Analysis

Penny Black's Social World: September 2019

Memory Walk, dazzling dress up and the Silver Line cycle

Top 30 European Insurers 2019: Insurers see 4.4% growth

Gross written premium reported by the 30 largest European insurers in 2018 was 4.4% higher than the aggregated figure for the previous year but those writing significant business outside of the eurozone have seen foreign exchange rate movements having an…

Special Report: The future of personal lines insurance

Retail insurance customers are changing, with a growing opinion that those born after 2000 will have very different expectations than those over twice their age because they are digital natives. Sam Barrett explores what the industry needs to do to…

Spotlight: SME market: Where do the biggest opportunities lie for brokers in the SME market?

There seems to be a significant number of drivers for change in the SME market, which begs the question how the relationship between brokers and these clients will change. Edward Murray looks at the opportunities available for intermediaries to remain as…

Analysis: Protecting businesses against political risks

The political risk map of Europe is being changed by a toxic combination of uncertainty — both political and economic, populism, geopolitical changes, political violence and technological advances

Insurtech 100: May - July 2019 quarterly update

Hippo, Lemonade and Zego are just three of the start-ups that have been in the news recently. Matt Connolly, founder and CEO of Tällt Ventures, reflects on a what has been happening for the Insurtech 100 since the list was published in May.

Analysis: Investing in a sustainable future

European governments and a wide range of international governmental and non-governmental organisations are looking to big institutional investors to back the development of a sustainable, greener infrastructure. Insurers and pensions funds are top of…

Penny Black's Social World: August 2019

British Insurance Awards, Dive In for diversity and funds from filming

Analysis: Discount rate decision casts a shadow over personal injury settlements

The personal injury discount rate will be set at minus 0.25% from 5 August providing certainty for insurers and claimants alike, but uncertainty created by the Ministry of Justice review behind the new rate could have left claimants – as well as insurers…

Analysis: Impact of smart home technology on escape of water claims

In 2018 insurers dealt with 228,000 escape of water claims, at a cost of £617m – an increase from £529m paid out five years ago, according to statistics from the Association of British Insurers. With the rising cost of claims, can technology help reduce…

Analysis: Mitigating the risk of sexual harassment in the workplace

Over the past two years, awareness of how prevalent sexual harassment is in the workplace has reached perhaps unprecedented heights.

Analysis: SME risk management: Loss of appetite

Small and medium-sized enterprises are facing a plethora of challenges. So how are insurers helping this sector?

Penny Black's Social World: July 2019

Festival of Football, charity communities and clean air commitments

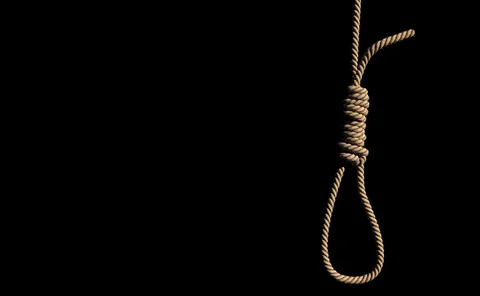

Analysis: The future of pricing - Tightening the noose

The dual pricing noose is slowly tightening around the insurance industry’s neck. Its laudable attempts to escape from the regulatory hangman seem increasingly futile as the pressure is mounting on the Financial Conduct Authority to take action.

Analysis: The future of pricing – Data and technology

Insurers are coming under increasing pressure to develop new ways of pricing. But, while data and technology hold the key, insurers face some significant challenges as they move to this brave new world.

Analysis: The road to inclusion

Most people in the industry would probably describe themselves as open-minded, abhorring any kind of discrimination and supportive of more diversity in the workplace. The enthusiasm for change from all quarters is testament to that

Analysis: Charity & CSR: Protect and survive

The insurance sector is one of the mainstays of the UK economy, contributing nearly £30bn and employing more than 300,000 people. Its sheer size and financial strength gives the industry the opportunity to do good for the people who rely on it

Analysis: Diversity and Inclusion: A marked shift in commitment

Diversity and inclusion have moved from buzzwords to being embraced by the insurance industry for all the right reasons but is it doing enough?

Penny Black's Social World: June 2019

Challenging conversations, supporting good causes and embracing diversity

Analysis: Managing ‘unthinkable risks’

The insurance industry has become progressively familiar with the idea of ‘unthinkable risks’ in recent years as unpredicted and unprecedented losses, caused by both natural catastrophes and man-made events, have continued to happen

Analysis: Grenfell – Putting rehabilitation outside litigation

Almost two years on from the horrific fire at Grenfell Tower, with the inquiry ongoing, are survivors getting the help they need?

Analysis: Balancing risk and reward at board level

Risk managers believe that risk reporting and mitigation should no longer be an isolated item on the board agenda but how can they get the executive buy-in to this?

Analysis: Cutting the costs and risks of employee benefits

Being able to offer attractive employee benefits is vital in terms of recruitment, retention and productivity, but they are both costly and risky

Analysis: Are AI solutions being used to mitigate risks?

In the commercial space, artificial intelligence has the potential to enable an insurer to get all the information it needs to write a risk in a matter of hours and support customers’ risk management activity, but only if it is deployed appropriately