Articles by Tom Luckham

ABI tracker shows quarterly decline in motor premiums

Motor insurance premiums decreased by 2% in Q2 compared to Q1, according to the latest data from the Association of British Insurers.

Undisciplined motor insurers at risk of dragging the market down

Sabre’s CEO Geoff Carter has told Insurance Post that firms must be “disciplined” when it comes to pricing, lest they risk dragging the market down.

E-bike battery legislation ‘warmly’ welcomed

The UK government has announced its intention to legislate to reduce the fire risks associated with electric power-assisted bicycles and lithium-ion batteries.

Domestic & General looking to utilise AI following growth

Domestic & General CEO Matthew Crummack spoke to Insurance Post about the firm’s artificial intelligence strategy, after its annual revenue passed £1bn in 2024.

Esure loses customer claim in ‘isolated’ incident

Esure has been accused of negligent customer service after BBC’s The One Show highlighted two claims from policyholders who struggled to get in contact with the insurer following accidents.

Insta-scammer left reeling following ghost broking sentence

A man who made £17,618 by selling invalid car insurance policies on Instagram has been handed a two-year suspended sentence.

Wrisk targets European expansion after tripling revenue

Wrisk has told Post the firm is targeting more partnerships and eyeing European expansion, while also addressing the issues surrounding Jaguar Land Rover’s insurance launch.

Q&A: James Eveling, Woodgate & Clark

James Eveling, managing director of loss adjuster Woodgate & Clark, addresses the war for talent and discusses the firm’s growth plans plus its new claims system.

Thatcham calls on government to address automotive challenges

Thatcham Research has called upon the government to address several key challenges in the automotive sector to help ease high motor premiums.

Van and moped crash-for-cash schemes on the rise

Crash-for-cash schemes involving vans and mopeds are on the rise and moving into urban areas outside of London, according to Ageas.

LexisNexis accused of price increases despite limited product improvements

A source has told Insurance Post that they have seen prices for Thatcham's motor data increase by around 60% since the partnership with LexisNexis was announced earlier this year, despite very few of the promised improvements coming through.

Brown & Brown sets $8bn revenue target

Speaking at the Managing General Agents’ Association conference in London, Brown & Brown president and CEO Powell Brown told the audience the broker’s ambitious revenue targets.

Nine out of 10 brokers currently recruiting

Aviva’s Broker Barometer shows that 94% of brokers are actively recruiting, a significant increase on last year when 71% of brokers had a vacancy open.

LexisNexis working on Jaguar Land Rover security solution

LexisNexis Risk Solutions is working on a way for Jaguar Land Rover to get its vehicle security data to insurers to address pricing issues, Insurance Post can reveal.

Tui ditches Axa for Allianz on travel insurance

Allianz Partners has been appointed travel insurance provider for Tui’s UK business, with the holiday provider ending its partnership with Axa Partners in April.

Q&A: Graham Gibson, Allianz

Allianz chief claims officer and Thatcham Research chairman Graham Gibson reveals how the provider is using artificial intelligence to crack down on fraud and believes we are at “an inflection point” when it comes to automated vehicles.

Aviva sees 65% increase in non-whiplash injury claims

Non-whiplash-related injury claims have jumped by nearly two-thirds since the whiplash reforms, Aviva’s head of counter-fraud Pete Ward has told Insurance Post.

‘Stripped-back’ policies may lead to consumer confusion

Fairer Finance has warned that ‘stripped-back’ motor insurance policies may lead to greater consumer misunderstanding unless insurers begin to communicate clearer.

‘A lot of gaps’ to fill in Automated Vehicles Bill

There are still gaps left to fill regarding the use of automated vehicles, according to the Association of British Insurers’ manager for general insurance policy, Jonathan Fong.

One in four don’t declare all medical conditions for travel insurance

One in four people do not declare all of their medical conditions when buying travel insurance, according to a survey from AllClear.

Cifas sees false insurance claims increase by a fifth

Opportunistic drivers submitting false ‘no claims’ documents are raising concerns for insurers, with filings to the National Fraud Database increasing in 2023, according to Cifas.

Three key takeaways from ITC DIA Europe 2024

Artificial intelligence can be used to close the digital gap in insurance; meanwhile, some feel that generative AI is just a temporary hot topic, according to experts gathered at ITC DIA Europe, which took place in Amsterdam this week.

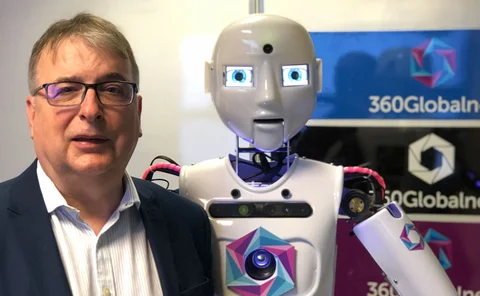

Q&A: Paul Stanley, 360Globalnet

Paul Stanley, CEO & founder of 360Globalnet, speaks to Insurance Post about the software firm’s growth, digital claims, and the benefits of no-code systems.

Vehicle damage claims drop following Welsh speed limit law

Wales has seen a 20% drop in vehicle damage claims since the implementation of a nationwide 20mph speed limit, according to Esure.