Regulation

Analysis: Is the industry prepared if the UK is hit with Brexit riots this year?

Legislation introduced in the wake of 2011 riots aims to simplify claims handling

Interview: David Rule, Prudential Regulation Authority

With Brexit, increased scrutiny over reserves, climate change and emerging risks on the ‘watch’ list for 2019 The Prudential Regulation Authority certainly has a lot on its plate. Its executive director for insurance, David Rule spoke to Stephanie Denton…

Research: Reconciliation and settlement systems

On the back of recent research by Post and Banking Circle – the financial utility – into the banking/payments infrastructure insurance companies use for reconciliation and settlement, Edward Murray sought to discover the most pressing pain points and how…

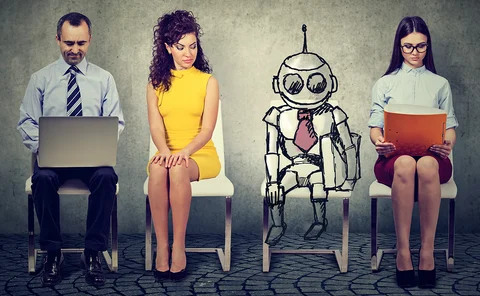

Blog: The future landscape for AI claims around the world

Governments around the world are looking to regulate artificial intelligence and as Lee Gluyas, partner, and Stefanie Day, associate with law firm CMS, explain those that get there first will be the ones to benefit.

Horizon Insurance declared in default

Gibraltar-based Horizon Insurance has been declared in default by the Financial Services Compensation Scheme.

The Civil Liability Bill receives Royal Assent

The Civil Liability Bill, which aims to transform Britain’s motor compensation culture to create a fairer system for insurance customers and claimants alike, has received Royal Assent today and is now part of UK law.

Government pushes for further reforms following Grenfell Tower disaster

The government has outlined plans that will see it commit to reforms over the coming years, following the tragic Grenfell Tower fire.

ABI criticises European Commission's plans for no-deal Brexit

The Association of British Insurers has criticised the European Commission for failing to make contingency plans that would allow UK insurers to fulfil contracts with EU policyholders in the case of a no-deal Brexit.

CMA unveils raft of recommended reforms as insurance slammed over pricing practices

The Competition and Markets Authority has ‘uncovered a range of problems’ around the loyalty penalty and made several recommendations for change in its damning response to a super complaint on pricing practices, but some feel that insurers are catching…

CBL shareholder in bid to save troubled firm from liquidation

CBL Corporation shareholder Oceanic Securities PTE has filed an opposition to the application to put the company in liquidation, leading to delays for the liquidation hearing.

Blog: How can insurers keep up when the future is being created every day?

Insurers will inevitably retain insurance as their core offering. But must act more like venture capitalists and develop innovation cultures to succeed according to Geoff Knott, director, Ninety Consulting

This week: God bless us, every one!

At a time of year when good cheer to all men is encouraged and Scrooge is forgiven all his wicked ways and most of the world has been out enjoying their Christmas parties (I know we have), it appears the insurance world is still seen as the Grinch.

Blog: You really need to listen before walking the walk

Given consumers less that flattering view of business, Marcus Taylor, director of claims, Minster Law, warns the insurance sector needs to make sure it listens to the public before enforcing the new online claims journey post April 2020.

Green light for UK-US insurance trade deal

Insurers have welcomed a deal that will preserve cross border insurance and reinsurance contracts between the UK and US.

Analysis: The mystery of the missing Insurance Fraud Taskforce report

Three years ago, the government established an Insurance Fraud Taskforce with much fanfare. However, in the last 18 months, the project has gone quiet. A report from the latter half of 2017 has yet to be published. Post looks at what the holdup is.

GRP’s Craig Pocock on SMCR

GRP’s chief people officer Craig Pocock explains why it’s important for brokers to plan for the new Senior Managers and Certification Regime.

CBL Corporation expected to be placed in liquidation, sees further delays to watershed meeting

The New Zealand High Court has granted a further application by CBL Corporation administrator Kordamentha to push back a watershed administration meeting to February 2019, though it is expected the corporation will be placed into liquidation.

Analysis: How most favoured nation clauses fell out of favour

The Competition and Markets Authority last month provisionally found Compare the Market in breach of the competition law due to clauses included in its contracts with home insurers, which limit the price insurance providers can charge for their products…

Director of Content's comment: Insurance dynasties - Who will be the next predator?

“Extraordinary animals, each in a heroic struggle against rivals and against the forces of nature, fighting for their own survival and for the future of their ‘Dynasties’."

Roundtable: The new wave: time to disrupt the disruptors

The insurance sector must remain vigilant to challengers, be they data giants like Google and Amazon, or nimble insurtechs. Especially given that some already hold such rich data. So how can incumbents take on potential usurpers? Is now the time to take…

Analysis: The Arron Banks show

No stranger to controversy, Arron Banks is back in the news and under the spotlight with allegations and appeals

Government moves a step closer to combustible cladding ban

As regulations for the combustible cladding ban for new and high-rise buildings progress in government, insurers say that they do not go far enough.

This week in Post: Another unrated insurer bites the dust

Hooking the headlines this week, Danish unrated insurer Qudos was placed in liquidation by its owner.

Broker in liquidation Larksway has FCA authorisation pulled

Broker Larksway, which is currently in liquidation, has had its Financial Conduct Authority authorisation removed after the regulator alleged it failed to comply with a Financial Ombudsman Service ruling.