Data analytics

Blog: Delivering a personal, timely and multichannel experience without putting core operations at risk

You don't need to risk crashing back-end legacy systems to deliver personalised and integrated customer service, argues Giuliano Altamura of the Fincons Group.

Blog: Getting over the back office blockade to maximise the omnichannel opportunity

You only have a short window of opportunity in the omnichannel world. Miss it, and it will soon shut warns Giuliano Altamura, financial services business unit manager at Fincons Group.

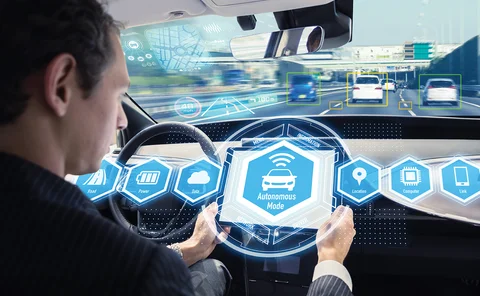

Motor Insurance World Live video presentation: The car is the star

Motor insurance companies have long focused on rating factors such as a driver’s age, occupation and where they live.

Analysis: Risk manager associations downbeat on Aon-Willis takeover

Post gathers feedback from across the industry on what Aon’s takeover of Willis – to create the biggest broker in the world – will mean for the market

Tribunal dismissed Eldon and Leave EU bias and unfairness claims despite ICO handling errors

While it acknowledged issues with the Information Commissioner's Office's handling of Eldon and Leave EU fines and audit notices, a tribunal has found its actions did not amount to bias, procedural unfairness or unlawfulness.

Q&A: Andrew Yeoman, Concirrus

Harry Curtis spoke to Andrew Yeoman, CEO and co-founder of Concirrus, about the increasing use of big data in insurance and the challenges facing the fleet and marine markets.

Interview: Scott Walchek, Trov

One of the original insurtech poster children, Trov recently pulled its personal lines offering in the UK and quickly followed this up by partnering with Lloyds and Halifax on renters’ insurance. Trov CEO and co-founder Scott Walchek sat down with Jen…

Blog: The telematics market - an opportunity for insurers?

Telematics technology is 22 years old but it's only over the last five to 10 years that telematics has really become a driving force in disrupting the insurance sector by challenging risk models. However, despite this evidence, rates of adoption still…

Willis Towers Watson's George Beattie on social data and changing consumer relationships

Social media is becoming radically democratised - a macroeconomic trend that the business world is just waking up to, writes George Beattie, director of property and casualty at Willis Towers Watson.

Data non-profit aims to spur development of climate-ready financial products

A non-profit seeking to draw up open industry data-sharing standards to address the climate crisis has launched with £1m funding and a consortium of partners that includes Aon and Brit.

Insurtech: Insurtech 100: May - July 2019 quarterly update

Hippo, Lemonade and Zego are just three of the start-ups that have been in the news recently. Matt Connolly, founder and CEO of Tällt Ventures, reflects on a what has been happening for the Insurtech 100 since the list was published in May.

Analysis: Tackling the skills shortage

The insurance industry is facing a huge skills shortage, with employers struggling to find ways to attract and retain top talent

Analysis: 5G ready: Super signal surge

Powerful 5G smart tech devices are expected to be rolled out this year. They are anticipated to overtake 4G in terms of reliability and innovation, as well as increasing data speeds, resulting in faster downloads and increased capability for digital…

This week in Post: Back to business

With the holiday break over, this week has seen people across the UK – some somewhat sluggishly – get back to business.

CII warns regulators that 'digital breadcrumbs' can’t replace human insight

The Chartered Insurance Institute has urged regulators to take caution as they adopt an increasingly data-driven approach to policing the financial services sector, warning “digital breadcrumbs” can’t replace human insight.

FCA unveils reforms to become highly data-driven

The Financial Conduct Authority has refreshed its Data Strategy, first published in 2013, and set out a “transformation plan” to become a highly data-driven regulator.

Interview: Claudio Gienal, CEO, Axa

Fifteen months ago Claudio Gienal stepped up to the role of CEO of Axa UK and Ireland, but he’s taken his time to reveal his strategy for the firm. He spoke to Stephanie Denton about why clarity, diversity and adding value really matter to him

Roundtable: What’s next for the modernisation of Lloyd’s and the London market?

Against a background of the winding down of the Target Operating Model and the publication of the Future of Lloyd’s Blueprint, Post, in conjuction with WNS, invited industry experts to discuss the six suggested proposals to modernise the market. Post…

Blog: Adas data shortage for insurance is about to get sorted

Advanced safety features not only differ in performance and description among different manufacturers, but even among models by the same car manufacturer. Andrew Ballard, senior global product manager at Lexis Nexis Risk Solutions, believes deep data…

Analysis: Embracing data ethics

With the increasing use of machine-learning models, the data being inputted into these models raises a number of ethical questions, but how are insurers addressing these potential issues?

Trade Voice: The ABI's James Dalton on why GI pricing will be a priority in 2020

James Dalton, director of general insurance policy at the Association of British Insurers, reveals what the trade body will be focusing on next year and why.

ICO procedural errors in handling Eldon/Leave EU investigation exposed

The Information Commissioner’s Office will be hoping that procedural bungles do not jeopardise its proposed audit and fines of Eldon Insurance and Leave EU, after its legal counsel was forced to admit standards had fallen “well below” expectations, Post…

ICO fines and enforcement action ‘significant and novel extension’ of regulatory powers: Eldon and Leave EU

Eldon Insurance and Leave EU fines totalling £105,000 and a data audit against the broker levelled by the Information Commissioner’s Office are “divorced from reality,” a tribunal heard yesterday.

Spotlight: Autonomous Vehicles: The insurance implications of a driverless marine cargo market

Similarly to developments in the auto industry, unmanned seafaring vessels could become prevalent in the future. But today the trend is towards partial autonomy. Valerie Hart looks at the prospects of improving vessel performance and safety, hurdles, and…