United Kingdom (UK)

Blog: Lloyd’s and the London Market, your time has come

With Lloyd’s, London market and wholesale broker accountability drawing the regulator’s attention in recent weeks, Michael Sicsic, managing director of Sicsic Advisory and former Financial Conduct Authority head of retail general insurance supervision,…

C-Suite: AIG’s Anthony Baldwin on people power

AIG UK CEO Anthony Baldwin shares how he will focus on London’s role as a global centre for insurance and a hub for talent during his year as president of the Insurance Institute of London.

Axa blames Lockton errors in defence to property developer's fire claim

Axa has blamed Lockton for issuing an incorrect certificate as the insurer estimated its liability for the damage portion of a property claim at £541,000 rather than the £1.7m being sought by property investor Aubrey Weis in a High Court action.

Blog: Building a more sustainable approach to motor claims

Before the 2012 London Olympics, the BBC aired a mockumentary following the challenges of the Olympic delivery team. In the series, Twenty Twelve, the 'head of sustainability' was portrayed as a joke. Fast forward to 2020 to forest fires, floods, ocean…

Spotlight: Sustainability - The impact of modern methods of construction on insurers

Modern methods of construction may be a solution for the UK housing crisis but what risks do insurers face? Michael Smale, senior associate at Kennedys and Chris Butler, partner at the firm explore the risks across all stages of the construction process…

Spotlight: Sustainability: Modern methods of construction

As the drive to a greener, more sustainable housing market continues so modern methods of construction are increasing in both popularity and usage. This drive is coming from a combination of government policies, consumer demand and also from within the…

Kingfisher alleges deceit and software breaches in £25m claim against ex-Fresh owners

Kingfisher UK Holdings has accused the former owners of personal lines specialist broker Fresh Insurance of covering up that its software used the Motor Insurance Bureau’s My Licence system in a way that breached its agreement with the MIB and the Data…

Cold call claims fraudsters come up with fresh scam, insurers warned

Exclusive: Cold calling fraudsters have contrived another method of targeting policyholders to make fake claims in what insurer LV told Post it believes is a twist on previous scams.

Take part in Post's Adas survey 2020

Post, in association with National Windscreens, invites industry professionals to take part in our latest Adas survey.

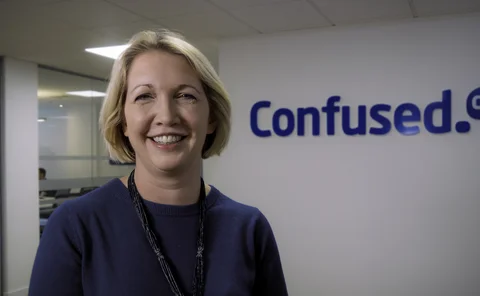

Q&A: Louise O'Shea, Confused

Louise O'Shea, CEO of Confused, spoke to Post about the comparison site's recent profits, its growth ambitions and what the FCA's pricing proposals will mean for consumers.

Trade Voice: Airmic’s Julia Graham on the D&O market

As premium rates for directors' and officers' rocket, Airmic deputy CEO and technical director Julia Graham says insurers need to wake up and innovate if they wish to prevent a flight to alternative risk financing by insureds.

Bobby Gracey joins Charles Taylor as global head of fraud

Charles Taylor has appointed Bobby Gracey, the chairman of the Chartered Institute of Loss Adjusters’ anti-fraud committee, as global head of fraud.

Union GMB calls for government intervention in AA deal

Trade union GMB called on the government to protect the AA from being “asset stripped” as the motoring group accepted a take-over offer from private equity firms.

Blog: Replacement vehicle services - building a stronger customer journey

While many of us work from home, looking out of our windows it’s hard not to spot the rising number of vans and other light commercial vehicles on our roads. James Roberts, business development director for insurance at Europcar Mobility Group UK, argues…

Blog: The importance of delivering an authentic brand experience

Companies that have a purpose are more successful than those that don’t, considers Zurich UK head of marketing communication Tracy Waxman, as she mulls how brand refreshes need to be more than just words.

FCA urges Lloyd's and London market insurers to behave 'ethically' in face of Covid-19

The Financial Conduct Authority has written to Lloyd’s and London Market insurers instructing them to “behave ethically and responsibly in the way they treat their customers, their employees and their counterparties” during the pandemic.

Esure adds former Sky betting and gaming CTO to top team

Esure Group has recruited Andy Burton as chief technology officer and appointed Justin Cockerill as chief commercial officer.

Arag appoints Simon Barrett CFO as UK co-founder retires

Arag has appointed Simon Barrett as chief financial officer in preparation for the retirement of longstanding CFO Bob Moreton next year.

Go Compare parent share price jumps 18% as group agrees Future sale terms

Shares at Goco, parent company of Go Compare, were almost 18% up this morning as the company agreed terms of an acquisition offer from British publisher Future, in a deal valuing the group at £594m.

Talbot Underwriting employee succeeds in unfair dismissal bullying claim

A tribunal has found in favour of a former employee of AIG business Talbot Underwriting who sued the insurer for constructive unfair dismissal.

AA accepts take-over offer from private equity firms

Motoring group the AA has confirmed it reached an agreement on the terms of recommended cash acquisition under which Towerbrook Capital Partners and Warburg Pincus International will acquire the business.

Briefing: "Alexa, do voice assistants have a future in insurance?"

As Confused launches an Alexa Skill that allows customers to get quotes from their Amazon Echo, Post content director Jonathan Swift asks other insurers about their experience of voice assistant technology to see if it is merely a gimmick - or has a…

Houghton targets £200m GWP in five years as Synova backs Glendinning MBO

Leeds-headquartered JM Glendinning is planning to buy 15 businesses over the next five years after its private equity-backed management buyout, group CEO Nick Houghton told Post.

Insurers told soul-searching, not superficial projects, will improve industry's reputation

Insurance companies must ensure they are “purpose-led” in order to restore the sector’s reputation, Blueprint for Better Business CEO Chris Wookey told members of the Worshipful Company of Insurers last week.