Future Focus 2030: The future of motor podcast - the road map to change

It is the year 2030. As the demands for a green economy has intensified the government has announced the ban on selling new petrol, diesel or hybrid cars in the UK will be brought forward from 2035 to this year (2030). Concerns still exist over electric charge points, which although now standardised to two types, are seen by some as lagging behind vehicle manufacture.

Around 40% of the UK carpool is now classed as level three automation having ‘conditional automation’. A further 50% has levels four and five and are thus classed as ‘highly automated’ and ‘fully automated’ respectively. Interconnectivity between vehicles and other electronics owned by consumers is growing due to increased Internet of Things.

Vehicle ownership has stabilised, reducing to 40% in large cities and conurbations. E-mobility and mobility-as-a-service solutions have thrived here as people – especially those aged 25 to 40 – started to shun congested public transport in the wake of the Covid-19 pandemic in 2020.

Personal injury claims have significantly reduced as a result, but there is still a fervent market for claimant lawyers due to accidents resulting from accidents linked to the mixed carpool, as well as the rise in e-mobility solutions that are predominantly still controlled by drivers.

There have also been some extreme legal cases where fully autonomous vehicles have had to make an ethical call in terms of who to kill when put in a unusual situation. There have also been a number of accidents resulting from targeted vehicle hacks and public outrage over data leaks originating from cars.

Repair costs are still an issue, not least because the body shop network was decimated by the Covid-19 epidemic and numbers have fallen significantly. However, the market has consolidated and some major players have emerged the likes of which the sector has never seen before, with significant buying power and technological solutions. Around 60% of repairs are now notified by mobile apps at the first notification of loss, using AI to diagnose damage.

In terms of insurance products themselves, the OEMs have still not weighed in as much as might have been predicted by some; but the annual insurance policy is now only bought by 30% of the population as most people prefer usage based products – another legacy of the Covid-19 pandemic. These solutions are largely digital and mobile based.

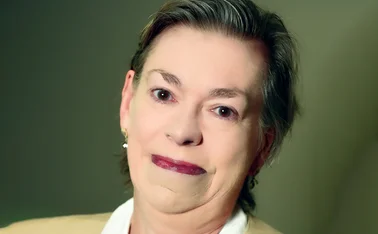

Based on this hypothesis, Post content director Jonathan Swift sat down with the strategy director, Verisk Claims, Chris Sawford and managing director, Verisk Ireland, Niall Kavanagh to discuss the possible road map between now and the 2030 outlined above.

This includes the growth in automation/ADAS and the challenges that throws up in terms of the mixed car pool, the growth of IoT and what kind of infrastructure changes will be needed across the UK to prepare for the 2030 future outlined in the associated article.

The trio also look at how the evolution of technology from automation to advanced satnavs that identify safest routes from A to B will impact personal injury claims; and how vehicle usage and ownership is likely to change and what will be the catalysts for it.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@postonline.co.uk or view our subscription options here: http://subscriptions.postonline.co.uk/subscribe

You are currently unable to print this content. Please contact info@postonline.co.uk to find out more.

You are currently unable to copy this content. Please contact info@postonline.co.uk to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@postonline.co.uk

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@postonline.co.uk