Personal

Motor insurers set for widespread profit in 2024

EY has predicted the UK motor insurance market will return to profitability in 2024 following two years of losses, but that profitability will be short-lived..

ManyPets co-founder joins Bikmo as chair

Cycle insurer Bikmo has appointed Steven Mendel, co-founder of ManyPets and former CEO of its parent company ManyGroup as chair, subject to approval from the Financial Conduct Authority.

Motor insurers with most satisfied customers revealed

NFU Mutual, Halifax, LV, Saga, and Direct Line have the most satisfied car insurance customers, according to Fairer Finance’s latest consumer survey, which also reveals an increase in premiums means fewer motorists are happy with their provider today…

Diary of an Insurer: Admiral’s Danielle Jones

Danielle Jones, social purpose leader at Admiral, is adding to the social impact team, takes part in a terrarium-making session and is inspired by Freddie Flintoff’s Field of Dreams show.

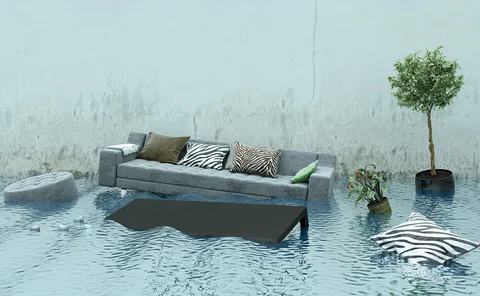

Labour’s building ambitions fail to factor in insurance

The government’s overhaul of the planning system to accelerate housebuilding and deliver 1.5 million homes over this parliament has been slated by insurers for failing to consider flood risk.

Does Aviva’s move for DLG clear the path for Ageas to land Esure?

Following the news that Direct Line Group looks set to accept Aviva's £3.6bn takeover bid, Tom Luckham asks: What does this mean for the race to acquire Esure?

AA raises concerns about comprehensive motor cover

The AA has called for comprehensive motor insurance policies that do not include windscreen cover to be renamed in order to avoid complaints from consumers that policies fall short of their expectations.

Zurich UK replaces CEO Bailey with Jaksic

Tim Bailey is stepping down as CEO of Zurich UK to become CEO of Zurich’s new global life protection business, with Drazen Jaksic named as his replacement.

Millions of Brits priced out of car insurance

Research by Citizens Advice has revealed that 2.6 million people don’t drive because they’re unable to afford the accelerating cost of car insurance, a figure which has jumped by almost one million in the last 12 months.

Big Interview: Steve Hardy, Policy Expert

Steve Hardy, CEO of Policy Expert, talks to Tom Luckham about the firm’s plans for expansion, addresses claims concerns, and reveals what American musician Iggy Pop is really like.

Home insurance premium growth slows year-on-year

Home insurance premiums increased by 21% year-on-year between July and September this year, according to research from Compare the Market.

Diary of an Insurer: HDI Embedded’s Nelson Castellanos

Nelson Castellanos, chief partnerships officer for international at HDI Embedded, discusses factoring in different country’s needs to product development, explores embedded insurance options for the European telecommunications industry and loves the fact…

Sabre targeting £80m profit by 2030

Geoff Carter, CEO of Sabre, has told Insurance Post that the firm plans to take in "at least" £80m in profit by 2030.

All Amanda Blanc wants for Christmas is Direct Line

News editor view: Now a deal between Aviva and Direct Line Group has reached "preliminary agreement", Scott McGee looks at what the deal could mean for the future of the businesses and the wider market.

Sabre to launch motorcycle brand in Q1 2025

Sabre has confirmed in a market statement that it intends to launch an online-only motorcycle insurance brand in Q1 2025.

Insurers share concerns after killing of UnitedHealthcare CEO

Adrian Jones, chief of staff for international and global markets at insurtech Acrisure, observed UnitedHealthcare CEO Brian Thompson’s death was shocking and deeply concerning given the accessibility of the insurance sector’s leaders.

Policy Expert reveals lessons learnt after customer complaints

Steve Hardy, CEO of Policy Expert, outlines the changes it made following issues with the claim of a dissatisfied customer who then went on to create an action group.

Q&A: Gary Murphy, Gigasure

Gary Murphy, head of travel at recently launched MGA Gigasure, talks to Insurance Post about the firms’ travel agenda and balancing transparency with policy personalisation

Lying motor claims lawyer lands in legal labyrinth

HF and Admiral have secured a finding of fundamental dishonesty against a lawyer who lied about injuries following several road traffic accidents.

Ageas announces raft of personal lines hires

Ageas UK has today announced changes to its executive leadership team, as it commits to growing in the personal lines broker market.

Lord Chancellor announces UK-consistent Ogden rate

Lord Chancellor Shabana Mahmood has announced her intention to increase the personal injury discount rate to 0.5% from -0.25%, in line with Scotland and Northern Ireland.

Uptick in M&A activity among large carriers expected

An uptick in M&A activity at the larger end of the UK insurance carrier capitalisation spectrum is expected towards the end of this year, according to a Clyde & Co report.

Transport Secretary Haigh quits over phone offence

Louise Haigh has resigned as transport secretary after pleading guilty to a criminal offence related to incorrectly telling police that a work mobile phone was stolen in 2013.

Industry demands small claims limit increase

Several figures in the insurance industry have urged the government to increase the small claims track limit.