RSA Group

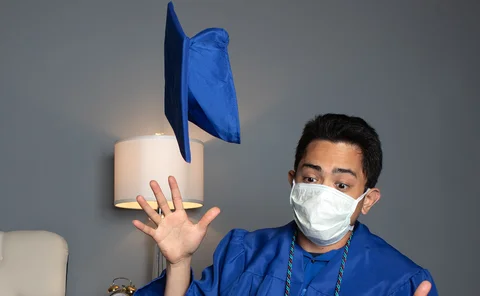

Analysis: Delivering opportunities for graduates during the Covid crisis

Insurers have maintained their graduate programmes during the coronavirus pandemic, according to an investigation by Post, and adapted to the challenges of training and recruiting in a virtual world to keep this crucial entry route into the profession…

Lockdown: Many insurer and broker offices to remain open as Lloyd's underwriting room closes

Insurers and brokers have told Post that the majority of their staff will continue to work from home and that offices will remain open to those few that need to access them, following the start of a third national lockdown in England.

Preview: What will 2021 bring?

Post spoke to insurers, brokers and claims professionals to get their predictions for what 2021 will look like.

Review of the Year 2020 – Insurers

Post spoke to insurers to get their thoughts on the highs and lows of 2020

No Supreme Court BI judgment before January, says FCA

Insurers and policyholders will have to wait until next year for the final outcome of the Financial Conduct Authority-led business interruption test case, according to an update from the regulator.

RSA names Steve Watson London market head

RSA has appointed Steve Watson as managing director of its London market business with immediate effect.

Intelligence: Procurement - making two-way partnerships work

Procurement in the 1980s and 1990s was all about who you knew. Tender processes then took over but today the market relies on a rolling review system to ensure customer service levels remain high and partners are delivering as they should on a day-to-day…

Brit names RSA’s Gavin Wilkinson as group CFO

Brit has appointed Gavin Wilkinson as group chief financial officer, joining from RSA where he is currently CFO for Scandinavia.

Spotlight: Cyber - How have cyber risks changed since the Covid-19 pandemic started?

With millions of UK employees forced to work from home during the Covid-19 lockdowns, organisations are more aware than ever of the cyber risks they face. But, while many expect this to push up demand for cyber insurance, the new landscape could also…

False job fraud: The crooks capitalising on Covid unemployment

Under the weight of coronavirus curtailment the UK unemployment rate has hit 4.8%. Crafty criminals are capitalising on unsuspecting job hunters to ‘phish’ personal information and commit insurance fraud.

Hester poised for £17.7m and Egan £6.7m from RSA sale

RSA group CEO Stephen Hester could pocket £17.74m from the sale of the insurer with UK and international CEO Scott Egan in line for a £6.67m pay out, according to analysis of the latest documents published by the provider as part of the proposed takeover…

Insurers urge MOJ for an early Christmas present of the rules for the whiplash portal

Insurers have urged the Ministry of Justice to release the rules for the whiplash portal as soon as possible, after delays earlier this year.

Insurers must improve internal fraud team collaboration to join the dots, conference hears

Internal collaboration among fraud teams is important when fighting fraud, experts said at Post's Claims and Fraud summit.

Hiscox had pandemic possibility 'well in mind' when it drafted BI policies, action group tells Supreme Court

The Hiscox Action Group has responded and opened its appeal as part of the Supreme Court hearing on the business interruption test case.

Coronavirus the 'disease equivalent' of the Great Storm of 1987, Supreme Court hears

The Financial Conduct Authority’s counsel today likened the spread of coronavirus to the Great Storm of 1987, appearing in front of the Supreme Court for the third day of the business interruption test case appeal.

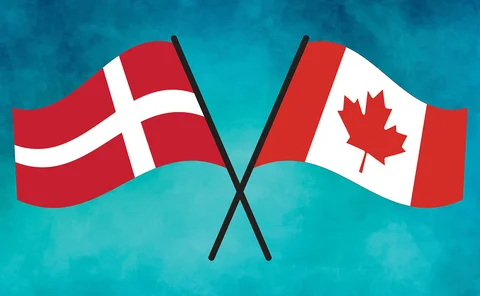

Analysis: Who are RSA buyers Intact and Tryg?

RSA's would-be co-owners Intact and Tryg intend to split the insurer once a deal closes. Post investigates what the parties' track records could mean for its future.

Insurers and FCA clash on trends clauses in Supreme Court BI test case

Insurer defendants and the Financial Conduct Authority set out their starkly differing views on the use of trends clauses on day two of the ongoing business interruption test case hearing at the Supreme Court.

Local coronavirus cases did not cause national lockdown, BI insurers tell Supreme Court

The Supreme Court heard arguments from lawyers representing QBE, Argenta and MS Amlin on Monday as insurers began their appeal of the September judgment handed down in the Financial Conduct Authority’s business interruption test case.

Travelers expands Mike Lawton’s role to lead on specialty

Former Towergate and RSA boss Mike Lawton, vice president of business insurance at Travelers Europe, will now also be responsible for specialty business including its Lloyd’s syndicate, the insurer has confirmed.

Claims and Fraud Summit 2020: Hear from AA, Allianz, Aviva, Ecclesiastical, Hiscox, Markel, Munich Re, NFU Mutual, QBE, RSA and Zurich

The annual Insurance Post Claims and Fraud Summit will be taking place this year virtually on 18-19 November 2020 – so be sure to join us and take advantage of our online networking platform, livestreamed agenda sessions and explore a wealth of content.

Briefing: Is RSA's sale to an overseas bidder a sign of the UK’s declining stature as a global insurance player?

With RSA poised to be sold to a consortium of a Danish and Canadian investors, the number of internationally recognised UK-domiciled insurers is set to reduce by one. Post content director Jonathan Swift asks: is it time to dust off plans for the Royal…

Briefing: The Seven Year Pitch - Why has it taken Stephen Hester so long to sell RSA?

Almost seven years after he took over as group CEO, Stephen Hester looks like he is finally closing in on a sale for RSA. The big question, as Post content director Jonathan Swift asks, is why has it taken so long?

RSA in £7.2bn sale talks

RSA has confirmed it is in takeover talks with Canadian insurer Intact Financial Corporation and Danish provider Tryg about a £7.2bn deal that would split up the business.

Briefing: BI test case verdicts and appeals broken down – In pursuit of clarity

As the search for lesser-spotted clarity continues, simple confirmation from the regulator on which business interruption wordings are being contested, and by who, is a welcome aid.