Cyber

Interview: David Walsh, CFC Underwriting

A child of the dot-com boom, CFC Underwriting has now left its teenage years behind as it enters its twentieth year as one of the pre-eminent specialist managing general agents in the London market. CEO David Walsh spoke to Jonathan Swift about the …

I work in insurance: Tom Bennett, cyber incident specialist, CFC

Working as cyber incident specialist at CFC Underwriting Tom Bennett ensures he stays abreast of recent developments in both hacker methodologies and cyber defence strategies

This week in Post: Carnival spooks

This week, some Post colleagues and I attended CFC Underwriting's annual Halloween party. The theme this year was carnival, and accordingly, the party was full of clowns, fortune tellers and more than the odd Joker.

Marsh raises concerns over syndicates' response to Lloyd's silent cyber mandate

Businesses could face surprising changes to their policy wordings ahead of their January renewals, as Lloyd’s property underwriters move to either affirm or exclude cyber coverage.

MGA CFC mulls entering personal lines with cyber for HNW individuals

CFC is exploring the possibility of entering the personal cyber market.

Analysis: The challenges of cyber modelling

The size and complexity of cyber perils are constantly increasing and pose a major challenge to insurers and insureds alike as they attempt to assess potential cyber losses.

Blog: Building resilience in an age of cyber risks

Developing resilience to cyber liability is now a significant task for businesses of every size. But according to Paul Bassett, managing director of crisis management at Gallagher, the rise of cyber and IT security risks, malware viruses and data…

This week: All at sea

The fraudulent claims we’re used to hearing about involve banged-up cars and invented cases of whiplash. Ones involving oil tankers, pirates, the Admiralty Judge, and statements given in places as far-flung as Aden and Manila are somewhat harder to come…

CFC's focus remains on organic growth following its first acquisition in 20 years

CFC Underwriting made its first acquisition in its 20 year history yesterday when it bought Solis Security, but the purchase will not mark a change in its acquisitive appetite, CFC chief innovation officer Graeme Newman told Post.

The NED Blog: What keeps risk committees awake at night

One of the ways that non-executive directors ensure there is independent oversight is through the use of various board committees. Michael Gaughan explains how the Risk Committee oversees the capital risks and why it worries about technology, cyber…

CFC makes first acquisition in 20 years as it buys Solis Security

CFC Underwriting has bought Texas-based incident response provider Solis Security, marking the company’s first acquisition in 20 years.

2019 Insurance Fraud Awards: Full list of winners

Zurich was the big winner at the 2019 Post Insurance Fraud Awards picking up three awards, and a highly commended including top prize in the Investigation of the Year category.

Blog: Cyber attacks - how can businesses combat human error?

Approximately three-quarters of cyber claims notified to CFC in the last year involved some kind of human error or oversight. This is in part due to the truth that theft of funds, ransomware, extortion and non-malicious data breaches usually involve the…

Special report: The future of claims in commercial broking

To find out what brokers think of commercial claims handling Post and Aviva carried out some extensive research. Sam Barrett reflects on results that highlight insurers have some way to go to meet their expectations.

AIG's Anthony Baldwin on the evolution of the London market

2019 has been a year of changes in the London Market. The Decile 10 review at Lloyd’s in 2018 was the most high-profile example of insurance businesses reviewing their operations

Remedying Risks: Managing cyber risks in marine

Seizure of oil tankers hits headlines but Royston Ford, head of marine and specialty at RSA Risk Consulting, believes the likelihood of cyber attacks occurring are low and can easily be guarded against.

Analysis: Rash of cancelled cover highlights the role of the broker

A rise in the volume of UK businesses that have cancelled at least one type of insurance cover over the past few years has served to highlight the importance of the broker’s role in the insurance buying process

This week in Post: Culture vultures

At the Monte Carlo annual rendezvous this week, Lloyd’s chairman Bruce Carnegie-Brown said the corporation was ready to “hang” perpetrators of bad behaviour after its culture survey revealed some “sobering” results.

Pool Re CEO predicts greater ILS diversification beyond US property-cat

Julian Enoizi, CEO of UK government-backed terrorism reinsurer Pool RE, has predicted that the insurance-linked securities market will diversify away from US property-catastrophe risks, into other “difficult to insure perils” such as terrorism.

Blog: Cyber crime - keeping ahead of evolving threats

With the imminent explosion of Internet of Things devices via the 5G rollout and the systemic rise in the use of artificial intelligence, technology is increasing both in complexity and connectivity writes James Maass, cyber incident specialist at CFC…

Gallagher warns cyber security is the 'soft underbelly' of UK SMEs

Crisis incidents cost UK SMEs a combined £8.8bn in 2018, with cyber-attacks, data breaches and cyber extortion incidents being most prevalent, research from Gallagher has found.

Blog: Silent cyber - the challenges facing the insurance industry

Following a line of cyber-related regulatory developments, Lloyd's has announced it is mandating that “all non-affirmative policies provide clarity regarding cyber coverage by either excluding or providing affirmative coverage". But according to Barnaby…

Roundtable: Opening up new insurance opportunities using IoT

The Internet of Things continues to offer insurers considerable opportunities in terms of maximising existing data to better understand customers and enter new markets previously considered unprofitable. With this in mind, Post, in association with…

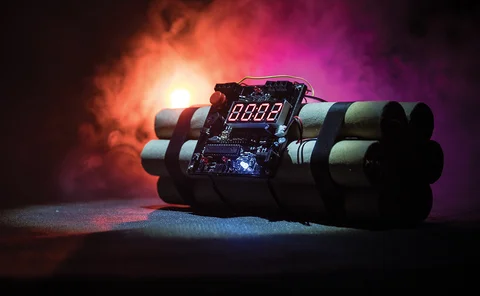

Spotlight: SME market: SMEs and cyber risk - a ticking time bomb

SMEs are a prime target for cyber criminals because they are believed to have limited resources and employ less technically aware employees than larger enterprises. Despite this, these businesses, their insurance providers and brokers are not assessing…