Personal

Covéa strikes up motor insurance deal with John Lewis

Covéa has arranged a deal with John Lewis Finance that will see it act as the sole insurer for the company’s motor insurance offering.

Claims costs drive an increase in van insurance premiums

Claims costs have driven an average premium increase of 35.1% since April 2014, Consumer Intelligence has found.

Q&A: Claims Apprentice 2019 winner Verity Ross

Verity Ross, motor claims handler for Zurich has been crowned winner of the Claims Apprentice 2019. Hiriyti Bairu caught up with her to discuss how she met the challenge, what the experience has taught her now and moving forward in her career.

Spotlight: Data - Ordering data in

Insurers continue to hang their success on the quality and use of data, with businesses continually reviewing how to gain a commercial advantage. Edward Murray looks at the benefits of using external data providers and why some peril risks have proven…

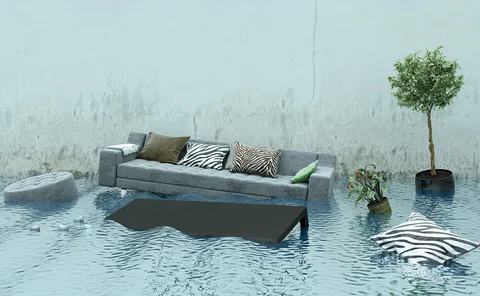

Spotlight: Data - Why are insurers ignoring data for escape of water claims?

Don’t blame the rain for the growing number of water-related claims in the UK, blame the plumbing

Allianz in talks to buy L&G general insurance business – report

Allianz is in talks to buy Legal & General general insurance business, according to Sky News.

ABI tracker shows fall in motor premiums in advance of whiplash reforms

The average cost of motor insurance fell to its lowest level in two years, according to a survey from the Association of British Insurers.

Trade Voice: Foil's James Heath on the Civil Liability Act

The Civil Liability Act was passed in December, changing the way whiplash claims are calculated. As part of the bill, the government also agreed to reform the discount rate, which is currently under review. James Heath, President at Forum of Insurance…

Analysis: What do Tesla’s insurance ambitions mean for its partners?

Exclusive: Tesla’s plan to launch its own insurance for customers within a month has raised questions over how it will affect its current affinity deals with insurers.

Hastings sees bump in revenue despite loss ratio warning

Hastings has reported a 4% rise in gross written premiums for the first three months of 2019.

Blog: Shaping the future of urban mobility

There is no question that the UK is on the brink of big change in urban mobility and that it is set to transform the motor insurance landscape, says James Roberts, business development director for insurance at Europcar Mobility Group UK.

Flagging personal lines see Covéa's profits slashed

Covéa Insurance saw its underwriting profit slashed to £1.8m in 2018 compared to £12.4m in 2017, as its personal lines business felt the impact of claims inflation and adverse weather.

UK General's Matthew Schofield on how profit, not volume, will drive growth and respectability of MGA sector

In recent months managing general agents have been in the spotlight, with the media seeking to get under the skin of one of the fastest growing insurance sectors. UK General's Matthew Schofield says MGA management teams need to now stop 'navel gazing'…

Machine learning insurtech raises £4.2m in seed investment round

London-based insurtech Artificial Labs has announced it has raised £4.2m in a seed round to scale up its team, product offering and geographic reach.

This week: Easter egg-citement

As we head towards a welcome four-day weekend, the insurance world has been getting in the spirit for Easter in the only natural way: smashing chocolate eggs.

Blog: Aquiline's recommitment to ERS highlights turnaround success after dark days of IAG

Jonathan Swift reflects on the turnaround at ERS and why Aquiline might have decided to wait to sell the motor insuer

Customers increasingly looking to credit to pay for premiums: research

Insurance customers are increasingly relying on credit to pay premiums, with nearly one in three planning to use more credit this year, research found.

Analysis: Joining forces on Adas: How motor manufacturers are looking to work with insurers on driver safety

As insurers complain of double-digit increases in repair costs as a result of advanced driver assistance systems, Edward Murray spoke to motor manufacturers about why the underwriting focus needs to move from the driver to the vehicle.

Analysis: How can insurers offset the increased repairer costs associated with Adas?

For all the work has been done by the insurance industry to contain and control personal injury costs, many are seeing repair claims increasing as a result of a wider use of advanced driver-assistance systems. Edward Murray looks at what the sector can…

Motor premium upturn 'on the horizon' after modest Q4 price cuts: Confused and WTW

The price of car insurance fell 1.6% in the first quarter of 2019 after creeping upwards during the second half of 2018, according to the Confused car insurance price index, produced in association with Willis Towers Watson.

Blog: The changing landscape of identity theft

Valid motor insurance is proving to be as valuable a disguise for today’s criminals as stockings over the head or a mask, according to James Burge, fraud manager at Allianz

This week in Post: Funds, loyalty and crime

Gift cards may not be very personal, but they are perfect when you are not sure what to get someone. However, if you are anything like me you put them away in a “safe” place and forget to use them in time.

Lemonade raises $300m in latest funding round

US-based insurtech Lemonade has raised $300m in a Series D round, bringing its total funding to date to $480m.

Crawford & Co on hunt for UK & Ireland head as Clive Nicholls steps down

Crawford & Company has begun the search for a new president, UK and Ireland, after incumbent Clive Nicholls announced his intention to retire on the 30 September 2019.