Technology

How connectivity can improve our health

By 2020 it is estimated there could be 30 billion connected devices worldwide – more than four devices for every person alive.

Startup Trov secures $45m for expansion efforts

On-demand insurance provider Trov has secured $45m (£36m) of investment for its global expansion efforts.

RMS expands cyber risk models to include physical damage

RMS has expanded its range of cyber models to include cyber physical models to help insurers weigh up the cost of risk.

Plum high net worth home insurance to include cyber cover

Plum underwriting has included cyber and data risks cover into its high net worth and mid net worth home insurance products.

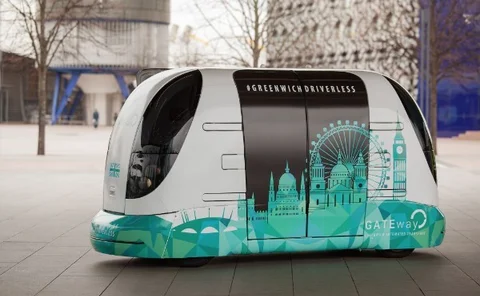

RSA takes part in study of autonomous vehicle prototype

RSA is taking part in a study of prototype autonomous vehicles as driverless shuttlebuses take to London roads.

Interview: John Nelson, Lloyd’s of London

It is the most prestigious chairmanship in UK insurance. But next month, John Nelson will step down after six years in the role of Lloyd’s chairman. He talks to Ryan Hewlett about steering the market through one of its most turbulent periods

Willis Towers Watson and AIG launch cyber cover for global airlines

Willis Towers Watson and AIG have created a cyber insurance product designed to combat the emerging risks facing global airlines.

FM Global launches interactive global flood map

FM Global has launched its interactive global flood map for executives and risk managers.

Roundtable: Tackling the start-ups

As traditional insurers partner with start-up tech companies, the landscape of insurance is changing. Start-ups pose less as threats hellbent on disrupting the industry and more as an opportunity waiting to happen. Post, in association with Mendix,…

In Depth: Using lie detectors to root out fraud

How broker Only Young Drivers is taking a novel approach to application fraud

Lemonade expands to Illinois six months after New York launch

Lemonade has expanded to Illinois as part of its plans to expand nationwide and reach 97% of the US population by 2017.

Open GI completes Biba software house review

Open GI is the first software house to complete an independent review by the British Insurance Brokers’ Association.

Insurtech start-ups graduate from Accenture incubator

A series of insurtech start-ups have completed the Accenture Innovation Lab programme and are set to begin their seed funding rounds.

Blog: Engaging tomorrow's customers today

Insurance has traditionally been considered a grudge purchase, driven by the legal requirements for cover and a desire for financial protection. Indeed, 41% of respondents in a Consumer Intelligence poll said they thought of insurance as "a necessary…

Half of insurtech investment is in artificial intelligence and IoT

Investment into insurtech increased by more than 50% globally to nearly £15m last year, with the majority of deals involving artificial intelligence, a report found.

Blog: The young and the connected, the new face of claims handlers

Businesses in the insurance sector have to deal with change from a ‘new' type of social-savvy policyholder. Engaging and empowering your workforce is the best way to go about it, and technology provides the tools for it.

Competition watchdog updates investigation into price comparison sites

The competition watchdog will look into whether price comparison sites could be more transparent.

Blog: Being prepared for a ransomware attack

Imagine this scenario: Your employees walk into the office on a Monday morning, turn on their computers and a message appears demanding payment to access company systems and data.

11 more insurers join automated subrogation platform

Validus has added 11 insurers to its Verify subrogation portal community following Aviva and Ageas going live on the platform in 2016.

Over one third of insurance jobs at risk from robots

Artificial intelligence could place more than a third of jobs in the UK financial and insurance sectors at high risk, according to a report from PWC.

Brokers outline reasons for leaving SSP

Brokers that moved from SSP to a rival software house have spoken about their reasons for leaving.

This week in Post: highs, lows and running with the wolves

It has been a week of highs and lows in our household. My son went on his first Cub sleepover and earned the honour of becoming a Sixer. I, meanwhile, returned to the X-ray machine.

WTW's Alastair Swift on why adapting is key to success

The broker landscape continues to evolve at an increasing rate and the industry is under constant pressure to adapt rapidly in order to keep up.

CIBA: Insurers need to offer more comprehensive cyber policies in time for GDPR

New methods of hacking and types of cyber breach could lend themselves to greater fines following the incoming General Data Protection Regulation.