Marsh

AIG’s Anthony Baldwin steps up as IIL president

Anthony Baldwin, CEO of AIG UK has been elected as president of the Insurance Institute of London for 2020 to 2021.

Spotlight: Future of insurance work: transitioning back to the office

When lockdown happened in March some insurers and brokers were better placed than others to continue operating remotely with little or no impact on service. These firms had already been invested heavily in technology to enable more flexible working and…

Return to offices halted following government’s work from home guidance

Businesses have put their return to office plans on hold following the latest statement from the government asking people in England to work from home where possible.

Ex-Jelf boss Alway and former Aston Scott owner buy RWA

Alex Alway and Andrew Scott have teamed up to form UKGI Group and have bought compliance consultancy firm RWA, Post can reveal.

Covid 'uncertainty' to complicate January reinsurance renewals: Guy Carpenter

Total Covid-19 losses remain an unknown, leading to greater complexities and individual approaches at 1 January reinsurance renewals, Guy Carpenter has cautioned.

DRP unveils grossing up and pay gap bonus allegations in Jelf legal wrangle

David Roberts & Partners has denied the client and team poaching claims by Jelf in a High Court case and accused the Marsh-owned business of having a "toxic" work atmosphere and grossing up premiums, while a counterclaim from one defendant alleged human…

Jelf slams DRP response in 'unlawful conspiracy' poaching legal battle

A filing by Jelf has slammed DRP’s defence and counterclaim allegations for including “much irrelevant and often inaccurate information, seemingly included for perceived prejudicial value” and addressed the accusations of grossing up premiums and gender…

Former branch director sues Jelf for invasion of privacy over Facebook messages

Jason Lauchlan, a former branch director of Jelf’s Malton office, is seeking compensation for what he alleges was an “unlawful” breach of his privacy after Jelf obtained and shared Facebook messages between him and another former employee.

Analysis: Covid-19 event cancellations

Following the Covid-19 outbreak live events across the world had to be postponed or cancelled due to fears for public health and safety. Multibillion-dollar losses as a result of coronavirus has put the contingency market under the spotlight, while…

Analysis: Ethnicity pay gap reporting - getting the ball rolling

With growing pressure on the government to introduce mandatory ethnicity pay reporting to measure inequality in the workplace, Post investigates what steps the industry is taking to prepare and what is still to do.

UK property pricing up 16% in Q2: Marsh

Global commercial insurance prices rose 19% in the second quarter of 2020, research by Marsh has revealed.

Beirut marine and port insured losses should not exceed $250m, says Guy Carpenter

The combined hull, cargo and port facility insured losses from last week’s warehouse explosions in Beirut should not exceed $250m (£191m), according to an initial analysis by Guy Carpenter.

Aon/Willis combination not ‘good for clients or good for the market’: MMC CEO Dan Glaser

In a half year results call, Marsh and McLennan CEO Dan Glaser aired a “personal” view that the Aon and Willis Towers Watson merger will be negative for clients and the market .

Brit digital syndicate Ki takes Dan Hearsum from Marsh as MD

Digital algorithmically-driven Lloyd’s of London syndicate Ki has appointed Dan Hearsum as managing director joining from Marsh JLT Specialty where he was head of placement for the specialty business in the UK.

Former insurance business development head Laurence Ives jailed for sexual offences against children

Laurence Ives, 55, of Western Road, Leigh, has been jailed for four years and placed on the sex offender register for ten years for committing 15 sexual offences against children.

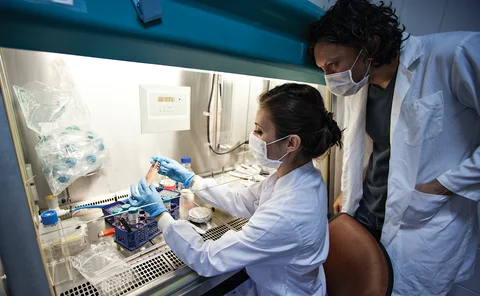

In-depth: How the life sciences sector is supporting the fight against Covid-19

The industry has found itself under the spotlight for all the wrong reasons during the Covid-19 pandemic. However, one area where it should be singing its praises is life sciences. Post investigates how brokers and insurers have supported the quest for…

180 years: Hurricanes in history

PREMIUM: The insurance industry has suffered very large losses from natural disasters over the past two centuries and this still remains a problem today, with 409 natural catastrophe events totaling $232bn in losses in 2019. Post looks at some of the…

Action groups hit out at 'absurd' insurer defences in FCA BI case

Insurers have been accused of filibustering in relation to business interruption as firms suffer “devastating losses” following coronavirus lockdown.

Gallagher-backing and US opportunities will help drive growth, says Capsicum Re boss Swallow

Capsicum Re’s new chairman Raja Balasuriya is a “force to be reckoned with,” CEO Rupert Swallow told Post as the reinsurance broker unveiled the executive committee team line-up designed to lead the business through its next phase of growth.

Marsh supports partnership between British Red Cross and the British Psychological Society

The British Red Cross and the British Psychological Society have teamed up to recruit specialist Psychosocial Reserve Volunteers who will support people experiencing trauma or emotional distress during and after major emergencies in the UK.

Aon u-turns on salary cuts

Aon will repay colleagues in full, plus 5% of the withheld amount, after cutting the salaries of 70% of its workforce.

Insurers accused of ‘dragging feet’ as extra FCA BI September trial dates mooted

Insurers have been accused of "dragging feet" in the Financial Conduct Authority's business interruption test case, as they sought additional hearing time in September to debate on the regulator's use of an analysis by the University of Cambridge to…

Briefing: Have insurers thrown brokers under the bus on BI?

There have always been points of conflict in the insurer and broker relationship but this week that reached a new low as RSA offered up Marsh as a human shield in its battle to avoid payment of business interruption claims for the Covid-19 pandemic.

Biba CEO blasts 'irrelevant' and 'unhelpful' insurer conduct in FCA BI test case

Insurers' comments about the duty of brokers made in the defences in the ongoing Financial Conduct Authority business interruption court case are "irrelevant" and "unhelpful" according to British Insurance Brokers' Association CEO Steve White.