers, warns Piers Williams, insurance lead at AutoRek, as using these solutions without human input runs the serious risk of introducing error.

Deadline to enter British Insurance Technology Awards fast approaching

The countdown has started for you to get entries in for the inaugural 2024 British Insurance Technology Awards (BITAs).

AI breakthroughs promise sea change in supply chain insurability

Recent technological advancements mean organisations are now able to better understand their supply chains far quicker than they were before, according to Marsh’s head of strategic risk consulting James Crask.

Cyborg CROs with place at top table are needed

Data analysis: Insurers where chief risk officers, supported by artificial intelligence, have a seat at the top table are most likely to succeed over the next decade, according to a report by consultancy LCP.