Brexit

Insurers issue motor claims inflation warning over new technology

Exclusive: The complexity of repairing semi-autonomous vehicles has seen claims inflation rise significantly in the past year, insurers have warned.

Blog: Aviva's plan to split its UK business is more of a reset than a shake-up

This week Aviva has been tipped to unveil a new structure which will again see its UK general insurance and life/pensions businesses split. Jonathan Swift reflects on why this should not come as a surprise as history dictates the insurer has never been…

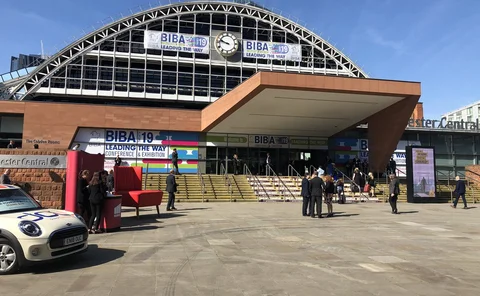

This week in Post: Conference, cuts and conservative leadership

This week, along with the rest of the team, I attended the British Insurance Brokers’ Association conference. I knew it would be an action-packed week - but nothing could prepare me for what was ahead.

Analysis: Managing the M&A insurance risk

It was the Competition and Markets Authority that recently put paid to Sainsbury’s and Asda’s marriage plans, but there are plenty of other risks that also regularly threaten the success of mergers and acquistions – ranging from the uncovering of…

Clyde & Co establishes presence in Dublin ahead of Brexit

Clyde & Co has opened an office in Dublin to ensure its Irish law insurance practice can continue to operate seamlessly as the UK leaves the EU.

Analysis: Consolidators look to Europe for acquisitions as UK competition grows

The UK has seen a wave of consolidation in regional broking over the past few years, making competition for viable targets a challenge. In response, several consolidators are starting to look to Ireland and Europe as a potential area of expansion.

Discount rate: Are insurers being too optimistic?

In anticipation of the new discount rate announcement, expected by 5 August 2019, many insurers have already started to price and reserve at 0%

Claims costs drive an increase in van insurance premiums

Claims costs have driven an average premium increase of 35.1% since April 2014, Consumer Intelligence has found.

Flagging personal lines see Covéa's profits slashed

Covéa Insurance saw its underwriting profit slashed to £1.8m in 2018 compared to £12.4m in 2017, as its personal lines business felt the impact of claims inflation and adverse weather.

Brexit and fair pricing lead FCA general insurance agenda for 2019/20

The Financial Conduct Authority has set out its priorities for the year ahead in its 2019/20 business plan, identifying Brexit as its “immediate priority”.

Trade credit claims mount as UK tops global insolvency forecasts

Trade credit insurer Atradius has forecast that global insolvencies are set to rise for the first time in 10 years, with the UK facing the highest increase of all advanced markets.

French insurer to set up UK branch as Brexit fail-safe

French insurance company La Parisienne Assurances will establish a third-country branch in the UK, in order to continuing operating in the country after Brexit.

Pukka halts UK branch Brexit plan

Exclusive: Pukka has shuttered a dormant UK branch that would have acted as a contingency if the UK and Gibraltar lost passporting arrangements.

Special Report: Motor Insurance Research 2019

What’s fueling motor insurance today? Michele Bacchus talks to the industry and gives the low-down on what’s heading down the highway towards insurers in both the fast and slow lanes

This week: All change... please!

The more things change, the more they stay the same. So runs a French expression that feels apt in a week that saw Brexit delayed, leaving us all wondering whether we will be able to talk about anything else ever again.

Brexit could fuel motor price uptick after year of falling premiums

Despite motor insurance premiums falling 6.7% in the past year, data analytics company, Consumer Intelligence, has warned that concerns over Brexit could be causing premiums to creep upwards.

Liberty redomiciles its European insurance company to Luxembourg

Liberty Mutual Europe has completed its re-domicile from the UK to Luxembourg.

Delayed riot claims guide finally gets government green light

The Chartered Insurance Institute’s New Generation Claims Group has issued guidance for the compensation of claims in the event of riots.

Underinsurance among the risks for increasing number of stockpiling businesses

More than one in five employees say their employers are stockpiling as a contingency against Brexit-related disruption, with these businesses at risk of being underinsured unless they ensure their cover is brought into line with the value of their…

This week: The end of the hard sell

When the regulator fined Carphone Warehouse £29m this week, the real target was the use of high pressure sales techniques in insurance.

Amanda Blanc reveals Brexit fears over upcoming Solvency II review

Amanda Blanc said insurers should not accept a Brexit outcome that prevents the UK industry from having influence over a critical European Union Solvency II review.

Analysis: How might a no-deal Brexit affect claims inflation?

With the outcome of Brexit still unclear and a possible European Union exit on 29 March looming, some insurer bosses have cautioned that we could see rising claims inflation this year.

QBE's Cecile Fresneau on being prepared for the worst

Businesses are operating in unpredictable times and Cecile Fresneau, executive director for UK Insurance at QBE, believes preparing for the what if’s and the absolute worst-case scenario will keep insurance relevant.

Bosses could be sued for lack of Brexit preparation

Company directors could face legal action if they fail to prepare adequately for a no-deal Brexit, with limitations to directors and officers cover meaning they could find themselves personally liable.