Post blog

Inside Out: Is more regulation needed to stop insurers profiting from BI claims?

Post invites industry insiders affected by the key issues they believe insurance is getting ‘inside out’ to share their perspective and state their case for change. Here, a former business interruption insider argues that the government should follow the…

Blog: Why a collaborative approach for MGAs will be key for philanthropy

Jamil Elbahou, CEO and chief underwriting officer at Connect Underwriting, and board member of the International Insurance Charitable Foundation, considers how, when working for the greater good, individual companies can have far greater impact when they…

Blog: Brand legacy vs digital innovation within the insurance industry

As customers now expect their insurance provider to have strong digital capabilities, companies can no longer rely on brand loyalty alone to appeal to their audiences. Kelly Ward, chief sales and distribution officer at Axa Partners UK, considers how…

Telematics watch: Driving everyone out of the Covid-19 pandemic

Among the many things upended by Coronavirus was the nation’s driving habits. Igo4 telematics data from the past two years shows that Covid-19 not only changed how much we drove but how we drove. And as we emerge from the pandemic, the trends in the data…

Blog: The government must work with our industry to tackle climate change

Hannah Gurga, director general at the Association of British Insurers, explains why the government and insurance sector need to work together to help the industry maximise its contribution towards tackling climate change before it is too late, and why…

Blog: electric vehicles spark concerns around fire and safety

As the cost of fuel soars, and with the move towards a greener lifestyle, the popularity of electric cars is exceeding all expectations. However, attention is now turning to their safety, in particular the fire risks that come with e-vehicles, writes Tim…

Blog: Why short-term car insurance is moving into the mainstream

As driving habits change following the Covid-19 pandemic, Simon Jackson, co-founder and director at Go Shorty, explains why short-term car insurance is moving into the mainstream market as a sustainable solution.

Blog: Using sentiment analytics to measure reputational risk

While sentiment analytics is not a new concept, its adoption by insurers has not yet been fully realised. Arguably, its biggest potential is in the area of reputational risk, writes Karim Derrick, product and innovation director at Kennedys IQ.

Blog: Why diversity matters in digital insurance innovation

Rocio Garcia, user interface lead at Instanda, explains the importance of diversity in digital insurance innovation.

Blog: Making the wrong team moves risks losing regulatory permissions

As we emerge from the Covid-19 pandemic, employers and recruiters are anticipating a growing trend in employees wanting to move roles in what has been dubbed the 'great resignation'. BDBF partner Nick Wilcox, and associate Blair Wassman, explore the…

Blog: SMEs must reinstate pre-pandemic cover levels or risk being underinsured

Many small businesses are now returning to pre-pandemic activities, but still keeping the reduced levels of cover they had during the Covid-19 lockdown, writes Helen Bryant, director of digital trading at Allianz Commercial, as she warns against the…

Digital Bar Quarterly: What does it take to be ‘The Insurer of the Future?’

Having attended Insurtech Insights Europe 2022 last month, Altus Consulting business executive Mike Daly shares some thoughts including the possibility we are at a ‘tipping point’ in terms of someone creating ‘the Netflix of Insurance’.

Blog: Importance of robust agency arrangements in insurance sales and supply chains

With Axa suing Santander for £624m over its payment protection insurance policies, Caroline Harbord, partner, and Charlie Paddock, trainee solicitor at law firm Forsters, discuss the importance of robust agency arrangements in insurance sales and supply…

Blog: Ocean investment is critical to protect the welfare of ecosystems

As Axa and WTW join a new global finance ecosystem designed to channel funds into coastal and ocean natural capital by 2030, Chip Cunliffe, biodiversity director at Axa XL and co-chair of Ocean Risk and Resilience Action Alliance, takes a deep dive into…

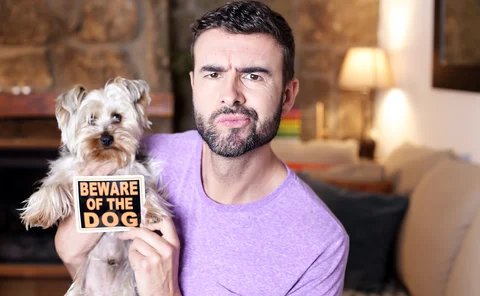

Blog: The curious incident of the dog and the bite crime

Rebecca Conway, chief legal officer at Arc Legal Assistance, reflects on the increase of pets in households in the UK during lockdown, and what route policyholders can pursue if they are bitten by a dog that has not been trained or socialised enough.

Blog: The lost art of underwriting

James Gerry, chairman of MX Underwriting, argues that the insurance industry is losing sight of the art of true underwriting, as technology continues at pace to replace the human interactions with brokers.

Inside Out: A former BI insider looks at what the insurance industry should have learnt in the past two years

Post invites industry insiders affected by key issues they believe insurance is getting ‘inside out’ to share their perspective and state their case for change. Here, a former business interruption insider talks about how the recent Corbin & King v Axa…

ESG Blog: Follow the Green Claims Code

Andrew Waddelove, head of sustainability at LV general insurance, looks at substantiating ESG claims, and considers what the Green Claims Code means for the insurance industry.

ESG Blog: On the trail of green regulation and reporting

With the new rules expected to come into force in 2022, which will make ESG reporting compulsory for big companies, Allianz's head of strategy and propositions Glen Clarke, considers what companies will need to do to account not just for their own…

ESG Blog: Insurers must make the move towards carbon neutral in 2022

The COP26 conference has prompted the insurance industry to look more closely at its carbon footprint and explore ways to reduce emissions. But are those in the insurance sector really committed to making tangible changes to become carbon neutral, or is…

ESG Blog: Companies must disclose environmental, social and governance procedures and manage liability risks

Sylvie Gallage-Alwis, Paris partner, and Kate Gee, London counsel at Signature Litigation, consider how the impact of liability and litigation risks, and environmental, social and governance issues will affect insurers.

Blog: Don't risk playing with fire over insurance claims

Over recent years, insurance claims for fire-related incidents have grown significantly. James Mountain, sales and marketing director at Fire Shield Systems, explores the factors influencing the rising fire risks and discusses how insurers can strengthen…

Blog: Is this the end of the paper-based insurance premium tax era?

With the UK tax landscape constantly shifting, the year ahead is likely to see further developments and changes in policy and regulation. Russell Brown, senior consulting manager at Sovos, considers what this could mean for insurance premium tax.

Blog: The key ingredients for successful M&A

Prodinity CEO and founder Theunis Viljoen looks at how best to achieve post-acquisition value following a merger or acquisition.