News

Armilla to tackle AI screw-ups with warranty product

Insurtech start-up Armilla AI has launched an AI product warranty to give companies protection and peace of mind against the risk of issues with the technology.

Professional indemnity insurers raise AI worries

Around two thirds of UK professional indemnity insurers believe the use of AI by professional services firms is increasing their risk of practice, according to a survey by Clyde & Co.

Insurers and Ukrainian government to split Black Sea shipping risks

Ukraine has struck a deal with Marsh and insurers at Lloyd’s to set up a public-private partnership providing cover for Black Sea grain shipments.

Five key takeaways from Post's AI roundtable

Insurance Post recently gathered together a group of insurance technology experts to discuss the rapid rise of artificial intelligence and how insurers need to position themselves to respond to the changing business landscape. Frances Stebbing recounts…

Marsh helps insurtech to train AI tool ahead of open market launch

AntWorks, a specialist in intelligent document processing, is targeting commercial insurance companies with the launch of Insurants.

ManyPets completes flurry of executive hires as CEO Eleazu departs

ManyPets has a new line-up for its UK executive team, as CEO Oke Eleazu announces he is to leave the business, Insurance Post can reveal.

Verisk on testing generative AI platforms

Chris Sawford, Verisk's managing director of claims for the UK, discusses what makes an artificial intelligence trial successful and how the technology helps insurers achieve operational efficiency.

Kennedys IQ on using AI for ‘highly complex’ claims

Karim Derrick, chief products officer at Kennedys IQ, shares how the company is using artificial intelligence for complex claims documents.

IFB reveals how AI has sped up detection of fraudulent claims

One year on from launching its AI counter-fraud solution, the Insurance Fraud Bureau has revealed how the tool has “elevated” the sector's fight against fraud.

Standalone R&Q legacy business to target profitability by 2025

A “refocused” R&Q legacy insurance business will expect to deliver operating profitability by the end of 2025 if the proposed sale of the company’s programme management arm Accredited goes ahead.

Insurers told to ditch Big Bang-style transformation

Insurers gathered at the Guidewire Connections conference have been told to stop talking about “modernisation,” to ditch Big Bang-style transformation programmes and pursue bite-sized technology updates.

Ten arrested in commercial fraud crackdown

Ten individuals across the country have been arrested following a two-week police operation to tackle commercial insurance fraud.

Environmental threats slip down agenda as top UK risks are revealed

Economic and societal concerns have overtaken environmental risks as global business leaders share their biggest concerns in the World Economic Forum’s executive survey.

Planned Lloyd’s investment venture scrapped at eleventh hour

Financials Acquisition Corp, which had planned to provide hundreds of millions of pounds of capacity to Lloyd’s syndicates as early as 2024, following a proposed merger, is now set to appoint liquidators.

Principal on how AI is spotting vulnerable customers

Principal Insurance has revealed how it has deployed Xdroid’s artificial intelligence powered solution to report on all speech, email and chat interactions to improve customer outcomes.

How AI is transforming Aurora’s underwriting

Bijal Patel, co-founder of Aurora, explains how the MGA is leading the way in taking a data science approach to underwriting and what skills insurers need to develop.

Classic motor market approaching ‘pinch point’ as a result of premium stagnation

Richard Morley, broking director at Markerstudy Broking, said the classic car market is “behind the curve” when it comes to pricing compared with standard motor.

How AI is helping Mind Foundry spot the signs of cognitive decline

Selim Cavanagh, director of insurance at Mind Foundry, explains how the company is using the latest machine learning techniques to “drive real value” for insurance organisations.

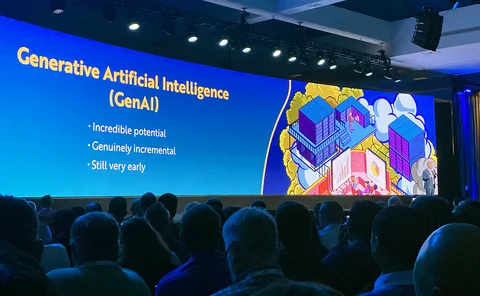

Guidewire CEO warns insurers against too big a bet on AI

Mike Rosenbaum, CEO of Guidewire, has warned insurers against “taking too big a bet” on one generative artificial intelligence path at this stage, as it “is still very early”.

Ageas reveals it is developing an AI claims assistant

Tom Quirke, chief actuary at Ageas UK, shares how the personal lines insurer is already ensuring humans and AI work in synergy to allow agents to focus on meaningful relationships with customers.

Protesters target Chubb and AIG demanding they ‘rule out’ fossil fuel support

Climate activists took to the city to warn insurers that underwriting fossil fuel projects in Africa is a “risky business” that threatens the rainforest, human rights and their reputations.

Sedgwick appoints Neil Gibson as UK CEO

Sedgwick has promoted chief operating officer Neil Gibson to the position of UK CEO.

Policy Expert bought by Abu Dhabi Investment Authority

The Abu Dhabi Investment Authority has bought a majority stake in insurtech Policy Expert from Primary Group.

Arch takes Aon team; Gallagher expands operations; Vision Track’s CEO

Friday Round-Up: Insurance Post wraps up the major insurance deals, launches, investments and strategic moves of the week.