United Kingdom (UK)

Pen's Tom Downey says MGA sector's secret sauce is its recipe for success

Tom Downey, CEO Pen Underwriting, believes the managing general agents sector is in rude health and discusses what he believes could be its 'secret sauce'.

Fears OIC portal is not meeting objectives as unrepresented claimants make up less than 10% of users

Latest figures from the Ministry of Justice show that unrepresented claimants still make up less than 10% of those using the Official Injury Claim portal, as concerns grow that portal is not meeting objectives of being “consumer friendly”.

Start-up Peppercorn to launch this year with a customer-empowering motor solution

Exclusive: Insurtech start-up Peppercorn will launch later this year with a digital motor solution that will challenge the mechanics of traditional incumbents.

Intelligence: Our duty to protect must begin now

Protect Duty legislation has been touted as a way to reduce the potential for catastrophic events from terrorist attacks at publicly accessible locations, and it is likely to affect public and employers’ liability polices. But, as Edmund Tirbutt reports,…

Nikhil Rathi pledges to make the FCA more assertive and quicker in stamping out wrongdoing and consumer harm

The Financial Conduct Authority has launched a three-year strategy to improve outcomes, with the CEO Nikhil Rathi pledging to make the regulator more assertive and quicker in responding to changing financial services sector.

Insurers to save £2bn as Vnuk law set to be axed by the end of June

The controversial Vnuk law, which could have created an extra £2bn a year of costs for the insurance sector, is expected to be axed by the end of June as Motor Vehicles Bill passes through House of Lords’ committee stage with no amendments.

FCA regulatory reforms no ‘silver bullet’ but step towards more nimble regulator

Regulation experts have praised the Financial Conduct Authority’s steps towards tackling authorisation delays but have warned they will not be enough to tackle the problem on their own.

Lords Committee expresses concerns of ‘overly demanding’ and ‘burdensome’ regulation of London Market

The Industry and Regulators Committee has written to the Economic Secretary to the Treasury John Glen to outline concerns about lack of proportionality in the regulation of the London Market by the Financial Conduct Authority and the Prudential…

British Insurance Awards: 2022 shortlist revealed

This year the British Insurance Awards return back to their spiritual home at the Royal Albert Hall after a two year absence.

IBM ordered to pay another £80m after it unlawfully breached Co-op IT contract

The Court of Appeal has found that IBM must pay another £80.6m to the owner of Co-operative insurance due to breach of an IT contract in 2017.

Editor's comment: Walk the walk on ESG

Last August the Intergovernmental Panel on Climate Change report warned that ‘unless there are immediate, rapid and large-scale reductions in greenhouse gas emissions, limiting warming to close to 1.5°C or even 2°C will be beyond reach’.

Penny Black's Social World: April 2022

Getting pied, planting trees and Macmillan money

McPhail swaps Zurich for Keoghs

Calum McPhail, formerly head of liability claims at Zurich, has left the insurer to join Keoghs as strategy consultant on a part-time basis.

Interview: Kelly Ogley, A-Plan

Four months after stepping up to the role of CEO at A-Plan, Kelly Ogley tells Pamela Kokoszka about her three passions, discusses the growth plans for the broker, and reveals how it has managed to remain relevant for the past 58 years

FCA reforms authorisation process as it continues recruitment push

The Financial Conduct Authority has said it is committed to bring a more robust and efficient authorisation process and confirmed it has reformed its authorisation process with more decisions now taken by individual senior managers rather than by…

Citizens Advice ethnicity penalty campaign a ‘wake up call to FCA’

Citizens Advice ethnicity penalty report must be "a wake up call to the Financial Conduct Authority” to act on its promise to HM Treasury as insurers face warnings the fallout from this could be as far reaching as the Test Achats gender ruling.

Woodgate & Clark acquires media and entertainment adjuster Spotlite

Woodgate & Clark has acquired media and entertainment adjuster Spotlite as it continues to build specialist expertise.

Allianz’s Catherine Dixon explains why we should all be on the path to Net Zero

Meeting environmental, social and governance targets should be a relay race, with each baton pass advancing the cause towards Net Zero, explains Catherine Dixon, chief underwriting officer at Allianz Commercial.

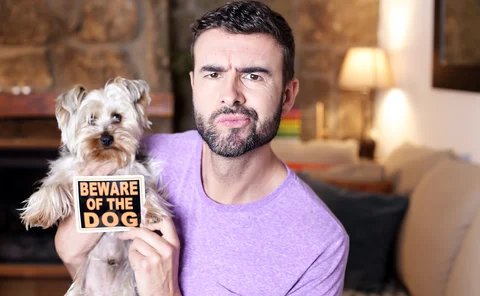

Blog: The curious incident of the dog and the bite crime

Rebecca Conway, chief legal officer at Arc Legal Assistance, reflects on the increase of pets in households in the UK during lockdown, and what route policyholders can pursue if they are bitten by a dog that has not been trained or socialised enough.

Analysis: How dual pricing reforms are shaking up insurance

Post investigates what changes the industry has seen following January’s dual pricing reforms, and if insurers are following the right path on price walking.

Robust e-scooter regulation needed at 'earliest opportunity', sector urges Shapps

Four insurance industry trade associations have called on the government to bring in 'robust' legislation around the use of e-scooters as soon as possible if they are to be permitted beyond current trials.

Judgment closing dental liability loophole could herald insurance step change

A Court of Appeal judgment has closed a legal loophole that meant dental practices were not liable for injuries caused by individual dentists during treatment, potentially further opening up the market to commercial insurers.

Axa will not appeal Corbin & King BI verdict

Axa has decided not to appeal a £4.36m Commercial Court business interruption judgment against it.

Blog: The lost art of underwriting

James Gerry, chairman of MX Underwriting, argues that the insurance industry is losing sight of the art of true underwriting, as technology continues at pace to replace the human interactions with brokers.