RSA Group

Roundtable: ADAS and the next step to driverless cars

Autonomous vehicles, drones and cyber innovation have been hogging much of the discussions as to how insurers can prepare themselves for the technology of the future. What can easily be overlooked is the complex technology that already exists in the…

Interview: Brendan McCafferty, Axa

Brendan McCafferty joined Axa as CEO, intermediated and direct, in February. He talks to Will Kirkman about his new role

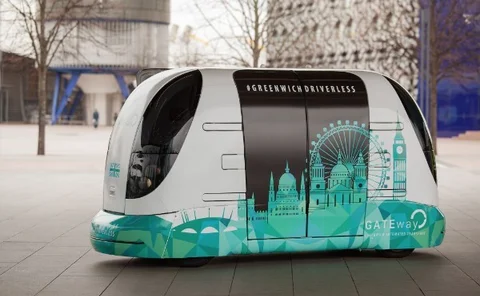

RSA takes part in study of autonomous vehicle prototype

RSA is taking part in a study of prototype autonomous vehicles as driverless shuttlebuses take to London roads.

In Depth: Using lie detectors to root out fraud

How broker Only Young Drivers is taking a novel approach to application fraud

Climate change: insurers feeling the heat

The global risk landscape is currently dominated by environmental upheavals caused by climate change. The resulting catastrophes are of concern to people in general and insurers, in particular, tasked as they are with underwriting and managing ever…

Towergate promotes Erotocritou to deputy chief financial officer

Towergate’s Antony Erotocritou has been promoted from underwriting finance director to deputy chief financial officer.

Q&A: Winnie Wong, Asia Insurance

Insurance Post asked one of Hong Kong's most experienced insurance professionals about her latest role as CEO of Asia Insurance.

RSA appoints Gearey as CRS MD

RSA has appointed James Gearey has managing director for Commercial Risk Solutions.

Apprenticeships: A radical overhaul

The radical overhaul by the government of the apprenticeship scheme - with the core aim of creating three million new apprentices by 2020 - is set to have a major impact on recruitment and training in the insurance industry, potentially reaching far…

Broker Network forms five-strong insurer panel

Broker Network has formed a five-strong panel of insurer partners made up of Ageas, Allianz, Axa, NIG and RSA.

Financial Ombudsman reveals 5% increase in complaints about insurers

Insurers had 5% more complaints made about them in the second half of 2016 than in the first half of the year, up to almost 18,000.

Costs for SMEs could rise £6.8bn over 2017

Seven out of 10 small to medium enterprises expect their revenues to shrink or stay the same in 2017.

This week: Personal injury, fundamental flaws and results

Personal injury took on a new meaning for me this week when I discovered a bruised ankle picked up during a recent paragliding adventure was actually a bad break.

RSA says more than 900 jobs culled last year, as it looks to further efficiencies

RSA made more than 900 redundancies last year and plans to make an additional £50m in cost savings.

RSA's profit climbs 25% in 2016 as annual cost savings hit £290m

RSA's UK operating profits increased 76% in 2016 to £259m - the best result in a decade.

Former RSA Ireland CFO fined and banned for misconduct

The former chief financial officer and two former actuaries of RSA Insurance Ireland have admitted misconduct and agreed to fines following a Financial Reporting Council investigation.

RSA's Thomas on how partners can serve your customers better than branches

The future of overseas trading for UK businesses is somewhat clouded by the uncertainty of a post-Brexit world. But what's clear is that it is not just the giants of UK industry that have to grapple with how to work within new rules and channels for…

Solvency II driving demand for reinsurance

January renewals show that Solvency II will increase demand for reinsurance products as European insurers attempt to strengthen their capital position through risk transfers, according to Fitch Ratings.

Week in Post: Darts, brokers and wooden spoons

The first rule is that you shouldn’t talk about it, but nevertheless I had the pleasure of hearing all about Post’s team visit to trendy Shoreditch darts venue Flight Club this week.

RSA puts in place new GRS operation model

RSA Global Risk Solutions has implemented a new operating model in order to better cater to the complex risk of customers.

RSA legacy sale to bolster its Solvency II position

RSA will use the sale of its legacy assets to further bolster its Solvency II position, according to its chief financial officer.

RSA disposes of £834m UK legacy book

RSA has agreed to dispose of UK legacy insurance liabilities worth £834m to the Bermuda-based Enstar Group.

Here are the most successful insurers, brokers and adjusters in BIA history

To celebrate the 20th edition of the British Insurance Awards, three years ago, I sat down and went through all the previous events to find out who had been the most successful company in its history.

Post Power List 2017: Stephen Hester

Group CEO, RSA