Thatcham

Thatcham aims to tackle assisted driving confusion with scoring system

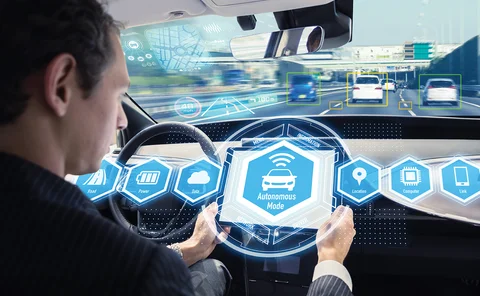

Confusion around assisted driving systems fuelled in part by carmakers’ marketing must be tackled in order to avert serious road collisions, Thatcham Research has warned as it unveils a new safety scoring system.

ALKS cannot be classified as 'fully automated' warn insurers as driver charged in Uber case

As the driver in a fatal autonomous Uber car crash from 2018 was charged with negligent homicide, the insurance industry has warned more needs to be done before introducing Automated Lane Keeping Systems onto UK roads next year.

Thatcham publishes requirements for repair of ADAS vehicles

Thatcham releases insurance industry requirements for the safe repair of ADAS-equipped vehicles.

Future Focus 2030: The future of motor

In the first of a new monthly series, Post looks into the future at how the insurance market might change, with each part focusing on a specific issue. For the first instalment, Jonathan Swift fast forwards a decade to report on the changing face of the…

Analysis: Will lockdown car insurance profits trickle down to policyholders?

Quieter roads have led many to assume that car insurers are in for pandemic profits. Post investigates calls for lockdown windfalls to be re-gifted to motorists.

Ageas looks to salvage deal to triple ‘green parts’ use by 2023

Exclusive: Ageas UK has struck up a deal to combine its salvage and ‘green car parts’ suppliers in a move to be more environmentally conscious, cut waste and drive efficiency.

Analysis: Reinsurance hikes add to motor pricing pressure

The UK motor market had the unwanted title of the biggest riser in the annual global reinsurance renewal season this January, adding another reason for intense scrutiny on insurance pricing in the loss-making sector

This week in Post: hanging by a thread

This week, Transport for London has revoked Uber’s licence to operate in London, causing fear among the capital residents who often rely on the app-based service to get them home safely after a night on the town.

Interview: Jonathan Hewett, Thatcham CEO

Jonathan Hewett replaced Peter Shaw as CEO of Thatcham Research in January this year. He spoke to Post about Thatcham’s 50th anniversary, vehicle 2.0 and the trends in the motor industry.

Analysis: E-vehicles - A missed opportunity?

As people are increasingly switching to electric vehicles, are insurers taking the opportunity to explore this market?

This week: Dive in and let it out

In the biggest news of the week the Supreme Court didn’t hold back when it ruled Prime Minister Boris Johnson’s advice to HM The Queen that parliament should be prorogued was unlawful.

Blog: Advancements in vehicle technology - are insurers keeping up?

Fifty years ago, as the first Ford Capris, Austin Maxis and Aston Martin DBS V8s arrived on the UK’s forecourts, Thatcham Research was established to improve vehicle safety standards and contain claims cost. However Graham Gibson, chief claims officer at…

This week in Post: Culture vultures

At the Monte Carlo annual rendezvous this week, Lloyd’s chairman Bruce Carnegie-Brown said the corporation was ready to “hang” perpetrators of bad behaviour after its culture survey revealed some “sobering” results.

Thatcham publishes guidelines for autonomous vehicles

Thatcham has published guidelines to help transition vehicles from assisted to automated driving.

Blog: Post trials a driverless car

Driverless technology will shape the future of motor insurance. Thatcham offered Post the chance to trial a driverless car at a test track in Nuneaton, and see how the technology will change over the next six years.

Direct Line motor head warns of 'dangerous' autonomous vehicle tipping point

The tipping point between level two and level three automation is a potentially dangerous place, according to the head of motor at Direct Line.

Insurers need to raise awareness on keyless car thefts

Insurers and manufactures have to educate customers on the risks of keyless car thefts, a conference heard.

Q&A: National Windscreen managing director Jan Teo

Having taking over the reins of National Windscreens as managing director in 2018, Jan Teo spoke to Jonathan Swift about what attracted her to the role; the challenges the business faces and what it is like being caught up in a motor manufacturer space…

Insurers issue motor claims inflation warning over new technology

Exclusive: The complexity of repairing semi-autonomous vehicles has seen claims inflation rise significantly in the past year, insurers have warned.

Analysis: Joining forces on Adas: How motor manufacturers are looking to work with insurers on driver safety

As insurers complain of double-digit increases in repair costs as a result of advanced driver assistance systems, Edward Murray spoke to motor manufacturers about why the underwriting focus needs to move from the driver to the vehicle.

Driverless experts split over ‘manual’ driver premiums

A move towards autonomous vehicles could lower premiums for drivers of non-autonomous cars, but insurers remain split over the issue.

Drivers in autonomous vehicles 'shouldn't be held liable'

Drivers of fully automated vehicles should not be held liable for accidents involving their cars while technology is in charge, says the Association of British Insurers and Thatcham Research.

Industry pays tribute to former Thatcham CEO, Peter Shaw

Tributes have flooded in from across the industry to Peter Shaw, former CEO of Thatcham Research, whose death was announced on Monday.

Thatcham CEO Peter Shaw passes away

Thatcham Research's former CEO Peter Shaw has died.