United Kingdom (UK)

Bollington buy a ‘super fit’, says Gallagher boss Michael Rea

Michael Rea, CEO of Gallagher’s UK retail division, has hailed the takeover of Bollington as supercharging the firm’s presence in the North West and adding specialisms to the group.

Supreme Court to hand down BI verdict on Friday

The Supreme Court is expected to hand down its judgment in the business interruption test case appeal on Friday 15 January, the Financial Conduct Authority has confirmed.

Loss making SSP reveals financial struggles ahead of sale

SSP made an after tax loss of £115m in the 18 months to 30 September 2019 and breached its banking covenants in March 2020, the business has revealed ahead of its takeover by Canadian firm Constellation Software.

QBE’s Jon Dye on managing emerging risks in 2021

From trade tariffs on parts and whiplash reform, through to fraud, automatic lane keeping technology and connected vehicles, there is plenty for insurers to keep an eye on this year, says Jon Dye, director of motor at QBE.

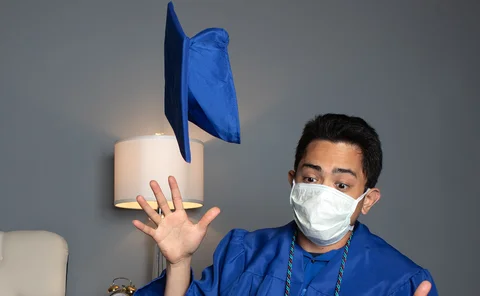

Analysis: Delivering opportunities for graduates during the Covid crisis

Insurers have maintained their graduate programmes during the coronavirus pandemic, according to an investigation by Post, and adapted to the challenges of training and recruiting in a virtual world to keep this crucial entry route into the profession…

Briefing: Has the MOJ bitten off more than it can chew with whiplash reforms?

Perhaps the only surprise about today’s delay to part one of the Civil Liability Act (2018) whiplash reforms is that they are only being put back one month.

Former RAC employee sentenced after selling personal data to CMC

Former RAC employee Kim Doyle has been sentenced to eight months imprisonment, suspended for two years, in a prosecution brought by the Information Commissioner’s Office for selling unlawfully obtained personal data to a claims management company.

SSP users hopeful of investment as takeover nears completion

Users have expressed hope that SSP’s expected takeover by Canadian-listed Constellation Software will lead to investment in the technology company as it exits private equity ownership.

Whiplash reforms pushed back to May

Whiplash reforms have been pushed back to May, Lord Chancellor and Secretary of State for Justice Robert Buckland confirmed today.

Intelligence: Gaming the new frontier

The insurance needs of the gaming sector are complicated and ever evolving but there are plenty of opportunities for those prepared to immerse themselves in this flourishing market.

FCA fines more than halve to £192.6m in 2020

The Financial Conduct Authority imposed fines of £192,570,018 in 2020, the third lowest total on record since the watchdog was formed in 2013.

Storm Bella claims volume ‘significant’ say loss adjusters

Late 2020’s storm Bella has driven a “significant” number of claims, loss adjusters told Post, though damage was not witnessed on the scale of storms Ciara and Dennis.

Former Lib Dem leader brands insurer Covid BI claims handling 'deeply depressing'

Former Liberal Democrat leader Tim Farron has called the conduct of insurers during the coronavirus pandemic “deeply depressing” and urged the Chancellor of the Exchequer to “take steps to protect insurance customers from the actions of insurers”.

Iprism swings back to profit in 2020

Iprism Underwriting Agency has returned to profit in 2020 with a bottom line result of £435,365 reversing its £761,988 loss the year before when it was hit by restructuring costs.

Jeff Brinley named Be Wiser CEO as Sharon Beckett steps down

Jeff Brinley has been named Be Wiser CEO with Sharon Beckett having left the role this year, Post can reveal.

FCA reports 30% drop in broker liquidity and warns 4000 financial firms are at risk of failure

The Financial Conduct Authority’s coronavirus financial resilience survey has revealed that insurance broker liquidity fell by 30% due to the pandemic, the largest drop measured in any sector.

Lockdown: Many insurer and broker offices to remain open as Lloyd's underwriting room closes

Insurers and brokers have told Post that the majority of their staff will continue to work from home and that offices will remain open to those few that need to access them, following the start of a third national lockdown in England.

Cécile Fresneau adds syndicate active underwriter role at QBE as David Harries retires

David Harries, active underwriter of QBE Syndicate 386 and head of financial lines will be stepping down and handing over to UK insurance executive director Cécile Fresneau, the provider has confirmed.

Penny Black's Social World: January 2021

Charity counts, commitments and cups of coffee

Editor's comment: Talking about reputation

To start 2021 we asked the major players in broking, claims and insurance to predict what the biggest event of the new year would be and what trends the first year in the next decade would bring.

Clear makes Mike Edgeley CEO as Lickens moves to chairman role

The Clear Group has appointed former A-Plan managing director Mike Edgeley as CEO with founder Howard Lickens moving to become executive chairman.

Loss-making Markerstudy sniffing out investors as loan discussions continue post-deadline

Managing general agent Markerstudy made a loss in 2019, with discussions ongoing around its near £200m debt to Qatar Re.

Interview: Patrick Tiernan, International Underwriting Association

Newly appointed chair of the International Underwriting Association Patrick Tiernan sat down for a virtual chat with Pamela Kokoszka to discuss his plans as a chairman of the association, climate change and how the industry can overcome challenges…

Adam Boakes hails opportunities as first joint Ataraxia-MVP broker deal completes

Ataraxia and Minority Venture Partners have facilitated the merger of Altrincham-based Alan Stevenson Partnership and Seacombe Insurance Brokers taking a minority stake in the business.