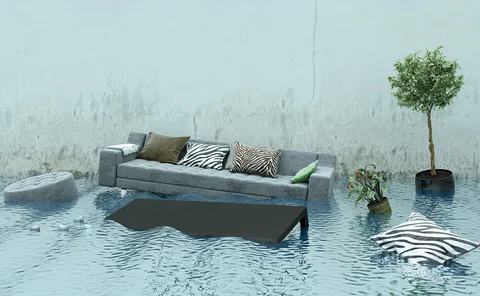

escape of water

Analysis: What's on the horizon for 2020?

For an industry that strives to understand and manage risk, uncertainty is not something that is relished. But with some market hardening, a final report from the Financial Conduct Authority on pricing practices and the possibility of Brexit all on the…

Top 100 UK Insurers 2019

The 100 largest UK-regulated insurers, ranked by non-life gross premium written, reported a combined underwriting profit in 2018, compared to a loss in 2017. Catherine Thomas, senior director of analytics in London at AM Best, explains how they achieved…

This month in Post: Insurtechs, results and discount rate

London seems strangely quiet in the summer, most people are away on holiday, and out of office replies are basically a given.

This week: No hiding place

As we start the month of August, many of us are planning to jet off abroad for a well-deserved break. And for those who do, very few would dream of placing a false sickness claim in order to receive a pay-out that would inevitably land them in jail.

Q&A: Homeserve Labs chairman, Mark Wood

Homeserve Lab’s Leakbot is currently live and working with a wide range of insurers in the UK, Europe and the US. Post spoke to the company’s non-executive chair, former Axa UK CEO and Prudential UK and Europe CEO Mark Wood, to hear about its plans for…

Analysis: Impact of smart home technology on escape of water claims

In 2018 insurers dealt with 228,000 escape of water claims, at a cost of £617m – an increase from £529m paid out five years ago, according to statistics from the Association of British Insurers. With the rising cost of claims, can technology help reduce…

Editor's comment: Fair and quick

As many of you know I’m a motorhome owner and as a family we enjoy camping.

Home insurance premiums drop despite higher claims

Average home insurance premiums have dropped 1.2% in the past year to £134, despite a rise in subsidence claims, according to the latest report.

Spotlight: Data - Ordering data in

Insurers continue to hang their success on the quality and use of data, with businesses continually reviewing how to gain a commercial advantage. Edward Murray looks at the benefits of using external data providers and why some peril risks have proven…

Spotlight: Data - Why are insurers ignoring data for escape of water claims?

Don’t blame the rain for the growing number of water-related claims in the UK, blame the plumbing

Roundtable: Escape of water - managing the rising indemnity spend

Escape of water claims continue to exercise property claims managers. According to the most recent estimates from Association of British Insurers, domestic escape of water claims cost insurers £483m. With this in mind, Post, in conjunction with Acumen,…

Aviva prepares for further claims inflation in 2019

Aviva’s UK business is anticipating pricing increases in 2019 as a result of non-weather claims inflation.

Analysis: SMEs: Emerging risks - Protecting the little guys

A changing risk landscape is creating new challenges for SMEs and those tasked with providing the sector with insurance. But SMEs need to evolve as newer risks such as cyber attacks and data protection – along with the raft of uncertainties around Brexit…

Leakbot rival Waterlock trialling with major insurer

Energy sector technology company Geo is trialling its leak detector and preventer, Waterlock, with a "top 10" insurer.

Rising star: Michael Hearty, Auger

With the experience of a work placement in Malaysia, Michael Hearty joined the insurance industry with Auger and is already external operations manager

Analysis: Insuring unoccupied property

The issue of unoccupied property is a political hot potato in a climate of Brexit and increased online retail. How are insurers tackling this high risk area?

Roundtable: The new wave: time to disrupt the disruptors

The insurance sector must remain vigilant to challengers, be they data giants like Google and Amazon, or nimble insurtechs. Especially given that some already hold such rich data. So how can incumbents take on potential usurpers? Is now the time to take…

Home insurance prices fall despite claims costs

Home insurance prices are cheaper than they were a year ago despite premiums increasing in recent months, according to analysis by Consumer Intelligence.

Top 100 UK insurers 2018

In 2017, the combined underwriting results of the largest 100 UK non-life insurers improved but remained in the red. How well did insurers perform under pressure from strong competition and unfavourable claims trends?

Blog: Loss adjusters are developing new skills to tackle escape of water claims

As insurers are trying to tackle rising escape of water claims costs, loss adjusters are developing increasingly specialised skills, explains Darren Francis, escape of water project manager at Crawford & Company.

Blog: Smart homes need discounted insurance

Insurers need to offer discounts for smart home devices, argues Jay Borkakoti, director of home insurance, UK and Ireland, at Lexis Nexis Risk Solutions.

DLG’s operating profit slides as insurer is hit with weather claims

Direct Line Group saw operating profit slide in the first half of 2018, as it was hit by weather-related claims.

Blog: High-tech property restoration is worth paying for

Property restoration techniques and equipment are advancing and, while they may be costly, they're worth investing in, argues Jonathan Davison, strategic development director of the British Damage Management Association.

Analysis: Leisure market - At your leisure

Brexit may raise the prospect of more expensive holidays abroad and longer waits at borders. If fewer European city breaks beckon, could there also be an upside in spending more time in England’s green and pleasant land?