Sponsored

Blog: Reimagining insurance by learning from API innovation in other financial services

Application programming interfaces are now key to unlocking new sources of value for financial institutions. So much so, Cytora CEO Richard Hartley argues even the most traditional firms can digitally transform if they get the right data infrastructure…

How to take advantage of digital innovation as an MGA

At a time when managing general agents are performing strongly, working hard to stay profitable and maintain growth, the question of how to make best use of the latest tools is more important than ever

Blog: Are MGAs best placed to build the future of underwriting?

Unencumbered by legacy technology, managing general agents are well placed to invent a better future for insurance. Cytora CEO Richard Hartley on why the likes of C-Quence and Convex are creating a radically different type of insurance company.

Blog: Claims and Fraud – Collaboration will end the zero-sum game

Will the Post Claims and Fraud Summit on 21 November serve as another arena for the claimant and defendant sectors to go another nine rounds of verbal fisticuffs? Michael Lynch, head of insurance partnerships at Minster Law, offers his views.

Diversity and Inclusion Q&A: EXL's Iulia Vernis

Diversity and inclusion is gathering pace in the insurance market, and Post editor Stephanie Denton sat down with Iulia Vernis, senior assistant vice-president for insurance for EXL, to find out how the market can do more.

Roundtable: Cyber - the next big opportunity in personal lines

Cyber has been long-touted as offering insurers and brokers a huge opportunity in commercial lines – from SMEs to corporates. But as individual consumers become ever more aware of their vulnerability to data breaches and cyber attacks, an equally large…

Top 30 Asia Insurers: A volatile year

2018 was a volatile year for Asian insurers with the majority of them posting declines in gross written premium or sluggish growth. Christie Lee, senior director of analytics for Asia-Pacific at AM Best, explains the challenges they are facing.

Blog: Are insurers effectively engaging with SMEs?

The SME market represents a major area of growth for insurers but Sara Costantini, managing director of Crif Decision Solutions, asks what providers are doing to capitalise on this opportunity?

Roundtable: Vulnerable customers: how does technology deliver fairer claims outcomes?

The FCA continues to be concerned about the problems faced by vulnerable customers. The regulator is expected to soon unveil a consultation to provide clarity on expectations of firms. Experienced claims handlers will play a key role in helping insurers…

Blog: Getting ready for the B-word

As the ins and outs of the UK leaving the European Union continue to be debated, James Roberts, business development director for insurance at Europcar Mobility Group UK, feels that - whatever the outcome - the pain for customers facing lengthy and…

Blog: Diversity and inclusion are essential to success in insurance

As data and technology become increasingly important to insurance, Mohit Manchanda, head of consulting for UK and Europe at EXL, believes ensuring the diversity of the teams owning the data, building and maintaining the algorithms, and providing audits…

Insurance Technology Summit Q&A: Duck Creek Technologies Europe managing director Bart Patrick

Ahead of the Post Insurance Technology Summit, Post editor Stephanie Denton sat down with Duck Creek Technologies Europe managing director Bart Patrick to discuss the cultural step change need in insurance to remove the upgrade nightmares.

How climate change is impacting the risk profiles of financial institutions

A closer look at how board-level considerations of climate change must shift, and the potential consequences if they do not

Special report: The future of claims in commercial broking: Expert view

Technology and staff investment are key to delivering great commercial claims service. Insurers must show the way in embracing future claims innovation, as well as their in-house capabilities and expertise, writes Victoria Keating, claims relationship…

Blog: Urban mobility - the differentiation battle zone

The current credit hire regime has no place for choice other than a hire car for the duration of repair, even though that might not meet the needs of the claimant. James Roberts, business development director for insurance at Europcar Mobility Group UK,…

Insurance Technology Summit Q&A: Equinix global head of insurance James Maudslay

Ahead of the Post Insurance Technology Summit, Post editor Stephanie Denton sat down with Equinix global head of insurance James Maudslay to discuss the role inter connection and ecosystems play in giving insurers a digital edge.

Advertising Feature: Is a lack of expertise at bodyshops putting drivers at risk?

New technology can save lives, but Neil Atherton, sales and marketing director at Autoglass, fears a lack of expertise at bodyshops could put drivers at risk and lead to increased insurance claims.

Insurance Technology Summit Q&A: Crowe partner Daniel Bruce

Ahead of the Post Insurance Technology Summit content director Jonathan Swift sat down with Crowe partner Daniel Bruce to discuss the difficult questions insurers need to ask themselves before undertaking digital innovation projects, and why they need to…

Special Report: The future of personal lines insurance: Expert view

The insurance industry needs to understand the demands of its future customers if it is to satisfy their expectations. EXL’s head of UK and Europe and SVP Insurance, Nigel Edwards explains how smarter insurers will adopt personalisation and a…

Roundtable: Opening up new insurance opportunities using IoT

The Internet of Things continues to offer insurers considerable opportunities in terms of maximising existing data to better understand customers and enter new markets previously considered unprofitable. With this in mind, Post, in association with…

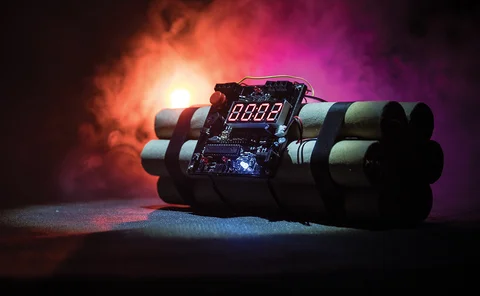

Spotlight: SME market: SMEs and cyber risk - a ticking time bomb

SMEs are a prime target for cyber criminals because they are believed to have limited resources and employ less technically aware employees than larger enterprises. Despite this, these businesses, their insurance providers and brokers are not assessing…

Blog: Breaking the under-reporting habit

In order to solve a problem, we need to accept that it’s there. This principle is common sense – and it certainly applies to insurers’ fight against financial crime, says Dennis Toomey, global head of insurance fraud at BAE Systems.

Roundtable: Innovation in pricing: the need to adapt

As insurers innovate, those at the core of insurers’ pricing and underwriting strategies face a growing need to adapt. Post held a roundtable, in association with Sas, to examine what is driving innovation in pricing and what challenges those changes…

Blog: The financial crime insider threat

The insurance industry has woken up to the growing criminal threat. However, Dennis Toomey, global director of counter fraud analytics and operations at BAE Systems, highlights that much investment in this area has focused on the external threat.