Mergers & acquisitions (M&A)

Direct Line and More Than launch telematics products; Easy Jet adds Covid-19 cover; Sedgwick sells UK subsidiary; and Shift becomes latest European insurtech unicorn

Post wraps up the major insurance deals, launches, investments and strategic moves of the week not covered elsewhere on www.postonline.co.uk

Editor's comment: Proving its resilience

With May comes the market staple of the British Insurance Brokers’ Association conference, albeit in a slightly different virtual guise. Our thoughts therefore turn to the broking sector and what the impact of the last 12 months have been on it.

Interview: Stephanie Smith, Allianz

Allianz Insurance chief operating officer Stephanie Smith virtually joined Jen Frost to discuss her engineering and aviation experiences, Allianz’s LV and Legal & General integrations and £5bn ambitions.

Admiral comparison site business sale to RVU completes

Admiral’s sale of Penguin Portals, which counts aggregator Confused amongst its offering, to RVU has completed after gaining regulatory approval.

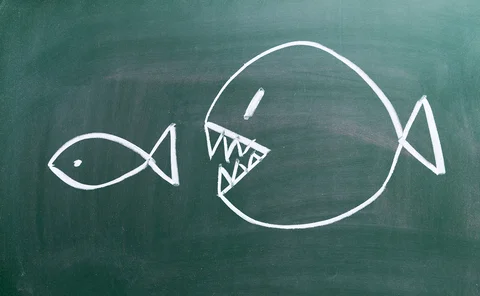

Intelligence: Broker Focus - No sign of slowdown in broker mergers and acquisitions

Many parts of life have been on hold for the past year but broker mergers and acquisitions have gone from strength to strength. Post discovers why this sector has been so resilient and asks what the future might bring

Admiral, Aviva and Lloyd’s sign Fintech Pledge; Nextbase Insurance launches with Axa and Ageas; Rightchoice buys Fresh and Zurich in Ping An tie-up

Post wraps up the major insurance deals, launches, investments and strategic moves of the week not covered elsewhere on www.postonline.co.uk

Abacai has an 'opportunity to drive' insurtech consolidation but will not pay over the odds, says co-founder Hay

Private equity-backed digital insurance venture Abacai will not be a “consolidator for consolidation’s sake”, although it is inevitable that there will be activity in the insurtech space, one of its co-founders has told Insurance Post TV.

Atlanta to buy Be Wiser

The Ardonagh Group’s retail platform Atlanta is buying Be Wiser, with 60 staff expected to leave Be Wiser as a result of its recent consultation.

Axa teams up with Microsoft; Ardonagh unveils Beazley capacity deal; Lloyd's to open Manchester hub; LV rolls out ethical standard

Post wraps up the major insurance deals, launches, investments and strategic moves of the week not covered elsewhere on www.postonline.co.uk

Abu Dhabi invests in Qmetric

The Abu Dhabi Investment Authority has taken a stake in Policy Expert owner Qmetric in two transactions, Post can reveal.

European Commission pushes back deadline for Aon/WTW merger decision to July

The European Commission has pushed back the deadline for its decision on whether or not to approve the Aon’s acquisition of Willis Towers Watson, after the broker submitted new commitments.

Markerstudy names former Tesco Bank boss as group chair as it completes Brightside buy

Markerstudy has appointed former Tesco Bank CEO Benny Higgins as its group chairman.

Ardonagh targeting eight international hubs by 2025, says O’Connor

Ardonagh Global Partners is aiming to have at least one more international hub by the end of the year, CEO Des O’Connor told Post.

MS Amlin acquires MGA; Ethos buys 13th hub; insurtech recruits Esure CUO ahead of launch; and PIB bolsters Irish footprint

Post wraps up the major insurance deals, launches, investments and strategic moves of the week not covered elsewhere on www.postonline.co.uk

Atlanta to spread Marmalade specialism into van and bike

Buying motor specialist Marmalade addresses Atlanta Group’s weakness in telemetric offerings and provides opportunities for growth across the business, CEO Ian Donaldson told Post.

Ardonagh makes first US buy and launches Ardonagh Global Partners

Ardonagh Group has bought US healthcare and benefits underwriter Accurisk in a joint venture with insurance services company Amynta Group and has launched Ardonagh Global Partners.

Blog: MGAs and the shift in the insurance industry distribution ecosystem

The number of delegated underwriting authority enterprises has grown rapidly over the past 10 years. David Blades, associate director of industry research and analytics at AM Best, explains why this is and what this means for the market.

Analysis: Deconstructing Aviva

With a new group CEO in role, Aviva has made serious strides in offloading its overseas operations. What inspired these moves and what does this mean for its core operations in the UK, Ireland and Canada?

GRP’s Stephen Ross on why sometimes selling your house is like selling your broking business

After looking at over 100 potential deals last year but only striking a small proportion of them Stephen Ross, head of mergers and acquisitions at Global Risk Partners, details what brokers considering a sale need to think about.

Aviva completes 'refocus' with sale to Allianz; Axa and Tesco join forces; Chubb takeover rebuffed and Bought By Many enters US

Post wraps up the major insurance deals, launches, investments and strategic moves of the week not covered elsewhere on www.postonline.co.uk

RSA names Hodges chair for UK and International business after proposed takeover

RSA has confirmed Mark Hodges as chair and Charlotte Jones as chief financial officer for its future structure following the completion of Intact Financial Corporation’s proposed takeover.

Ardonagh boss David Ross hits out at CMA Bennetts decision

Ardonagh was “really surprised and disappointed by the approach that was taken” by the Competition and Markets Authority as it blocked the firm buying Bennetts, CEO David Ross has declared.

Insurance lives in the Covid era - 12 months on from the first National Lockdown: Part Four

On the 23 March 2020 as Covid-19 infection rates soared Prime Minster Boris Johnson told us to “stay at home” triggering the first National Lockdown. One year on Post spoke to a host of insurance workers - the insurer boss, the broker boss, the insurer…

For the record: Chubb bids $23bn for rival; Amazon to sell SME insurance; RAC launches pay per mile cover and London team swaps AFL for SRG

Post wraps up the major insurance deals, launches, investments and strategic moves of the week not covered elsewhere on www.postonline.co.uk