Zurich Insurance

Penny Black's Social World: February 2021

Charity contributions, championing cricket and continuing challenges

Zurich appoints Penny Seach as CUO for EMEA

Zurich has named Penny Seach as chief underwriting officer for Europe, Middle East and Africa moving across from CEO of general insurance for Zurich Hong Kong.

Insurers and brokers offer leave and flexible working as school closures strain parents

Insurers and brokers have increased paid leave and introduced more flexible working arrangements to employees under additional pressure from lockdown restrictions, with a particular focus on those now juggling work with childcare responsibilities.

Robert Kuchinski replaces Lloyd’s bound Patrick Tiernan as IUA chair

Robert Kuchinski, deputy chairman of the International Underwriting Association and head of commercial insurance at Zurich UK, has been elected as the new chairman replacing Patrick Tiernan who will be leaving Aviva to become chief of markets at Lloyd’s.

Insurers wary of CMC influx following whiplash reforms

Insurers are concerned that the implementation of whiplash reforms will result in an increase of personal injury claims management companies if fee caps are not introduced.

CMC fee caps: Are proposed tariffs too generous or will they drive a choice exodus?

Insurers have argued that proposed fee caps for claims management companies may be too generous, while the claims sector has cautioned measures could reduce choice and service quality.

Blog: Mental health – the silent casualty of climate change

Zurich UK chief claims officer David Nichols considers the impact of weather-related claims on mental health, and what insurers, government and public bodies must do to help.

Zurich offers free counselling to claimants

Zurich is to offer policyholders that make a claim free counselling sessions, following a nine-month pilot last year.

Insurers count cost of Christoph as warnings of further flooding intensify

Storm Christoph is not expected to prove as costly as other recent winter storms, with PWC predicting insured losses could hit £120m, but could set the stage for more severe flooding as soon as next month.

Intelligence: Insurance protecting nature

In 2020 the world’s first coral reef insurance policy was triggered in Mexico, following damage resulting from October’s Hurricane Delta. Post looks at how insurance is helping nature in other parts of the world.

IUA starts hunt for chair as Patrick Tiernan swaps Aviva for Lloyd’s

The process for appointing a new chair of the International Underwriting Association has begun, Post can reveal.

Preparation for unlikely crises more than a 'tabletop exercise', warns World Economic Forum panel

Policymakers and business leaders need to pay greater attention to low-likelihood, high-impact risks, panellists warned at the launch of the World Economic Forum’s annual Global Risks Report on Tuesday.

Frustrated policyholders call for insurers to ‘take responsibility’ after Supreme Court rules many are due payouts

Policyholders and their representatives have called for insurers to “take responsibility” and “immediately start paying claims” in the wake of a bittersweet Supreme Court judgment on disputed coronavirus-related business interruption policies.

The Supreme Court BI test case judgment in summary

The Supreme Court has substantially found in favour of the Financial Conduct Authority in the final stage of the Covid-19 business interruption test case. Post highlights key points given among the reasons behind the ruling.

Live: Supreme Court rules largely in favour of policyholders in FCA's BI test case battle

Free content: Access market and insurance reactions to the Supreme Court ruling that dismissed appeals against a High Court judgment on insurers paying out in Covid-related disruption on business interruption insurance policies and overturned the Orient…

BI Case Notes: The FCA’s test case in numbers

Updated: On Friday 15 January the Supreme Court will return a verdict on appeals in the Financial Conduct Authority’s business interruption test case.

Supreme Court BI ruling looms

The Supreme Court will issue its ruling today in the Covid-19 business interruption legal case with up to 370,000 policyholders and their insurers awaiting the outcome.

Supreme Court to hand down BI verdict on Friday

The Supreme Court is expected to hand down its judgment in the business interruption test case appeal on Friday 15 January, the Financial Conduct Authority has confirmed.

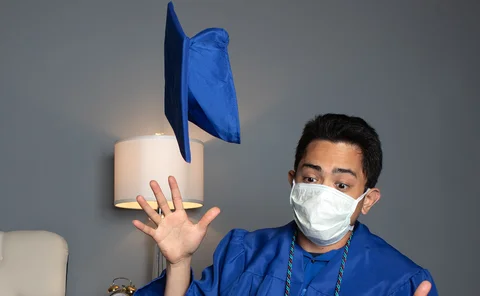

Analysis: Delivering opportunities for graduates during the Covid crisis

Insurers have maintained their graduate programmes during the coronavirus pandemic, according to an investigation by Post, and adapted to the challenges of training and recruiting in a virtual world to keep this crucial entry route into the profession…

Briefing: Has the MOJ bitten off more than it can chew with whiplash reforms?

Perhaps the only surprise about today’s delay to part one of the Civil Liability Act (2018) whiplash reforms is that they are only being put back one month.

Whiplash reforms pushed back to May

Whiplash reforms have been pushed back to May, Lord Chancellor and Secretary of State for Justice Robert Buckland confirmed today.

Lockdown: Many insurer and broker offices to remain open as Lloyd's underwriting room closes

Insurers and brokers have told Post that the majority of their staff will continue to work from home and that offices will remain open to those few that need to access them, following the start of a third national lockdown in England.

Cécile Fresneau adds syndicate active underwriter role at QBE as David Harries retires

David Harries, active underwriter of QBE Syndicate 386 and head of financial lines will be stepping down and handing over to UK insurance executive director Cécile Fresneau, the provider has confirmed.

Personal injury claimants mired in £240m pandemic litigation backlog for over a year

Road traffic accident claimants have waited over a year just for their cases to be heard in court due to backlogs exacerbated by the Covid-19 pandemic, according to an analysis of Ministry of Justice figures by Zurich.