Investment returns

Analysis: D&O and the rise in securities class actions

Securities class actions are on the increase as law firms target smaller companies and focus on litigation related to initial public offerings

QBE's Grant Clemence on moving CSR forward

Insurers must think more ambitiously about their corporate social responsibility, says QBE Foundation's chairman Grant Clemence

Blog: Insurers must look beyond Brexit

From change management to cyber risk, Onno Bloemers, head of insurance at Delta Capita, explains why insurers need to look beyond Brexit to the wider challenges facing the industry.

BP Marsh: On the hunt for the next Besso

The last year has seen investment firm BP Marsh exit three of its largest investments; Besso, Trireme and the remaining portion of its stake in Hyperion. As a result of the sale, the company had a war chest of £29.9m and a deluge of enquiries from start…

Ageas's Bart De Smet on why insurers don't need start-ups to innovate

The hype around insurtech start-ups should not overshadow the in-house innovations coming from incumbent insurance companies, writes Ageas’s CEO Bart De Smet, defending the ‘internal incubator’ model.

Lloyds Bank's Bill Cooper on private equity

The valuation of intermediaries is once again in the spotlight after a number of recent high-profile deals, where firms have changed hands for what appear to be very high multiples. Lloyds Bank's managing director and global head of insurance Bill Cooper…

BP Marsh saw 12% hike in profits in 2016

BP Marsh saw a 12% hike in profits in 2016, up to £9.8m from £8.7m in the previous year.

Running off captives in Luxembourg: How to recover the equalisation reserve

A treasure awaits those holding the keys for unlocking Luxembourg’s main assets within the insurance industry. According to the regulator’s latest annual report, reinsurers have built up €9.3bn (£7.8bn) in equalisation reserves in the country.

Zurich’s Guy Miller on why recovery is an opportunity for reform

A synchronised global recovery is an opportunity for reform, not for complacency, argues Guy Miller, chief market strategist and head of macroeconomics, Zurich.

Strong investment results bolster Munich Re's Q1 profits

Munich Re saw a 28% rise in profit in the first quarter of 2017, up to €557m (£469.6m) from €436m for the same period in the previous year.

Lancashire Holdings sees GWP fall in the first quarter

Lancashire Holdings saw a 22% drop in net operating profit in the first quarter of 2017, down to $25.2m (£19.56m) from $32.4m for the same period in the previous year.

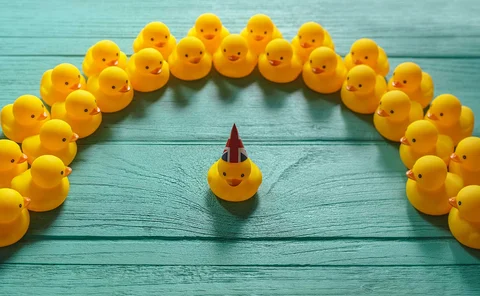

In Depth: Insurtech gold rush

Reinsurers are injecting more money into start-ups to get a foothold in insurtech - and the disruptors are welcoming the investment from these flexible partners.

Lloyds Bank's Bill Cooper on M&A in a challenging market

The government's recent decision to lower the discount rate from 2.5% to -0.75% took the market by surprise and generated many column inches of newsprint in the mainstream press.

Ecclesiastical UK underwriting profit tops £25m

Ecclesiastical has reported underwriting profits £25m from its UK and Ireland business in 2016, up from £11.6m in the prior year.

P&I Clubs face pricing pressure: AM Best

Underwriters in the marine protection and indemnity sector must exercise underwriting discipline as their ship-owning members continue to face economic pressure, AM Best has warned.

Fosun helps The Floow raise £13m

UK telematics technology provider The Floow has raised £13m for equity investment from a variety of international funds.

Greening up your investment portfolio

The last decade has finally started to see the talk about the virtues of sustainable energy result in significant action, particularly in the area of electricity, where it has been driven primarily by wind, solar energy and biomass.

MDP increases stake in Towergate following £40m rights offer

Towergate has completed its rights offer, raising £40m in additional investment.

'Mixed bag' for London market says Hiscox MD

Hiscox’s London market business has presented an inconsistent and mixed operating year for the insurer, according to Steve Langan, CEO of Hiscox Insurance.

Catastrophe bonds: A good year for disaster

Catastrophe bonds were invented in the early 1990s to help insurance companies mitigate the risk of major disasters. With storms brewing both politically and environmentally, can the catastrophe bond market open new doors to insurers in 2017?

Just Miles plans to help low mileage drivers get fairer polices

Just Miles is planning to launch an on-demand insurance service for low mileage drivers in a bid to make insurance fairer.

Reinsurers increasing insurtech investment to counter growing competition

Reinsurers are increasingly investing in insurtech to mitigate external threats from venture capital investment, experts told Post.

Post power List 2017: John O’Roarke

Partner, ABC Investors

Post Power List 2017: Donald Trump

President, US