Technology

Trade Voice: Lee Elliston, LMA

Lee Elliston, Lloyd’s Market Association claims director, considers what the claims workforce of the future is likely to look like.

Blog: Silent cyber - the challenges facing the insurance industry

Following a line of cyber-related regulatory developments, Lloyd's has announced it is mandating that “all non-affirmative policies provide clarity regarding cyber coverage by either excluding or providing affirmative coverage". But according to Barnaby…

Rideshare insurtech Inshur reaches $9.6m total investment

Rideshare insurtech Inshur has raised an additional $1.5m (£1.2m) from Viola Fintech for its Series A funding round, taking total investment in the startup to date to $9.6m.

Kin Insurance raises $47m

Kin Insurance has raised $47m (£38m) to launch as an insurer.

Roundtable: Opening up new insurance opportunities using IoT

The Internet of Things continues to offer insurers considerable opportunities in terms of maximising existing data to better understand customers and enter new markets previously considered unprofitable. With this in mind, Post, in association with…

Aggregator disruptor Honcho launches

Reverse auction market place Honcho has launched its motor insurance bidding app.

LV's Pardeep Bassi on how insurers can harness AI

The insurance industry is on the verge of a seismic, data-driven shift due to the quantity of data available and the ability to turn this data into an action via artificial intelligence, writes Pardeep Bassi, head of data science at LV.

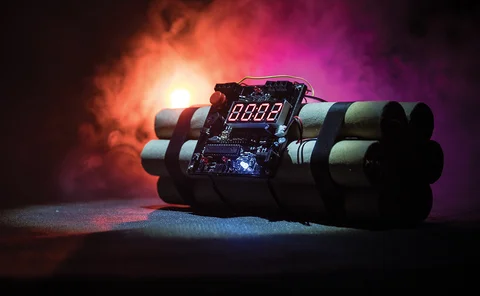

Spotlight: SME market: SMEs and cyber risk - a ticking time bomb

SMEs are a prime target for cyber criminals because they are believed to have limited resources and employ less technically aware employees than larger enterprises. Despite this, these businesses, their insurance providers and brokers are not assessing…

Spotlight: SME market: Where do the biggest opportunities lie for brokers in the SME market?

There seems to be a significant number of drivers for change in the SME market, which begs the question how the relationship between brokers and these clients will change. Edward Murray looks at the opportunities available for intermediaries to remain as…

This week: Winners and lasers

Nothing says team building quite like stumbling around a dark maze, falling headfirst into mirrors and haphazardly shooting lasers at your colleagues. Or so the democratic vote we held a few weeks earlier decreed.

Telematics Watch: Improving customer engagement and building trust

As a service-led insurance proposition based on individual driving behaviour, Igo4 CEO Matt Munro explains how telematics presents a wealth of opportunities to add value and tailor propositions to create long-lasting customer relationships built on trust.

Blog: Loyalty penalties - how the industry can be changed by smart technology

Creating and retaining loyal customers is a goldmine for businesses. Customers who champion and support a particular brand not only continually strengthen their own relationship but also act as an advocate to other consumers.

Barton steps down as CEO of Wrisk

Niall Barton has stepped down as CEO of insurtech start-up Wrisk to become executive chairman.

Blog: The digital claims manager – a flash in the pan, or sign of progress

As Allianz appoints a digital claims propositions manager, Post content director Jonathan Swift mulls whether this is part of a sustainable trend - or a short lived attempt by insurers to give the impression they are doing something to transform their…

Insurtech 100: May - July 2019 quarterly update

Hippo, Lemonade and Zego are just three of the start-ups that have been in the news recently. Matt Connolly, founder and CEO of Tällt Ventures, reflects on a what has been happening for the Insurtech 100 since the list was published in May.

Insurers throw support behind calls to ban use of hands free devices while driving

Insurers have welcomed a Parliamentary report calling for tougher restrictions on using hands free mobile devices while driving.

More than half of London market risks placed electronically in Q2

Lloyd’s syndicates placed 60.2% of in-scope risks electronically during the second quarter of 2019, surpassing the 50% target set in December.

This month in Post: Insurtechs, results and discount rate

London seems strangely quiet in the summer, most people are away on holiday, and out of office replies are basically a given.

Insurtech Pluto teams up with Blink after £300,000 seed raise

Zurich backed start-up Pluto has entered partnership with travel insurtech Blink.

Blog: The Whaley Bridge experience - how well do insurers cope at times of crisis?

The Whaley Bridge incident has once again thrown the spotlight on insurers, their disaster plans and capacity issues. Alex Dalyac, founder and CEO, Tractable comments that while feet on the ground will never be totally replaced, the industry could be…

Cyber insurance payout rates at 99% but uptake still too low

Cyber insurance payout rates at 99%, but the take-up rate of cyber insurance by businesses in the UK still worryingly low, warn insurers.

Blog: Digital disruption - unlocking opportunities in insurance

Insurance via smartphone with information and advice at their fingertips - that's what customers who buy a policy for the first time expect today. In the long term, the companies that will prevail in the market will be those that best meet these changing…

Analysis: What do recent market exits mean for insurtechs targeting millennials?

Three insurtechs have pulled out of the insurance market so far this year, raising questions around the efficacy of selling insurance to millennials and whether more of these firms will fall.

Trov partners with Lloyds Banking Group to relaunch UK insurance offering

Insurtech Trov has today unveiled a white-label insurtech platform in partnership with Lloyds Banking Group.