Broker

BGL's Peter Thompson on combating insurance fraud

Detecting and and deterring insurance fraud is a priority for many in the insurance industry. Peter Thompson, BGL Group’s CEO for insurance, distribution and outsourcing, looks at what’s next in the industry's fight against insurance fraud and reflects…

Biba welcomes FCA consultation on SMCR deadline extension

The consultation by the Financial Conduct Authority on extending the deadline for the implementation of conduct rules is “welcome news”, according to David Sparkes, head of compliance and training at the British Insurance Brokers’ Association.

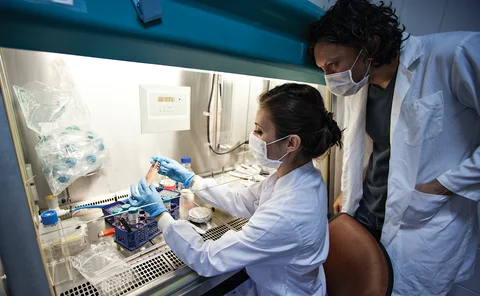

In-depth: How the life sciences sector is supporting the fight against Covid-19

The industry has found itself under the spotlight for all the wrong reasons during the Covid-19 pandemic. However, one area where it should be singing its praises is life sciences. Post investigates how brokers and insurers have supported the quest for…

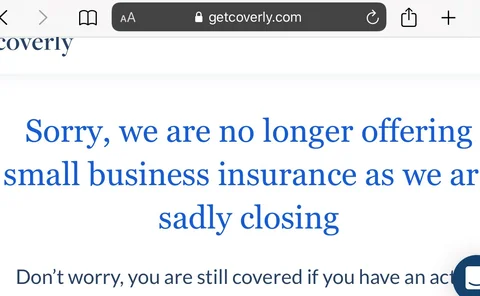

Updated: SME specialist Coverly becomes latest UK insurtech casualty as it closes

SME insurance specialist insurtech Coverly closed for new business on Friday 17 July, Post can reveal.

ABI and Biba tout 'postive impact' of voluntary action on dual pricing

Voluntary initiatives launched in 2018 to address dual pricing are “having a positive impact”, the Association of British Insurers has claimed amid suggestions that the industry needs to go further and do so quickly.

PIB reveals £75.6m acquisitions bill for 2019

PIB Group’s bill for buying five companies last year was £75.6m, according to a filing at Companies House, which also revealed the results of stress tests to assess the impact of Covid-19.

Insurers haul brokers into FCA BI case again

A joint skeleton argument attacks the FCA’s stance that SME customers are not sophisticated insurance buyers because they used brokers and slams Contra Proferentem as “restrictive” and “out of step”.

Barnaby Rugge-Price appointed chair of Howden Broking Group

Howden Broking Group has appointed Barnaby Rugge-Price as chair returning to the helm of the broking business from his recent position as CEO of Hyperion X.

Andrew Tunnicliffe returns to Aon as UK chairman for global and specialty

Andrew Tunnicliffe has rejoined Aon in the newly created role of UK chairman, global and specialty, part of its commercial risk solutions, health solutions and affinity business.

Insurance Covid-Cast: Black Lives Matter focus - Q&A with the first minority-led tier-one insurance and reinsurance broker Protecdiv

For the 34th episode of Post and Insurance Age’s video series content director Jonathan Swift sat down with the founders of Protecdiv, a business that claims to be first minority-led tier-one insurance and reinsurance broker.

Brokers not responsible for BI test case insurance policies under contract law, argues FCA

The business interruption policies under scrutiny in the Financial Conduct Authority’s test case are presented ‘in the manner which most benefits insurers’ and therefore brokers should not take the blame for any contractual breaches, the regulator has…

Wunelli and Smart Driver Club founder Penny Searles joins Trakm8 as NED

Trakm8 has appointed Penny Searles as a non-executive director to help lead on the vehicle technology specialist’s strategic vision and commercial growth.

Gallagher-backing and US opportunities will help drive growth, says Capsicum Re boss Swallow

Capsicum Re’s new chairman Raja Balasuriya is a “force to be reckoned with,” CEO Rupert Swallow told Post as the reinsurance broker unveiled the executive committee team line-up designed to lead the business through its next phase of growth.

Aventus' Peter Goodman on the challenges and opportunities that lie ahead for MGAs

With a hardening market, competition for capacity will intensify for managing general agents. As MGAs face new challenges and opportunities ahead Peter Goodman, CEO and founder of Aventus, asks if digitisation will become a regulatory requirement post…

Peter Staddon joins Trilogy MGA as NED

Trilogy Managing General Agents has appointed Peter Staddon as a non-executive director, effective immediately.

Decreasing claims from older collapses outweigh costs of recent failures to the FSCS

The cost of compensating customers of failed general insurance companies through the Financial Services Compensation Scheme fell 14% to £146.4m in the year to 31 March 2020.

Blog: Rebalancing the BI bad publicity - how insurers can rebuild public trust with positive PR messaging

Delays in comment sign off to interference in influencing messaging. Consultant Mark Bishop polled insurers and brokers about the sector's Covid-19 response and concludes lessons need to be learned in terms of balancing bad publicity in the future.

Blog: Covid-19 - time to re-evaluate

The coronavirus pandemic has hit people hard in a manner that the insurance industry can’t compute. Bundeep Singh Rangar, CEO of Premfina, looks at what lessons insurers can learn from the crisis.

Profits and turnover shrink at CDL in 2019

CDL Group has reported a 5.1% fall in turnover to £52.9m along with a 31.4% drop in post-tax profit to £4.7m for the year ended 30 September 2019.

US Department of Justice requests extra info on Aon WTW merger

The antitrust division of the US Department of Justice has asked Aon and Willis Towers Watson for additional information and documentary materials about the proposed $30bn (£23bn) takeover.

Insurance Covid-Cast: Future of Insurance Work – Lesson learned to help Gen Y employees adjust to a new work/life balance post-pandemic

For the 33nd episode of Post and Insurance Age’s video series we gathered together a panel of senior HR and talent managers to discuss the feedback they have had from millennials about how they have experienced lockdown and how insurers might adapt in…

Tiger Risk unveils fourth hire of the month

Tiger Risk has appointed Juan England as a partner with a mandate to help develop large, multi-regional clients in Europe and other international markets, the fourth recruit of the month for the rapidly expanding broker.

Blog: Dealing with a hardening market - risk management and loss control during and post Covid-19

With the current insurance market hardening at a rate not seen in over a decade, Risk Solved non-executive Richard Thomas argues those firms that drive improved risk profiling and begin to fully appreciate the quality of the risks within their portfolio…

Briefing: In CEO Amanda Blanc Aviva finally gets its woman

Having began her career at Commercial Union it always seemed fitting that Amanda Blanc would one day take the top job at its successor Aviva. Post content director Jonathan Swift reflects how the stars finally aligned for her to take up a role that for…