Product

Top risk for UK businesses; WTW’s latest launch; Lloyds Bank’s head of insurance

Friday Round-Up: Insurance Post wraps up the major insurance deals, launches, investments and strategic moves of the week.

Changes at the top of FOS as Rachel Lam leaves post

Insurance Post has been informed that Rachel Lam is no longer in her position as ombudsman director of insurance at the Financial Ombudsman Service.

Consumer group warns of insurers overcharging vulnerable customers

The Financial Services Consumer Panel has published a research paper raising concerns that vulnerable customers may be at risk of overpaying for insurance.

Q&A: Theo Duchen, Acturis

Theo Duchen, co-CEO and co-founder of Acturis, discusses Astorg’s increased stake in the company, how best to implement artificial intelligence, and why he thinks his business is well placed to take on rivals in the US and Canada.

Are insurers racing to be online-only excluding disabled customers?

As the insurance sector increasingly digitises, Damisola Sulaiman examines the barriers disabled customers face in accessing online insurance services, as well as the measures that have been implemented by insurers to address these issues.

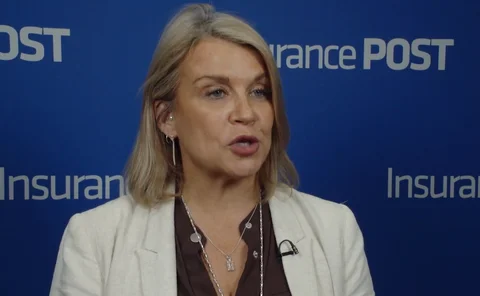

How to quickly launch an insurance product

How to spot a gap in the insurance market and move swiftly to produce a product to fill it is tackled by Vicky Rowlay, VP, national director for business transformation at Arch Insurance, in the latest Insurance Post Top Tips video.

Digital transformation solutions to ride the wave of the Insurance sector’s future

Advertisement feature: Fincons Group explains the recipe for successful collaboration with insurers to help them in their digital transformation

RSA’s cloud solution; Allianz’s new stadium; Gallagher’s managing director

Friday Round-Up: Insurance Post wraps up the major insurance deals, launches, investments and strategic moves of the week.

How ‘Baby Reindeer’ and streaming services are affecting insurance

As the way we consume media changes, Scott McGee considers how the furore over Baby Reindeer, and changing nature of the content we watch has had an impact on insurance.

Marsh’s carbon offering; Howden buys broker; Aventum’s AI assistant

Friday Round-Up: Insurance Post wraps up the major insurance deals, launches, investments and strategic moves of the week.

Is it time to ditch lithium ion batteries?

News Editor's View: Scott McGee considers if government legislation to make lithium ion batteries safer is too little too late for electric vehicle insurers and whether providers’ appetites for covering such cars will only return when manufacturers…

Pet insurance premiums increase in Q2

Pet owners have seen their premiums increase by 1.4% in Q2, according to data released by Pearson Ham.

Q&A: Vicki Wentworth, Agria

Vicki Wentworth, CEO of Agria, discusses the pet market and the importance of lifetime policies, and reveals the insurer considered purchasing RSA’s pet book.

MGA launches with travel insurance for pre-existing conditions

New travel MGA Gigasure plans to develop travel insurance for those with pre-existing medical conditions.

E-bike battery legislation ‘warmly’ welcomed

The UK government has announced its intention to legislate to reduce the fire risks associated with electric power-assisted bicycles and lithium-ion batteries.

Allianz’s PL motor product; Voyager is acquired; BMS’ growth officer

Friday Round-Up: Insurance Post wraps up the major insurance deals, launches, investments and strategic moves of the week.

Cuvva CEO on achieving profitability in a turbulent insurtech space

In its 2023 annual report, the car sharing insurtech revealed it was able to go from a £6m loss in 2022 to £3.8m adjusted profit in 2023.

Crunch time for insurers’ Consumer Duty reports

One year on from the introduction of the Financial Conduct Authority’s Consumer Duty requirements for open products, Emma Ann Hughes investigates whether insurers will get a pat on the back or a clip round the ear from the regulator when they hand in…

Big Interview: Sam White, Stella Insurance

Sam White, CEO of Stella Insurance, discusses her journey from aspiring stunt woman to insurance entrepreneur, the impact of her unconventional career path, and her mission to drive innovation and inclusivity within the industry.

Why are HNW MGAs dropping like flies?

After numerous MGAs operating in the high-net-worth space have either been sold or gone into run-off over the last few years, Scott McGee asks what does it take to survive in this space?

Kwik Fit's comeback; London Market’s world record; Ageas’ risk officer

Friday Round-Up: Insurance Post wraps up the major insurance deals, launches, investments and strategic moves of the week.

Sam White’s Stella to launch domestic abuse insurance in UK

Stella Insurance is set to launch a domestic abuse insurance product in the UK, to go alongside its motor policy, Insurance Post can reveal.

How can home insurance avoid a motor-like PR disaster?

As motor premium inflation is steadying, Scott McGee examines whether home insurance premiums will be next to rocket plus identifies ways to avoid the wrath of consumers facing paying more to insure their property.

LexisNexis accused of price increases despite limited product improvements

A source has told Insurance Post that they have seen prices for Thatcham's motor data increase by around 60% since the partnership with LexisNexis was announced earlier this year, despite very few of the promised improvements coming through.