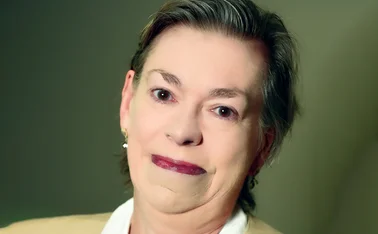

Diary of an Insurer: Allianz Partners’ Matt Crawford

After cycling from London to Paris in 24 hours, Matt Crawford, head of sales for roadside assistance at Allianz Partners, keeps motors running during his working week and learns lessons from the provider's travel insurance business.

Monday

I’m up early to review my to-do list and plan for the week ahead. Our weekly team meeting, covering the UK and Ireland, kicks off the week.

I start by updating on last week’s progress and setting objectives for the next week. Our deals management team ensure we always keep momentum on projects – very useful!

While Allianz Partners is one of the leading global providers of roadside assistance, in the UK we are less well known.

We are the roadside assistance partner for many vehicle manufacturers, including BMW who we’ve worked with for many years, and are now starting to roll out our proposition to a wider portfolio of partners including banks, insurance providers and fleet managers.

My next meeting is with our new head of mobility, Joe Pattinson, who joined today.

Ensuring our customers are always able to go where they want, when they want to, is why our products and services often combine mobility, insurance and assistance embedded in our partners’ product offer.

Joe joins the review of our latest commercial performance and sees how we’re tracking our progress into the fleet, banking and insurance sectors.

Tuesday

Joe and I are heading into town for meetings with brokers at Allianz UK at Gracechurch Street.

We’re increasingly working with brokers so it should be a productive day demonstrating how we can support their insurance propositions. It’s always good to catch up with our colleagues at Allianz – we’re working together more collaboratively than ever.

In the afternoon we meet one of our longest-standing car brand partners. Incredibly, we first started working with Mazda UK 25 years ago when we supported them on the mobility business – so it is good to introduce Joe as well.

We’ve just extended our contract until 2029 – it’s great to see how the relationship has grown from strength to strength. It really is a credit to the entire team. The meeting with the Mazda UK team goes well so afterwards we’re able to enjoy a drink before heading home.

Wednesday

As part of our growth plans, we have enhanced our team with a couple of new joiners: Donald MacSporran recently joined us with more than 30 years’ in the automotive and roadside assistance sectors, and Rich Spencer, whose background is in fleet, leasing and service, maintenance and repair.

I’m delighted to have them on board. We review our pipeline and update on progress, exchanging on the latest market intelligence and customer needs.

Later I meet with our head of travel insurance, Andrew Tolman, to discuss what has driven the success of our travel business.

This is what we want to replicate in roadside assistance so it’s good to share best practice – particularly as we have some exciting prospects.

Thursday

Today I’m busy with meetings this morning with Rich, preparing final details for our new fleet client. They have signed a two-year contract with us and we can’t wait to get started.

The team take me through how we are customising our customer portal to meet their needs: our IT capability and ability to integrate into partners’ system was key to us winning this piece of business.

Later on, I’m in discussions with colleagues in Europe about our mobility as a service offer, which is coming to the UK.

Sometimes it simply isn’t possible for a technician to fix your broken down car – unfortunately. We are developing a very clever technology that means that we can support customers however it is needed – and get them to their final destination – whether it means by car, taxi or train, and all managed seamlessly via Allianz Partners’ digital journey.

All very exciting and looking forward to the launch. We also believe this is a true differentiator outside of roadside assistance, assisting insurance companies in managing claims costs.

Friday

Back at the office in Croydon today. It’s a busy day because we’re holding our inaugural Technician of the Year awards.

We’re looking for a technician who is a general all-rounder, with excellent customer service skills and technically astute.

After beating off stiff competition, Callum Brown scoops the role – deservedly so by all accounts, but we’ve got some amazing technicians so choosing wasn’t an easy task.

Our technicians really do an outstanding job – they’re the most highly trained in the industry and go the extra mile to help our customers get back on the road safely and with minimum disruption. It’s great to publicly recognise them for their hard work, and Callum is absolutely thrilled.

The end of the day comes quickly and I’m looking forward to getting home to seeing my family tonight. It’s nice to have some down time following a busy week.

It’s also a bit more time to recover from cycling last weekend from London to Paris in 24 hours – part of the Duchenne Dash – the weekend before. My son Connor has Duchenne Muscular Dystrophy, so an important part of my life is supporting him and raising funds to support research for this devastating disease.

I’m very proud to say that we raised more than £40,000 – tipping us over our target.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@postonline.co.uk or view our subscription options here: http://subscriptions.postonline.co.uk/subscribe

You are currently unable to print this content. Please contact info@postonline.co.uk to find out more.

You are currently unable to copy this content. Please contact info@postonline.co.uk to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@postonline.co.uk

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@postonline.co.uk