Regulation

FCA takes aim at general insurance ‘poor product value’

The city watchdog has launched a consultation to address potential 'poor product value' in general insurance.

Blog: Are manufacturers recall ready?

With Brexit looming, manufacturers are facing the logistics of getting products to countries in the European Economic area and back. Natasha Catchpole, practice leader for crisis management and product recall at CFC Underwriting, explains how brokers can…

Insurers issue no-deal Brexit warning over Green Cards

Motorists from Northern Ireland will have to secure a Green Card from their insurer if they wish to cross the border into Ireland, if there is a no-deal Brexit.

This week: What does the fox say?

Brightside’s new managing general agent Kitsune takes its name from the Japanese word for fox. The animal is much admired in Japanese folklore for its intelligence and supernatural abilities – characteristics all the insurance companies that announced…

Blog: Model behaviour for insurance risk prediction - destroying the myth of the magic funnel

In a highly competitive market, it is important that insurers maximise their data models to create more intelligible insights. Only then, argues Alan O’Loughlin of Lexis Nexis Risk Solutions, will they gain a strategic advantage over competitors

Irish broker Arachas mulls post-Brexit UK broker partnerships

Irish broker Arachas is considering reaching out to UK partners to overcome potential passporting barriers in a post-Brexit world.

Analysis: Will BA data breach open floodgates for future data group actions?

The British Airways data breach is the first major case since the General Data Protection Regulation became law. With the firm facing group legal action and the Information Commissioner’s Office testing its teeth for the first time, what might this mean…

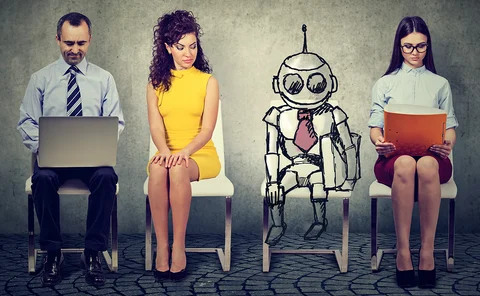

Month in Post: Do insurers dream of Brexit?

We may not have flying cars, humanoid robots and exaggerated shoulder pads, but there is every reason to believe that the 2019 predicted by 80s film Blade Runner, looks very slightly dystopian.

Roundtable: Building out from the back office

The hype over new technologies might have the industry excited. But there remains a question of whether these firms’ back offices are fit for purpose to enable them to maximise these customer facing investments. Against this backdrop, Post, in…

FCA sets March deadline for CMC permissions

The Financial Conduct Authority has invited claims management to register for temporary permission to continue operating once the sector enters the financial regulator’s remit later this year.

Analysis: Is the industry prepared if the UK is hit with Brexit riots this year?

Legislation introduced in the wake of 2011 riots aims to simplify claims handling

Interview: David Rule, Prudential Regulation Authority

With Brexit, increased scrutiny over reserves, climate change and emerging risks on the ‘watch’ list for 2019 The Prudential Regulation Authority certainly has a lot on its plate. Its executive director for insurance, David Rule spoke to Stephanie Denton…

Research: Reconciliation and settlement systems

On the back of recent research by Post and Banking Circle – the financial utility – into the banking/payments infrastructure insurance companies use for reconciliation and settlement, Edward Murray sought to discover the most pressing pain points and how…

Blog: The future landscape for AI claims around the world

Governments around the world are looking to regulate artificial intelligence and as Lee Gluyas, partner, and Stefanie Day, associate with law firm CMS, explain those that get there first will be the ones to benefit.

Horizon Insurance declared in default

Gibraltar-based Horizon Insurance has been declared in default by the Financial Services Compensation Scheme.

The Civil Liability Bill receives Royal Assent

The Civil Liability Bill, which aims to transform Britain’s motor compensation culture to create a fairer system for insurance customers and claimants alike, has received Royal Assent today and is now part of UK law.

Government pushes for further reforms following Grenfell Tower disaster

The government has outlined plans that will see it commit to reforms over the coming years, following the tragic Grenfell Tower fire.

ABI criticises European Commission's plans for no-deal Brexit

The Association of British Insurers has criticised the European Commission for failing to make contingency plans that would allow UK insurers to fulfil contracts with EU policyholders in the case of a no-deal Brexit.

CMA unveils raft of recommended reforms as insurance slammed over pricing practices

The Competition and Markets Authority has ‘uncovered a range of problems’ around the loyalty penalty and made several recommendations for change in its damning response to a super complaint on pricing practices, but some feel that insurers are catching…

CBL shareholder in bid to save troubled firm from liquidation

CBL Corporation shareholder Oceanic Securities PTE has filed an opposition to the application to put the company in liquidation, leading to delays for the liquidation hearing.

Blog: How can insurers keep up when the future is being created every day?

Insurers will inevitably retain insurance as their core offering. But must act more like venture capitalists and develop innovation cultures to succeed according to Geoff Knott, director, Ninety Consulting

This week: God bless us, every one!

At a time of year when good cheer to all men is encouraged and Scrooge is forgiven all his wicked ways and most of the world has been out enjoying their Christmas parties (I know we have), it appears the insurance world is still seen as the Grinch.

Blog: You really need to listen before walking the walk

Given consumers less that flattering view of business, Marcus Taylor, director of claims, Minster Law, warns the insurance sector needs to make sure it listens to the public before enforcing the new online claims journey post April 2020.

Green light for UK-US insurance trade deal

Insurers have welcomed a deal that will preserve cross border insurance and reinsurance contracts between the UK and US.