Financial Conduct Authority (FCA)

Travel insurers must ‘signpost’ policies for vulnerable customers

Travel insurers will have to ‘signpost’ policies that have exclusions over pre-existing medical conditions.

Clone broker warning issued by FCA

The Financial Conduct Authority has warned of an unregulated clone broker operating in the UK.

Spanish private health body hits out at ‘possible systemic fraud’ in UK travel insurance

The Spanish Private Health Alliance hit out at “possible systemic fraud” committed by British insurers offering problematic medical cover within travel policies.

Top 0.2% of firms to pay 61% of next year's FSCS levy

110 financial services firms will pay 61% of the Financial Service Compensation Scheme’s levy in 2019/20, according to indicative numbers published by the compensation fund.

Scammers used UK General's name to target unwary consumers

A clone firm has been masquerading as UK General, the Financial Conduct Authority has warned.

Tulsi Naidu appointed chair of FCA practioner panel

Zurich UK CEO Tulsi Naidu has been appointed as chair of the Financial Conduct Authority’s practitioner panel.

ABI accuses consumer panel of 'overlooking practicalities' in dual pricing automatic upgrade recommendation

The Association of British Insurers has criticised a proposal from the Financial Services Consumer Panel for an automatic upgrade rule to tackle dual pricing, saying it “overlooks the practicalities of underwriting and product choice.”

CMA price cap proposals could put pressure on 'weak profitability' in insurance

A proposal by the Competition and Markets Authority to place targeted price caps could change pricing and marketing models and put pressure on profitability in the insurance sector, Fitch Ratings has warned.

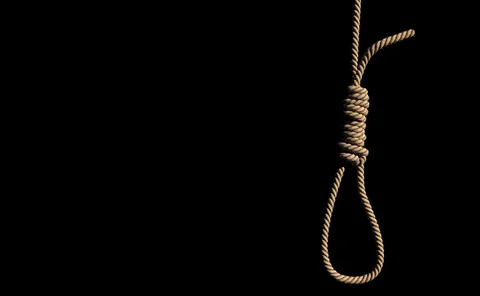

Analysis: The future of pricing - Tightening the noose

The dual pricing noose is slowly tightening around the insurance industry’s neck. Its laudable attempts to escape from the regulatory hangman seem increasingly futile as the pressure is mounting on the Financial Conduct Authority to take action.

Analysis: The future of pricing - A responsible revolution

Change is hitting insurers at a much faster pace than ever before. Are they ready to keep up and able to re-establish some of the trust that has been lost?

Analysis: The future of pricing – Data and technology

Insurers are coming under increasing pressure to develop new ways of pricing. But, while data and technology hold the key, insurers face some significant challenges as they move to this brave new world.

FCA warns of unauthorised motor broker

An unauthorised car insurance broker has been targeting customers in the UK, the regulator has warned.

This week: Court's adjourned?

Arnold Schwarzenegger’s decapitated head kicked off its last outing on our television screens this week as the FCA counts down to the PPI deadline on 29 August. However, as one battle comes to an end, another may be just beginning.

Insurers could face fines under plans to tackle dual pricing 'rip-off'

The Competition and Markets Authority could be given the power to impose fines on companies in breach of consumer law without going to court, under government proposals announced today.

This week: Dual pricing and sexual harassment claims

For a while now the insurance industry has been under the spotlight for the sheer volume of sexual harassment allegations its faced. And after Post reported this week the suspension of a senior boss at Marsh sister company Guy Carpenter, following…

Honcho secures investment from Maven

Maven Capital Partners has invested £750,000 in a disruptive car insurance platform Honcho, to support the business in launching the product nationally.

Fee caps for CMCs could lead to 'clear consumer detriment'

The Association of Consumer Support Organisations has urged the Financial Conduct Authority to consider how the market adapts to regulatory change before considering fee caps on claims management companies.

Home premiums could rise 22% if FCA acts on dual pricing

Home insurance premiums could rise 22% for new customers if the regulator moves to axe dual pricing, analysts have warned.

FCA issues warning over clone broker

A clone broker is operating under the name Wentworth Insurance Brokers, the Financial Conduct Authority has warned.

Montagu steps down as chair of FOS

Sir Nicholas Montagu will be stepping down as chair of the Financial Ombudsman Service after seven years.

Roundtable: Making data fit for compliance and regulatory purpose

The use of data is widespread but where insurers are on their integration journeys can be very different. Post, in association with Marklogic, brought a panel of experts together to discuss best practice in this area including effective compliance and…

Regulators form working group to tackle 'phoenix' companies

Financial services regulators have formed a working group to collaborate on tackling ‘phoenixing’ in the sector, whereby companies or individuals avoid liabilities or penalties by shutting down businesses only to re-emerge as new legal entities.

Blog: Claim sharing – the insurance alternative that cuts out the regulator

Despite a number of technological revolutions, general insurance hasn’t altered much since it was first conceived centuries ago in City of London coffee shops. You Do Pet founder Paul Dennis argues 'claim sharing' might be about to change that.