Willis Towers Watson

Allianz and LV win big at 2019 British Insurance Awards: Full list of winners

Allianz was among the big winners at the 25th British Insurance Awards at the Royal Albert Hall scooping three individual awards including General Insurer of the Year.

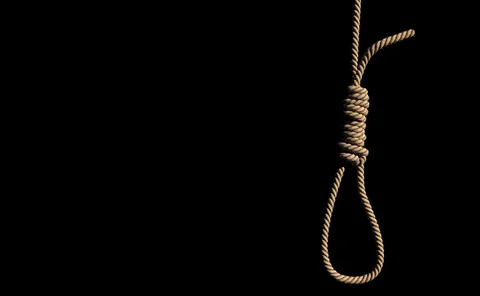

Analysis: The future of pricing - Tightening the noose

The dual pricing noose is slowly tightening around the insurance industry’s neck. Its laudable attempts to escape from the regulatory hangman seem increasingly futile as the pressure is mounting on the Financial Conduct Authority to take action.

Lloyd's assembles industry leaders to guide modernising efforts

Lloyd’s of London has established two advisory committees featuring prominent industry figures to support its ongoing modernising strategy.

Analysis: Charity & CSR: Protect and survive

The insurance sector is one of the mainstays of the UK economy, contributing nearly £30bn and employing more than 300,000 people. Its sheer size and financial strength gives the industry the opportunity to do good for the people who rely on it

Brightside MGA Kitsune passes 10,000 policies and is on-track for GWP target

Brightside managing general agent Kitsune Associates passed 10,000 policies sold last month and is on-track to meet its first year gross written premium target, according to managing director Trevor Bowers.

Geopolitical risks are a growing concern for boards: Airmic

Six out of ten risk managers believe that geopolitical tensions will become harder to manage for businesses in the next three years.

Interview: Airmic board members

In March, Airmic appointed four new board members. Post spoke to them about how risk management has changed during their time in the profession, what they need insurers to deliver and emerging risks

Analysis: Cutting the costs and risks of employee benefits

Being able to offer attractive employee benefits is vital in terms of recruitment, retention and productivity, but they are both costly and risky

Insurance companies urged to develop more dementia-friendly policies

Insurance policies come with technical jargon and are "inaccessible" to dementia sufferers, says the Alzheimer’s Society Charity.

Analysis: Are AI solutions being used to mitigate risks?

In the commercial space, artificial intelligence has the potential to enable an insurer to get all the information it needs to write a risk in a matter of hours and support customers’ risk management activity, but only if it is deployed appropriately

Environmental Agency works with insurers to review flood strategy

The Environmental Agency has launched an eight week consultation on a new long-term strategy to tackle flooding and coastal change.

Steve McGill launches new PE-backed specialty risk solutions business

Steve McGill, former group president of Aon, has launched a private equity-backed specialty risk solutions business alongside a team of other senior executives.

Motor premium upturn 'on the horizon' after modest Q4 price cuts: Confused and WTW

The price of car insurance fell 1.6% in the first quarter of 2019 after creeping upwards during the second half of 2018, according to the Confused car insurance price index, produced in association with Willis Towers Watson.

Former Marsh and JLT employees air concerns over merger

Former employees have expressed concerns over the impact of the Marsh/JLT deal on the market and the brokers themselves, after a former main board director of JLT slated the deal as a potential ‘train wreck’ in a Linkedin blog.

Blog: Aon and Willis Towers Watson – could the off deal be on again soon?

Post content editor Jonathan Swift looks at past aborted insurance bids and talks to consider whether a deal between Aon and Willis Towers Watson is dead, or merely on ice for now

Special Report: Motor Insurance Research 2019

What’s fueling motor insurance today? Michele Bacchus talks to the industry and gives the low-down on what’s heading down the highway towards insurers in both the fast and slow lanes

Swiss Re confirms exposure to Ethiopian Airlines crash

Swiss Re has confirmed it is a co-insurer of both Boeing and Ethiopian Airlines.

Marsh looks to further €1.1bn of debt to fund JLT acquisition

Marsh is raising €1.1bn (£942m) through a senior notes offering, in addition to the $5bn (£3.8bn) it has previously announced.

Chubb lead insurer in Ethiopian Airlines crash: reports

Chubb is reportedly the lead insurer for Ethiopian Airlines, the airline which saw a tragic plane crash yesterday in which 157 people died.

This month: Seeking the right fit

I’m a fan of making sure stuff is the right fit - I make a point of trying on new outfits in my own home with accessories and shoes to make sure it all works for me. I also test drove my new car a few times to check it was what I wanted. Aon, however,…

Aon pulls out of Willis Towers Watson talks

Aon has pulled out of a potential merger with Willis Towers Watson.

Aon-Willis deal could attract competition concerns

Aon might have to sell off portions of Willis Towers Watson, if it did proceed to buy the business, analysts said.

Aon in talks to buy Willis: reports

Aon is reportedly in talks to buy rival Willis Towers Watson.

Analytics: Why Robot?

Technology is predicted to be a huge part of the future business landscape but fears remain over letting robots have all the power. Post investigates how robotics and artificial intelligence is helping insurance now and how it could do more in the future