Cyber

Roundtable: Opening up new insurance opportunities using IoT

The Internet of Things continues to offer insurers considerable opportunities in terms of maximising existing data to better understand customers and enter new markets previously considered unprofitable. With this in mind, Post, in association with…

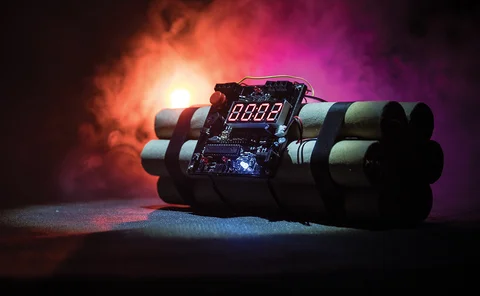

Spotlight: SME market: SMEs and cyber risk - a ticking time bomb

SMEs are a prime target for cyber criminals because they are believed to have limited resources and employ less technically aware employees than larger enterprises. Despite this, these businesses, their insurance providers and brokers are not assessing…

Spotlight: SME market: Where do the biggest opportunities lie for brokers in the SME market?

There seems to be a significant number of drivers for change in the SME market, which begs the question how the relationship between brokers and these clients will change. Edward Murray looks at the opportunities available for intermediaries to remain as…

Analysis: Protecting businesses against political risks

The political risk map of Europe is being changed by a toxic combination of uncertainty — both political and economic, populism, geopolitical changes, political violence and technological advances

ECB data breach demonstrates how using third-party providers can lead to cyber risks

The European Central Bank has said that it potentially lost data in a cyber-attack, in which hackers breached one of its sites using malware.

Cyber insurance payout rates at 99% but uptake still too low

Cyber insurance payout rates at 99%, but the take-up rate of cyber insurance by businesses in the UK still worryingly low, warn insurers.

Interview: Sara Mitchell, Chubb

Sara Mitchell has recently taken on the role of divisional president for the UK and Ireland retail business at Chubb. She talked to Stephanie Denton about her faith in the UK market, the importance of understanding the risks insurers are writing and not…

Blog: The financial crime insider threat

The insurance industry has woken up to the growing criminal threat. However, Dennis Toomey, global director of counter fraud analytics and operations at BAE Systems, highlights that much investment in this area has focused on the external threat.

Analysis: SME risk management: Loss of appetite

Small and medium-sized enterprises are facing a plethora of challenges. So how are insurers helping this sector?

Lloyd's cracks down on silent cyber risk with new mandate

Lloyd’s market participants will soon be required to clearly state whether policies cover cyber-related losses, such as cyber-attacks and loss of data.

MGA recovers 55% of money stolen through email conveyancing fraud

A fraud response initiative set up by managing general agent Pen Underwriting has more than halved the amount of money lost in cases of cyber conveyancing fraud since 2017.

Roundtable: Digital Transformation – to what extent has hype turned into action?

While the topic of digital transformation has been around for the past decade, consultancies continue to warn that further transformation is required. Post, in association with Marklogic, held a roundtable with senior figures from the insurance industry,…

Analysis: The future of pricing – Data and technology

Insurers are coming under increasing pressure to develop new ways of pricing. But, while data and technology hold the key, insurers face some significant challenges as they move to this brave new world.

Blog: To beat fraud, insurers have to tear down internal walls to future-proof their business

The insurance industry continues to treat cyber attacks and fraud as two independent problems. However, Dennis Toomey, global director of counter fraud analytics and operations at BAE Systems, argues they are in fact one and the same – and until the…

IFB counter fraud platform goes live

A counter fraud intelligence sharing platform, developed by the Insurance Fraud Bureau to help the industry fight the £2bn annual fraud bill, has gone live.

Two out of five brokers have never sold a cyber policy

Two out of five brokers have never sold a cyber policy, owing to both a lack of confidence and customer reluctance, research found.

US adjuster GRS recruits former Crawford execs to open UK office

US loss adjusting business Global Risk Solutions has recruited a pair of senior former Crawford & Company executives to launch a UK office.

Interview: Airmic - incoming Board members

In March, Airmic appointed four new board members. Post spoke to them about what they hope to achieve and their assessments of where the risk management profession stands with regard to talent acquisition and diversity

Risk spend should increase on intangibles: Airmic

Risk managers need to overcome their blind spot toward intangible assets like reputation and intellectual property, a conference heard.

Analysis: Managing ‘unthinkable risks’

The insurance industry has become progressively familiar with the idea of ‘unthinkable risks’ in recent years as unpredicted and unprecedented losses, caused by both natural catastrophes and man-made events, have continued to happen

Interview: Airmic board members

In March, Airmic appointed four new board members. Post spoke to them about how risk management has changed during their time in the profession, what they need insurers to deliver and emerging risks