Consumer Duty

FCA claims Gap action will save consumers £70m

The Financial Conduct Authority has said consumers will save around £70m due to improvements firms must make to guaranteed asset protection insurance products.

Insurance Post’s Top 90 MGAs revealed

Ardonagh Group, Brown & Brown, Gallagher, Markerstudy and Policy Expert are the UK’s five biggest MGAs.

Biba calls for larger SMEs to be exempt from Consumer Duty rules

The British Insurance Brokers’ Association has called for larger SME commercial customers to be removed from the scope of the Consumer Duty requirements.

Spotlight: Why insurance can’t afford to ignore RegTech

With growing regulatory demands, Zoë Parsons, marketing manager of REG Technologies, points out that RegTech is increasingly a necessity rather than a luxury for insurers.

Spotlight: Insurance’s regulatory burden – are we to blame?

The insurance industry is under immense pressure from an increasing regulatory burden, but to what extent are firms themselves to blame for failing to adopt modern technology and processes?

Defaqto warns consumers are ‘brainwashed’ by prices

Speaking at Defaqto’s Smarter Financial Decisions conference today (12 September), Mike Powell, insight analyst at Defaqto, said customers are too consumed by price when picking a general insurance policy.

Electric vehicles and the future of motor insurance

How will the rise of electric vehicles and the FCA’s Consumer Duty affect the car hire and replacement vehicle market?

Travel insurers that satisfy customers revealed

Saga, LV, Tesco Bank, Multitrip.com, and AA have the happiest travel insurance customers, according to the latest Fairer Finance survey.

CoreLogic’s Garret Gray on what the future holds for insurance

The president of global insurance solutions at CoreLogic, Garret Gray, gives Saxon East the lowdown on INTRConnect Europe and what the future potentially holds for the insurance industry.

Big Interview: Matthew Hill, Chartered Insurance Institute

Matthew Hill, the third CEO of the Chartered Insurance Institute in as many years, knows only 10 Downing Street has had a faster revolving door than the industry’s professional body in recent years.

FCA is banging its head against a wall on fair value

News Editor’s View: Following yet another thematic review where the Financial Conduct Authority says firms are unable to show fair value, and are even breaching rules, Scott McGee considers how the regulator could tackle poor conduct and asks if a…

Consumer group warns of insurers overcharging vulnerable customers

The Financial Services Consumer Panel has published a research paper raising concerns that vulnerable customers may be at risk of overpaying for insurance.

Are insurers racing to be online-only excluding disabled customers?

As the insurance sector increasingly digitises, Damisola Sulaiman examines the barriers disabled customers face in accessing online insurance services, as well as the measures that have been implemented by insurers to address these issues.

Big Interview: Warren Dickson, Howden

Warren Dickson, corporate and commercial CEO at Howden, sits down with Harry Curtis to discuss what has changed since the broker acquired Aston Lark and how its breadth of capabilities is paying dividends.

Open finance identified as key to Consumer Duty compliance

General insurers need to make greater use of open banking in order to comply with the Financial Conduct Authority's Consumer Duty requirements, according to Suzanne Homewood, managing director of decisioning at Moneyhub.

Regulator to reduce red tape for general insurers

Editor’s View: Emma Ann Hughes reflects on how general insurers should be careful about what they wish for from the Financial Conduct Authority's review of the rules governing financial services.

MGA launches with travel insurance for pre-existing conditions

New travel MGA Gigasure plans to develop travel insurance for those with pre-existing medical conditions.

FCA takes first steps to achieve proportionate regulation

The Financial Conduct Authority is looking for comment on the level of regulation regarding commercial and bespoke insurance products and companies, while also opening its review of requirements following the introduction of the Consumer Duty.

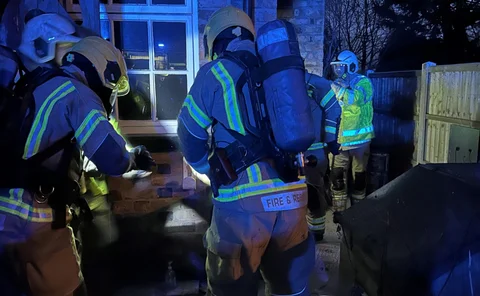

Claims ‘hell’ with Policy Expert causes mother to set up group

A mother-of-two, who has been through a 17-month battle with Policy Expert following a fire at her home, has set up an action group to help “other families going through hell with claims.”

Crunch time for insurers’ Consumer Duty reports

One year on from the introduction of the Financial Conduct Authority’s Consumer Duty requirements for open products, Emma Ann Hughes investigates whether insurers will get a pat on the back or a clip round the ear from the regulator when they hand in…

Consumer Duty fails to improve insurance customer’s experiences

Most general insurance customers have seen zero improvement in service from general insurance providers since the implementation of the Financial Conduct Authority’s Consumer Duty a year ago, with some even saying things have gotten worse, research has…

Which? demands FCA action over ‘widespread’ claims-handling failures

Consumer champion Which? has launched a new campaign to end “the insurance rip-off” and has called on the Financial Conduct Authority to take tough action against claims handlers who fall short of the regulator’s required standards.

How can home insurance avoid a motor-like PR disaster?

As motor premium inflation is steadying, Scott McGee examines whether home insurance premiums will be next to rocket plus identifies ways to avoid the wrath of consumers facing paying more to insure their property.

Which? demands action against insurers that are poorly handling complaints

Rocio Concha, director of policy and advocacy at Which?, urges the regulator to hold the insurance firms’ feet to the fire for causing customers unfair delay or distress.