Sponsored

Blog: The MIB's litigant in person portal is only fit for sunny days

The Motor Insurer's Bureau might have outlined how it expects the proposed litigant in person portal to work. But Marcus Taylor, director of claims at Minster Law, argues that while this might be fine for 'sunny day' scenarios, there was much detail…

Blog: How you can make a difference by supporting Alzheimer's Society at the 2019 BIAs

Every three seconds across the world, someone develops dementia. With this in mind Benedict Burke, chief client officer, global client development, Crawford & Company, explains why you should get behind Insurance United Against Dementia at the 2019…

Blog: Will Brexit fundamentally change the dynamics of travel insurance?

The UK's withdrawal from the EU could leave many travellers with pre-existing medical conditions struggling to get cover. Aquarium Software's product marketing director Mark Colonnese suggests a solution whereby insurers bid against each other to cover…

Roundtable: Digital Transformation – to what extent has hype turned into action?

While the topic of digital transformation has been around for the past decade, consultancies continue to warn that further transformation is required. Post, in association with Marklogic, held a roundtable with senior figures from the insurance industry,…

Analysis: The future of pricing - A responsible revolution

Change is hitting insurers at a much faster pace than ever before. Are they ready to keep up and able to re-establish some of the trust that has been lost?

Blog: What's stopping customers being given more choice for replacement mobility?

From vehicle size to type, motorists need to be given greater choice by insurers when their car is off the road. James Roberts of Europcar Mobility Group UK outlines some suggestions as to where flexibility could play a greater role.

Blog: To beat fraud, insurers have to tear down internal walls to future-proof their business

The insurance industry continues to treat cyber attacks and fraud as two independent problems. However, Dennis Toomey, global director of counter fraud analytics and operations at BAE Systems, argues they are in fact one and the same – and until the…

Q&A: National Windscreen managing director Jan Teo

Having taking over the reins of National Windscreens as managing director in 2018, Jan Teo spoke to Jonathan Swift about what attracted her to the role; the challenges the business faces and what it is like being caught up in a motor manufacturer space…

Blog: MoJ fixed costs consultation is whack-a-mole for policymakers

The government’s plan for fixed recoverable costs to be applied to most civil cases - including personaI injury - might fix some problem areas in claims. Minster Law's legal services director Rachel Di Clemente asks if it will create more.

Roundtable: Making data fit for compliance and regulatory purpose

The use of data is widespread but where insurers are on their integration journeys can be very different. Post, in association with Marklogic, brought a panel of experts together to discuss best practice in this area including effective compliance and…

Blog: How digital can help the pet insurance sector reach its full potential

The average cost of a pet claim is on the rise with payouts often exceeding premiums. However, insurers need not cut margins to remain profitable, with Mark Colonnese of Aquarium Software, pointing to the smart deployment of digital technology as key to…

Blog: Treating customers fairly is a business imperative too

Personal lines is a competitive space but Mike Smart, business development director at BAE Systems Applied Intelligence, believes that the first movers to tackle dual pricing and look at business structure will be the winners in the long run.

Spotlight: Data - Ordering data in

Insurers continue to hang their success on the quality and use of data, with businesses continually reviewing how to gain a commercial advantage. Edward Murray looks at the benefits of using external data providers and why some peril risks have proven…

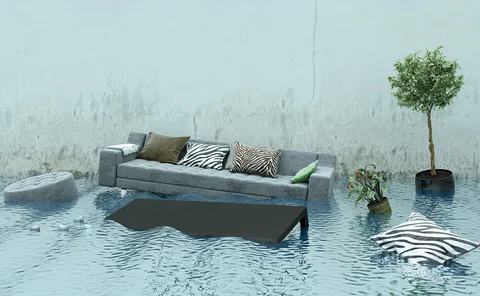

Spotlight: Data - Why are insurers ignoring data for escape of water claims?

Don’t blame the rain for the growing number of water-related claims in the UK, blame the plumbing

Blog: Shaping the future of urban mobility

There is no question that the UK is on the brink of big change in urban mobility and that it is set to transform the motor insurance landscape, says James Roberts, business development director for insurance at Europcar Mobility Group UK.

Claims Apprentice 2019: Episode 6 - The interviews

Team Discovery and Team Fortitudo are no more.

Blog: The discount rate review – calling King Solomon

The review of the discount rate will be fraught with moral, ethical and financial hazards. Minster Law's legal services director Rachel Di Clemente explains why those involved in the decision might be wishing for some of King Solomon's wisdom.

Claims Apprentice 2019: Episode 5 - Tech and Innovation

With Discovery taking a two-one advantage following the Talent Recruitment challenge, the apprentices now move onto their fourth and final task in their respective teams.

Blog: How insurers can maximise the value of data

Data is now in vogue for the insurance industry and Mike Smart, business development director at BAE Systems Applied Intelligence, explains why data scientists are going to be much sought out in the future.

Claims Apprentice 2019: Episode 4 - Talent Recruitment

With Team Discovery levelling the scores after the diversity and inclusion challenge last week, the apprentices now move onto their third task.

Roundtable: Escape of water - managing the rising indemnity spend

Escape of water claims continue to exercise property claims managers. According to the most recent estimates from Association of British Insurers, domestic escape of water claims cost insurers £483m. With this in mind, Post, in conjunction with Acumen,…

Special Report: Motor Insurance Research 2019: Expert View

With Adas on the rise, insurers need to better understand these technologies, including their impact on safety and claims, to derive the greatest benefits from them. National Windscreens managing director Jan Teo highlights how education can play a…

Blog: How ready is the motor insurance supply chain for the electric future?

Electric vehicle sales might be on the rise, but questions remain about how ready the insurance sector is for what has been described as “biggest technology advancement since the invention of the combustion engine”. Europcar Mobility Group UK’s James…

Claims Apprentice 2019: Episode 2 - The Debate

Now that the six contestants have been split into teams and decided on their names, it is time for the apprentices to tackle their first challenge.