Insurtech

Why insurers should reassure policyholders about AI

Roi Amir, CEO of Sprout AI, explains why insurers need to show policyholders they can trust artificial intelligence.

Flock to target larger fleets with NIG partnership

Flock has announced a partnership with NIG, which CEO Ed Leon Klinger says will allow the insurtech to target larger fleets as it aims to “evolve” the commercial motor insurance market.

Axa and Synectics partner; Tesco to offer non-standard home; Markerstudy's three NEDs

Friday Round-Up: Insurance Post wraps up the major insurance deals, launches, investments and strategic moves of the week.

Q&A: Will McAllister, Guidewire

Will McAllister, senior vice president and managing director of EMEA at Guidewire, shares the software provider’s plan to do more business in the UK plus how insurers can now launch new products in a few hours.

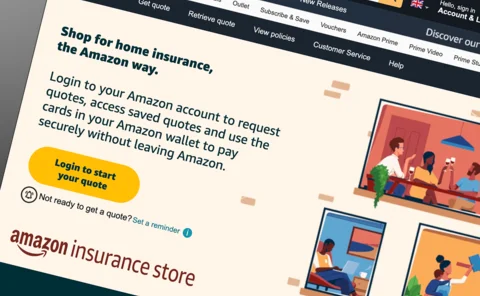

Amazon adds fifth provider to Insurance Store

Amazon has signed-up Urban Jungle to its Insurance Store, making it the fifth insurance provider on the tech-giant’s platform.

Big Interview: ManyPets’ UK CEO Luisa Barile and co-founder Steven Mendel

Following a difficult period where ManyPets pulled out of the Swedish market and paused sales in the US, newly appointed UK CEO Luisa Barile and co-founder Steven Mendel sat down with Scott McGee to talk through the provider's plan to get the UK business…

Insurtech Excellence Award winners 2023 unveiled

The category winners in the Chartis Insurtech Excellence Awards have been announced.

Have insurers learned from digital missteps as they grapple with AI?

Content Director’s View: A decade ago insurers got very excited about digitalisation; so much so they put it in special silos and created a culture of them versus us. Jonathan Swift asks what lessons might have been learned as they embark on similar…

How AI is improving pet insurance claims

Michael Lewis, founder and CEO of Claim Technology, on the practical application of artificial intelligence for pet insurance claims.

Four ways insurers can use AI to defeat disruptor rivals

As AI Week draws to a close, Leon Gauhman, co-founder of digital product consultancy Elsewhen, explains how large language models could allow traditional carriers to leapfrog over nimbler insurtech competitors.

ManyPets completes flurry of executive hires as CEO Eleazu departs

ManyPets has a new line-up for its UK executive team, as CEO Oke Eleazu announces he is to leave the business, Insurance Post can reveal.

Verisk on testing generative AI platforms

Chris Sawford, Verisk's managing director of claims for the UK, discusses what makes an artificial intelligence trial successful and how the technology helps insurers achieve operational efficiency.

Insurers told to ditch Big Bang-style transformation

Insurers gathered at the Guidewire Connections conference have been told to stop talking about “modernisation,” to ditch Big Bang-style transformation programmes and pursue bite-sized technology updates.

How travel led the way in embedding AI in insurance

Yannis Korgialos, vice president of insurance for EMEA at Cover Genius, on how travel offers a roadmap for AI transforming the way policyholders are protected.

Podcast: Should insurers fear or embrace AI?

We will never have an insurance company run by artificial intelligence “without a human in the loop”, according to Bijal Patel, co-founder and chief technology officer at Aurora.

Why generative AI is a commercial insurance game-changer

Andy Moss, co-founder and CEO of Send, on how artificial intelligence isn't the future of commercial insurance but an already embedded part of operations today.

Scale of insurers’ fight for tech talent laid bare

Data analysis: The amount of competition insurers face in attracting tech talent plus the type of skills providers are hunting for has been revealed by an Insurance Post deep dive into LinkedIn job adverts.

Diary of an Insurer: Genasys’ Gavin Peters

Gavin Peters, chief marketing officer at Genasys Technologies, explores ways to showcase his company's capabilities for the London Market, and accepts his destiny as the Sam Allardyce of the West Herts Youth League.

Policy Expert bought by Abu Dhabi Investment Authority

The Abu Dhabi Investment Authority has bought a majority stake in insurtech Policy Expert from Primary Group.

Wakam taps former RSA personal lines director to lead UK operations

Wakam, the European B2B2C insurer, has made a range of new hires, including the appointment of Mark Christer as UK branch manager.

How insurtechs are winning the war for talent

Ahead of Insurance Post's AI Week from 13 to 17 November, Melissa Collett, CEO of Insurtech UK, shares the tactics insurtechs are using to fight and win the war for talent in 2023.

Phoebe Hugh leaves DLG to ‘lead Monzo’s charge into insurance’

Phoebe Chibuzo Hugh has left Direct Line Group to head up Monzo Bank’s entry into insurance, she has announced.

Sprout AI reveals post-funding expansion plans

AI-led insurtech Sprout AI has revealed plans to “transform claims processing” as well as expand into new markets, following its latest funding round.

BIA 2023 Video: Winners Q&A with Policy Expert’s Steve Hardy

Following its recent win in the Customer Experience category at the 2023 British Insurance Awards, Policy Expert CEO Steve Hardy shared his thoughts on what made it stand out.