Property - personal

Tesco to buy out Ageas from insurance joint venture

Exclusive: Tesco has notified the Ageas UK board that it is likely to end its decade long home and motor insurance relationship next year, Post understands.

What has become of the vacant Swinton branches?

What happened to all the buildings that used to house Swinton branches? Post content director Jonathan Swift looks to answer this question on an insurance odyssey through south London

Arch-backed MGA Archipelago aims to address PL underinsurance with data driven fair pricing

Arch Insurance-backed managing general agent start-up Archipelago Risk Insurance has announced that after a six month “pilot” it is ready to open the doors in a “controlled way”.

Analysis: What do recent market exits mean for insurtechs targeting millennials?

Three insurtechs have pulled out of the insurance market so far this year, raising questions around the efficacy of selling insurance to millennials and whether more of these firms will fall.

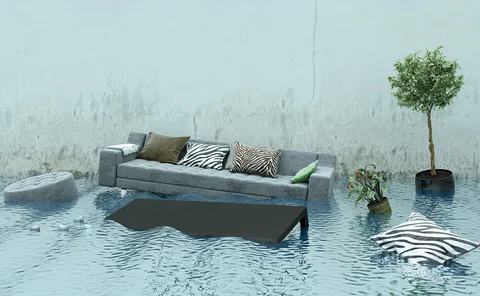

Analysis: Impact of smart home technology on escape of water claims

In 2018 insurers dealt with 228,000 escape of water claims, at a cost of £617m – an increase from £529m paid out five years ago, according to statistics from the Association of British Insurers. With the rising cost of claims, can technology help reduce…

Insurers respond to flood claims from Lincolnshire

Insurers have begun responding to claims following the flooding in Lincolnshire.

Flood defences save UK £1.1bn a year

Inland flood defences reduce river flood losses by 63%, saving the UK £1.1bn annually on average, according to a recent study.

Ageas pulls the plug on insurtech Back Me Up

Exclusive: Ageas has closed its app-based millennial insurtech Back Me Up to new business.

Saga’s three-year fixed-price commitment attracts more than half of its customers

Exclusive: Saga has revealed that the three-year fixed-price promise has attracted more than half of its customers.

Environmental Agency works with insurers to review flood strategy

The Environmental Agency has launched an eight week consultation on a new long-term strategy to tackle flooding and coastal change.

Spotlight: Data - Ordering data in

Insurers continue to hang their success on the quality and use of data, with businesses continually reviewing how to gain a commercial advantage. Edward Murray looks at the benefits of using external data providers and why some peril risks have proven…

Spotlight: Data - Why are insurers ignoring data for escape of water claims?

Don’t blame the rain for the growing number of water-related claims in the UK, blame the plumbing

Analysis: Insuring unoccupied property

The issue of unoccupied property is a political hot potato in a climate of Brexit and increased online retail. How are insurers tackling this high risk area?

Ageas' Ant Middle on why the industry shouldn't focus on 'doom bingo'

It's pretty easy to generate a list of challenges facing the insurance sector in 2019 but Ant Middle, chief customer officer at Ageas, believes insurers should be looking to creating new opportunities instead.

Subsidence surge sees claims up 300% in 2018

It has been predicted that 2018 won’t be just a subsidence surge year, but one that will see the greatest upsurge in claims over a two year period.

Blog: How insurance risks exclude victims of domestic abuse

Victims of economic abuse often struggle to access insurance, writes Alice Merry, financial inclusion consultant for Surviving Economic Abuse, explaining what the industry can do about it.

Blog: How to defend cavity wall insulation claims

Liability insurers are seeing a dramatic increase in claims arising from allegedly defectively installed cavity wall insulation. Tom Corrigan, partner at DAC Beachcroft, asks whether there is cause for concern.

Dual pricing: Dual pricing hitting loyal home insurance customers

Loyal customers are being penalised for staying with an insurance provider, leaving thousands paying excessive home insurance premiums, according to Which?

Analysis: Subsidence surge

Insurers and loss adjusters are using digital technologies to handle this autumn’s surge in subsidence claims but they are not forgetting the human touch is the best way to get to the root of the problem

Blog: Flood claims involving children

A flooded home can be traumatic, especially for children. Jonathan Davison, strategic development director at the British Damage Management Association, explains how the claims process can be designed to protect the mental wellbeing of younger family…

Analysis: Little online lies

Consumers might lie online to get cheaper quotes but insurers are using digital technology to detect potential fraud.

Top 100 UK insurers 2018

In 2017, the combined underwriting results of the largest 100 UK non-life insurers improved but remained in the red. How well did insurers perform under pressure from strong competition and unfavourable claims trends?

Blog: Loss adjusters are developing new skills to tackle escape of water claims

As insurers are trying to tackle rising escape of water claims costs, loss adjusters are developing increasingly specialised skills, explains Darren Francis, escape of water project manager at Crawford & Company.

Dual pricing hitting loyal home insurance customers

Loyal customers are being penalised for staying with an insurance provider, leaving thousands paying excessive home insurance premiums, according to Which?