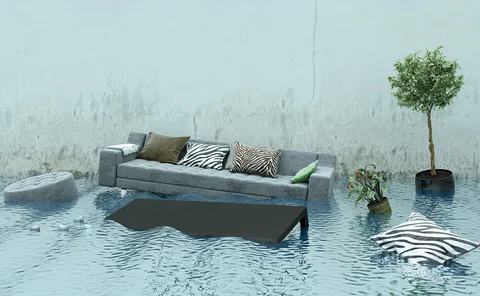

Flooding

This week in Post: Deluge, diversity and misdemeanours

More than 800 houses have been evacuated due to flooding and many of those families won't be back in their home for Christmas. Flood warnings are still in place and there are reports that flood defence equipment is being stolen.

Flood forecasting insurtech launches nationwide

Insurtech Previsico has launched nationwide, aiming to support insurers, brokers and their customers across the whole of the UK with live actionable flood warnings.

ABI and Biba at odds over ring-fencing insurance taxes for flood defences

Insurance trade bodies have found themselves at loggerheads over whether part of insurance premium tax should be ring-fenced for flood defences.

North of England floods could cost industry £80m to £120m: PWC

Flooding in the north of England could cost insurers between £80m and £120m, PWC has estimated, though this could rise.

Blog: Flood-damaged cars - are insurers missing a trick?

Earlier this year parts of the UK were under water and serious flood warnings are becoming more commonplace, writes Jane Pocock, managing director, Copart UK.

Insurers brace for some sizeable losses as UK barraged by floods

UK flooding is expected to continue, as insurers and loss adjusters have warned of a "spike" in both personal and commercial lines claims as a result.

Analysis: Reservoir dams - a water-tight insurance risk?

With almost 3000 dams supplying drinking water to towns and cities they are a common feature in the UK countryside. However, when heavy rain in August threatened the integrity of the emergency spillway at Toddbrook Reservoir an emergency evacuation of…

Lloyd’s supports Habitat for Humanity to aid cyclone hit Malawi

Lloyd’s Charities Trust has joined forces with Habitat for Humanity Great Britain as part of its ongoing response to emerging risks to communities around the world.

Analysis: How far has the insurance industry evolved to respond to natural catastrophes?

Sedgwick loss adjusters arrived on Great Abaco Island in the wake of Hurricane Dorian aboard a Black Hawk helicopter on 6 September.

This week: All at sea

The fraudulent claims we’re used to hearing about involve banged-up cars and invented cases of whiplash. Ones involving oil tankers, pirates, the Admiralty Judge, and statements given in places as far-flung as Aden and Manila are somewhat harder to come…

Insurers respond to Finsbury Park flood claims

Insurers have begun responding to claims after a burst pipe led to flooding in Finsbury Park.

How climate change is impacting the risk profiles of financial institutions

A closer look at how board-level considerations of climate change must shift, and the potential consequences if they do not

Blog: Managing commercial property risks - the role of data visualisation

When physician John Snow was trying to identify the source and path of cholera outbreaks in London, he plotted outbreaks on a map of the city. Richie Toomey, senior manager for commercial insurance at Lexis Nexis Risk Solutions argues as reliable as…

Government pledges £62m flood funding

The government has pledged £62m flood defence investment for communities across Yorkshire, Cumbria, the North East and the South East of England.

Zurich's John Keppel on environmental sustainability

The sustainability agenda has become the latest ‘trend’ for many businesses, with expectations rising for all industries to showcase how they contribute to our environment and help save our planet writes John Keppel, chief operating officer at Zurich.

Blog: The Whaley Bridge experience - how well do insurers cope at times of crisis?

The Whaley Bridge incident has once again thrown the spotlight on insurers, their disaster plans and capacity issues. Alex Dalyac, founder and CEO, Tractable comments that while feet on the ground will never be totally replaced, the industry could be…

Insurers on standby over ‘unprecedented’ Whaley Bridge emergency

Insurers confirmed they have boots on the ground at Whaley Bridge, after 1000 people from areas surrounding a nearby reservoir were evacuated.

Flood Re and Axa propose funding flood-resilient home improvements

Payouts on household flood claims could rise above the cost of damage in order to enable claimants to make their homes more resilient to future incidents, under proposals outlined by Flood Re.

Insurers respond to flood claims from Lincolnshire

Insurers have begun responding to claims following the flooding in Lincolnshire.

Flood defences save UK £1.1bn a year

Inland flood defences reduce river flood losses by 63%, saving the UK £1.1bn annually on average, according to a recent study.

Environmental Agency works with insurers to review flood strategy

The Environmental Agency has launched an eight week consultation on a new long-term strategy to tackle flooding and coastal change.

Spotlight: Data - Ordering data in

Insurers continue to hang their success on the quality and use of data, with businesses continually reviewing how to gain a commercial advantage. Edward Murray looks at the benefits of using external data providers and why some peril risks have proven…

Spotlight: Data - Why are insurers ignoring data for escape of water claims?

Don’t blame the rain for the growing number of water-related claims in the UK, blame the plumbing

Global floods cause $8bn damage in March alone

An estimated $8bn (£6.1bn) of damage was caused by floods around the world in March 2019, according to an Aon catastrophe report.