Personal

Ombudsman expects complaints about hollowed out insurance

The Financial Ombudsman Service is bracing for more complaints next year from consumers who didn’t realise cheaper insurance premiums often result in reduced cover.

Why winter weather should pull insurers and contractors together

Ben Blain, property manager at Verisk, urges insurers and contractors to look at their respective schedules of pricing to prepare for the worst weather extremes of winter.

Significant growth of non-standard market forecast

More modular homes, climate change plus increased sales of high performance cars will lead to "unprecedented, dynamic growth in the non-standard market," according to a report from Prestige Underwriting.

Big Interview: Nadia Côté and Serge Raffard, Allianz

After being named managing directors of Allianz Commercial and Allianz Personal, respectively, Nadia Côté and Serge Raffard met with Scott McGee to discuss their respective markets, how they have settled in, and where they see their businesses growing in…

Admiral tipped as preferred bidder for RSA home and pet books

Admiral is the preferred bidder for the RSA household and pet insurance books, Insurance Post can reveal.

Motor insurers with the happiest customers revealed

Data analysis: Fairer Finance’s latest consumer survey shows Audi, NFU Mutual, BMW, Santander, and By Miles have the happiest motor insurance customers and digs into the reasons why they are more cheerful than most.

CII asked for answers about finances ahead of AGM

Former Personal Finance Society board member Vanessa Barnes has raised concerns about the Chartered Insurance Institute Group’s 2022 annual report ahead of the professional body's annual general meeting this afternoon.

Animal Friends’ 2022 profits take £12m customer refund hit

The 2022 financial accounts for Animal Friends have revealed that the company paid out nearly £12m in “voluntary remediation payments” in 2022 – almost three quarters of the original £16m of profit it made that year.

Podcast: How climate change is transforming insurance

Climate change means the areas impacted by subsidence will double by 2050, and double again by 2080, Heikki Vesanto, manager for GIS data science at LexisNexis Risk Solutions, has warned.

Saga boss Sutherland steps down after four years

Saga has announced that group CEO Euan Sutherland is to be stepping down after four years in the role.

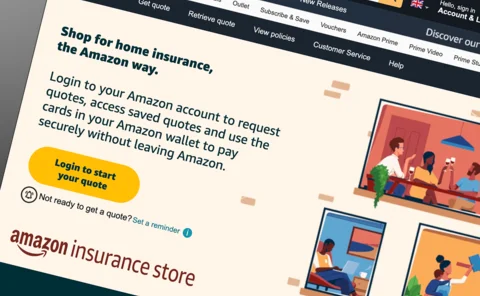

Amazon adds fifth provider to Insurance Store

Amazon has signed-up Urban Jungle to its Insurance Store, making it the fifth insurance provider on the tech-giant’s platform.

CII faces more changes at the top

As the Chartered Insurance Institute faces its second search for a new CEO in as many years, the professional body has been hit by further resignations in key roles.

Big Interview: ManyPets’ UK CEO Luisa Barile and co-founder Steven Mendel

Following a difficult period where ManyPets pulled out of the Swedish market and paused sales in the US, newly appointed UK CEO Luisa Barile and co-founder Steven Mendel sat down with Scott McGee to talk through the provider's plan to get the UK business…

Ifed in commercial motor fraud crackdown

In the Insurance Fraud Enforcement Department’s recent crackdown on commercial insurance fraud, Axa played a role in verifying motor insurance policy legitimacy.

State of the pet insurance market revealed

Data analysis: While the overall number of pet insurance providers has been decreasing for some time, Angela Pilley, insight consultant for general insurance at Defaqto, explores how the number of policies available has increased significantly.

117,000 drivers found guilty of insurance-related offences in 2022

More than 117,000 drivers were found guilty in court for insurance-related offences in 2022, with a third convicted for keeping a vehicle without insurance.

Pete Allchorne elected Foil president

Pete Allchorne, partner at DAC Beachcroft, has been elected president of the Forum of Insurance Lawyers.

Allianz suing Revolut for £10.4m over axed travel insurance deal

Allianz is suing Revolut for £10.4m, alleging that the neobank breached its obligations under a deal it struck in 2021 for Allianz to provide travel insurance to Revolut customers.

Q&A: Maddy Howlett, By Miles

After being named as James Blackham's successor, By Miles’ new CEO Maddy Howlett catches up with Scott McGee to talk through life as part of Direct Line Group, and how to stand out in a world where customers are choosing to shop around more.

Atec Group chief reveals plan to grow business

Brendan Devine, CEO of Atec Group, has told Insurance Post the foundations are in place to achieve £25m in turnover in 2024 with growth coming from non-standard home insurance.

Getting to the truth of vehicle risk

Andrew Ballard, product principle of LexisNexis Risk Solutions, considers the perfect storm in motor insurance and explains why vehicle build and specification data can help providers see clearly through the clouds.

Sabre chair Andy Pomfret passes away

Sabre has announced that its chairman and McGill and Partners director, Andy Pomfret, passed away at the weekend following an illness.

CII’s Suzi Rackley asks if it’s enough to Build Back Better

Trade Voice: Suzi Rackley, client director at Howden Private Clients and member of the Chartered Institute of Insurers’ broking board, argues the industry needs to push beyond Build Back Better to ensure the UK is flood-ready by 2039.

Big Interview: SRG CEO Warren Downey and deputy CEO Lee Anderson

Specialist Risk Group CEO Warren Downey and deputy CEO Lee Anderson explain how Marsh snapping up JLT created a gap in the market for a "great alternative for great specialists."