News

Unison extends LV agreement following UIA run-off

Insurance Post can reveal Unison has entered into a partnership with LV, in which the insurer will provide the trade union's members with home, travel, and pet insurance.

Ombudsman expects complaints about hollowed out insurance

The Financial Ombudsman Service is bracing for more complaints next year from consumers who didn’t realise cheaper insurance premiums often result in reduced cover.

Pool Re’s treaty reinsurance plans present SME cover opportunity

Proposals to make Pool Re a treaty reinsurer could lead to a greater proportion of UK SMEs taking out terrorism cover, senior industry figures have said.9

Whiplash exodus continues as 53% of law firms pull out of sector

Over half of law firms are ditching low-value RTA claims as a result of the whiplash reforms, with only one firm saying this area of business is profitable.

Lloyd’s D&O book expected to shrink

Directors’ and officers’ insurance is set to contract as a class of business at Lloyd’s next year, as the market keeps up its strong messaging on what it expects of underwriters.

Significant growth of non-standard market forecast

More modular homes, climate change plus increased sales of high performance cars will lead to "unprecedented, dynamic growth in the non-standard market," according to a report from Prestige Underwriting.

Admiral tipped as preferred bidder for RSA home and pet books

Admiral is the preferred bidder for the RSA household and pet insurance books, Insurance Post can reveal.

Howden pleads for protection of climate-vulnerable countries

Speaking at the COP 28 summit, David Howden, founder and CEO of Howden emphasised the power the private sector has to protect vulnerable countries against the effects of climate change and unlock future investment opportunities.

Flock to target larger fleets with NIG partnership

Flock has announced a partnership with NIG, which CEO Ed Leon Klinger says will allow the insurtech to target larger fleets as it aims to “evolve” the commercial motor insurance market.

Axa and Synectics partner; Tesco to offer non-standard home; Markerstudy's three NEDs

Friday Round-Up: Insurance Post wraps up the major insurance deals, launches, investments and strategic moves of the week.

Government to launch Martyn’s Law consultation after Christmas

The government will launch a consultation on proposed counterterrorism measures that smaller premises will have to take as soon as possible, according to a Home Office official.

Cyber has reared its ugly head again – time to have it as part of due diligence?

News editor view: As another cyber hack is revealed, and as it was Computer Security Day on Thursday, Scott McGee reiterates the importance of staying cyber vigilant, while bringing all your partners to a level of cyber security that you find acceptable.

CII asked for answers about finances ahead of AGM

Former Personal Finance Society board member Vanessa Barnes has raised concerns about the Chartered Insurance Institute Group’s 2022 annual report ahead of the professional body's annual general meeting this afternoon.

Walsh and Newman to leave CFC following Lloyd’s investigation

David Walsh and Graeme Newman will leave CFC Underwriting in 2024 following a Lloyd’s investigation into allegations of non-financial misconduct at the company.

Mapfre calls for AI regulation and improved cyber collaboration

Antonio Huertas, chairman and CEO of Mapfre explained why AI regulation is needed and how cyber continues to leave the industry at a crossroads.

Animal Friends’ 2022 profits take £12m customer refund hit

The 2022 financial accounts for Animal Friends have revealed that the company paid out nearly £12m in “voluntary remediation payments” in 2022 – almost three quarters of the original £16m of profit it made that year.

UK develops secure AI guidelines

The UK has published guidelines to ensure the secure development of artificial intelligence technology.

Saga boss Sutherland steps down after four years

Saga has announced that group CEO Euan Sutherland is to be stepping down after four years in the role.

Allianz makes changes to leasehold products following FCA reforms

Allianz has issued an email to its brokers outlining changes to its multi-occupancy buildings insurance products, which includes capping commission at 30%.

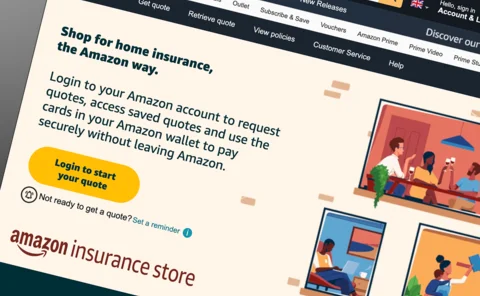

Amazon adds fifth provider to Insurance Store

Amazon has signed-up Urban Jungle to its Insurance Store, making it the fifth insurance provider on the tech-giant’s platform.

Lloyd’s consults on Net-Zero approach

Lloyd’s of London has launched a consultation among member firms on its proposed approach in insuring the low-carbon transition over the next three years.

CII faces more changes at the top

As the Chartered Insurance Institute faces its second search for a new CEO in as many years, the professional body has been hit by further resignations in key roles.

Gove brings Bill banning excessive commission to parliament

Michael Gove, Secretary of State for Levelling Up, has brought a Bill to give leaseholders more power, while banning opaque and excessive buildings insurance commissions for freeholders and managing agents.

Stonegate settles Covid BI dispute with MS Amlin, Liberty and Zurich

Stonegate, the UK’s largest pub group, has agreed a settlement with MS Amlin, Liberty Mutual and Zurich, bringing an end to a long-running legal dispute over Covid business interruption losses.