Keoghs

Close Brothers partners with Hedron; Howden buys Laurie Ross; Admiral rebrands Toolbox

Friday Round-Up: Insurance Post wraps up the major insurance deals, launches, investments and strategic moves of the week.

Fraud ring uncovered by Keoghs and major retailer

Following a three-year investigation, Keoghs and an unnamed major retailer have exposed and convicted a sophisticated fraud ring.

New year, new shape of the City for insurers

As Lloyd’s stays put in Lime Street and Aviva kicks off 2024 in a new City HQ, Emma Ann Hughes examines how insurers are reshaping the square footage they occupy in the Square Mile.

Fake documents for £150K claim costs claimant £20K

A court has ruled a dishonest claimant, who faked documents used to submit a £150,000 personal injury claim to Allianz, must cover at least £20,000 of the insurer’s legal bill.

Jail time for claimant who forged daughter’s birth certificate

QBE Insurance, along with Keoghs, have successfully pursued 20 counts of contempt against a claimant who falsely claimed damages of £600,000 following a workplace accident.

Allianz's Graham Gibson, Aviva, NFU and Zurich among winners at 2023 Claims & Fraud Awards

Allianz chief claims officer Graham Gibson, pictured, won the prestigious Achievement Award at the Insurance Post Claims and Fraud Awards yesterday evening (5 October) at The Brewery.

Big Interview: Davies Group CEO Dan Saulter

Dan Saulter, CEO of Davies Group, reflects on the last decade, shares the case for generative AI in his business and reveals growth plans for the years ahead.

How insurers are putting the pedal to the metal for mobility trends

Analysis: Fiona Nicolson explains what insurers looking to stay in the fast lane, as mobility trends develop, need to do to satisfy drivers and maintain profits.

Creditors set to lose out amid Plexus collapse

Documents show Plexus Group, which has entered administration, owes creditors about £21.5m, and that some are unlikely to receive the full payout, with most unlikely to receive anything at all.

Ardonagh’s hat trick of purchases; Hiscox and IS2 partner; Howden sponsors the Lions

Friday Round-Up: Insurance Post wraps up the major insurance deals, launches, investments and strategic moves of the week.

540 jobs saved as Plexus Law bought out of administration with Axiom Ince deal

Axiom Ince has acquired Plexus Legal LLP and Plexus North LLP out of administration for an undisclosed sum.

Qover partners with Zurich; Keoghs takes team from Plexus; Allianz appoints CIO

Friday Round-Up: Insurance Post wraps up the major insurance deals, launches, investments and strategic moves of the week.

Former Foil president predicts more legal consolidation

Further consolidation of the insurance defendant legal market is on the cards, according to Keoghs partner and former Forum of Insurance Lawyers president Don Clarke.

Court ruling reduces risk of unexpectedly high credit hire bills

A landmark High Court ruling means credit hire organisations will now need to properly address the issue of impecuniosity at the pre-litigation stage with insurers.

Is it time to overhaul the personal injury discount rate?

Ahead of the consultation on changes being made to the single personal injury discount rate closing on 11 April, Insurance Post explores what dual or multiple rate models could mean for claimants.

Insuring the new working world

Sam Barrett explores how the insurance industry is adapting employers’ liability insurance to reflect the risks associated with new ways of working post-Covid.

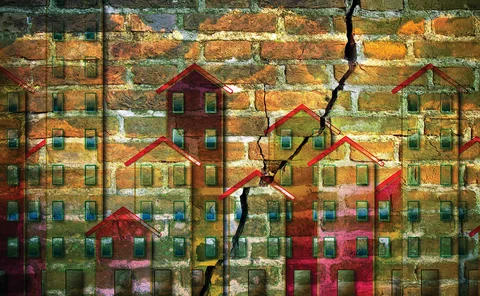

Intelligence: Tackling subsidence surges in a climate change era

With hot summers becoming more likely in the future, subsidence surge and event years may be the new norm. Fiona Nicolson looks at how insurers are preparing for these claims in a climate change environment.

Intelligence: Protecting customer-facing staff

With rising energy bills, inflation and the cost-of-living crisis all hitting consumers in the pocket tensions are running high and customers service departments are facing more hostility. Sam Barrett investigates what insurers are doing to protect their…

Shortlist for 2022 Insurance Post Claims and Fraud Awards revealed

The shortlist is now out for the 2022 Insurance Post Claims and Fraud Awards.

Vast majority of public would not drive a fully automated vehicle

Most people would not be happy to drive a fully autonomous vehicle, a survey commissioned by Post has found.

Analysis: One year on, is the whiplash portal working or heading for a crash?

With the Official Injury Claim portal celebrating its first birthday on 31 May, Post investigates how it has fared over the past 12 months.

Data Analysis: Awareness campaign needed for drivers before accelerating introduction of AVs

Exclusive: A survey commissioned by Post found there are significant gaps in knowledge when it comes to self-driving vehicles, prompting calls for more education of drivers on the distinction between driver assistance and self driving.

LV, Axa and Keoghs smash fraud ring; Flood Re launches Build Back Better; Howden buys SPF; Go Insur backs start-up Insuristic

For the record: Post wraps up the major insurance deals, launches, investments and strategic moves of the week.

Intelligence: Our duty to protect must begin now

Protect Duty legislation has been touted as a way to reduce the potential for catastrophic events from terrorist attacks at publicly accessible locations, and it is likely to affect public and employers’ liability polices. But, as Edmund Tirbutt reports,…