SME

Analysis: Revisiting 'Flood Re Plus' for businesses

The idea of a Flood Re Plus scheme has been mooted by Airmic as a solution for those businesses that struggled to obtain flood cover

Innovu Group buys equestrian specialist Wexford Insurances in Ireland

Sheridan Insurances owner Innovu Group has bought Wexford Insurance Group in Ireland for an undisclosed sum.

This week: Running off

Though a new decade and the opportunity for new beginnings are now firmly in view, this week proved that 2019 still has some endings to get out of the way first.

Q&A: CII society chairs

Following recent changes to the Chartered Insurance Institute's societies, Post caught up with Sue McCall, chair of the Society of Claims Professionals, Kevin Hancock, chair of the Society of Insurance Broking and Philip Williams, non-executive director…

Blog: The changing face of the SME market

The SME market is changing, with more IT consultants, gig workers and freelance project managers emerging alongside traditional businesses. To support both the old and new Helen Bryant, director of SME markets at Allianz Insurance, argues the insurance…

Harris Balcombe creates head of cyber risks role

Mark Harris has joined loss assessor Harris Balcombe as head of cyber risks, Post can reveal.

Analysis: What's on the horizon for 2020?

For an industry that strives to understand and manage risk, uncertainty is not something that is relished. But with some market hardening, a final report from the Financial Conduct Authority on pricing practices and the possibility of Brexit all on the…

A-Plan breaks £100m revenue barrier and set to open 100th office

A-Plan will be opening its 100th office within the next two months, CEO Carl Shuker told Post.

Creditors approve liquidation process for ex-Iprism holding company

The creditors of Spectrum Bidco, a former holding company of Iprism Underwriting Agency, have approved its administrator’s proposals which will lead to the liquidation of the company.

Ex-Aviva director Russell launches 'Fit Bit for business' insurtech Brisk

An insurtech fronted by a former Aviva director is in negotiation with a trio of major insurers about adopting its solution, which co-founder and CEO James Russell describes as “Fit Bit for business”.

Marsh Commercial unveils locations for five 'Enterprise Centres of Excellence'

Marsh Commercial has confirmed that Bristol, Glasgow, Harrogate, Leeds, and Worcester will host its previously announced Enterprise Centres of Excellence focused on SME business.

Iprism group restructures with holding co pre-pack administration

Bowmark Capital-backed Iprism Underwriting Agency has completed a group restructuring including a pre-pack administration of its holding company for £329,300, writing off tens of millions of debt.

Interview: David Walsh, CFC Underwriting

A child of the dot-com boom, CFC Underwriting has now left its teenage years behind as it enters its twentieth year as one of the pre-eminent specialist managing general agents in the London market. CEO David Walsh spoke to Jonathan Swift about the …

This week in Post: Carnival spooks

This week, some Post colleagues and I attended CFC Underwriting's annual Halloween party. The theme this year was carnival, and accordingly, the party was full of clowns, fortune tellers and more than the odd Joker.

Blog: Are insurers effectively engaging with SMEs?

The SME market represents a major area of growth for insurers but Sara Costantini, managing director of Crif Decision Solutions, asks what providers are doing to capitalise on this opportunity?

MGA CFC mulls entering personal lines with cyber for HNW individuals

CFC is exploring the possibility of entering the personal cyber market.

Blog: Building resilience in an age of cyber risks

Developing resilience to cyber liability is now a significant task for businesses of every size. But according to Paul Bassett, managing director of crisis management at Gallagher, the rise of cyber and IT security risks, malware viruses and data…

Insurtech Inshare targets SMEs to corporates with peer-to-peer launch

Insurtech Inshare is seeking to bring peer-to-peer risk and insurance management to the commercial community as it gears up to launch ahead of the Insurtech Connect event in Las Vegas next week.

Analysis: Rash of cancelled cover highlights the role of the broker

A rise in the volume of UK businesses that have cancelled at least one type of insurance cover over the past few years has served to highlight the importance of the broker’s role in the insurance buying process

Zurich receives dressing down on small business payment practices

For the second time in less than two months an insurer has come under fire from the Small Business Commissioner, after the SBC looked into a vehicle repair specialist’s complaint and made recommendations to Zurich to improve its payment practices for…

Insurers 'should use data to accurately price small business risks'

Insurers should take more data into account in order to quote small businesses premiums that properly reflect their risk, Lexis Nexis Risk Solutions has said.

Gallagher warns cyber security is the 'soft underbelly' of UK SMEs

Crisis incidents cost UK SMEs a combined £8.8bn in 2018, with cyber-attacks, data breaches and cyber extortion incidents being most prevalent, research from Gallagher has found.

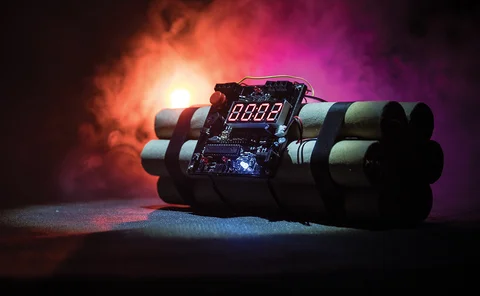

Spotlight: SME market: SMEs and cyber risk - a ticking time bomb

SMEs are a prime target for cyber criminals because they are believed to have limited resources and employ less technically aware employees than larger enterprises. Despite this, these businesses, their insurance providers and brokers are not assessing…

Spotlight: SME market: Where do the biggest opportunities lie for brokers in the SME market?

There seems to be a significant number of drivers for change in the SME market, which begs the question how the relationship between brokers and these clients will change. Edward Murray looks at the opportunities available for intermediaries to remain as…